As the financial downturn continues to daunt the world and we slowly move towards another recession, venture capital funding has dropped significantly, ultimately affecting the progression of early startup businesses. Entrepreneur McKeever “Mac” Conwell shares his tips on how startup businesses can survive, grow, and expand during these turbulent times. Black-owned VC firm, RareBreed, founded in 2021 by McKeever “Mac” Conwell, is a pre-seed fund that invests in early pre-seed tech companies. It also allows angel investors to become limited partners for more significant funds. So not only does it

Africa-focused investment firm, Persistent Energy, has raised $10 million in its Series C funding to help support the renewable energy sector in Africa. The funding round, led by Kyuden International Corporation and FSD Africa Investments, also saw private investors Kotaro Tamura, BK Ventures BV, and DPI Energy Ventures participate. Persistent Energy, founded over a decade ago, is a pioneer investor in Africa’s renewable sector. The investment firm works to support and build businesses that can “scale sustainably.” They provide financial capital for startups and allow their team members to work

Black-owned cardiovascular telehealth provider, Moving Analytics, has raised $20 million in Series A funding. The funding round, which Wellington Access Ventures and Seae Ventures led, also included investors Philip Ventures, Aphelion Capital, Nueterra Capital, SteelSky Ventures, and Citi Ventures. Moving Analytics, co-founded in 2013 by Ade Adesanya, Harsh Vathsangam, and Shuo Qiao, has partnered with cardiology offices and cardiac rehab facilities to expand access to secondary prevention for all patients. The platform specializes in cardiovascular prevention and uses a virtual cardiac rehab program, Movn, to support patients who have recently

Award-winning African spirits group, Spearhead, has raised $3 million in investment from venture capital firm Pendulum to help deliver their products to the world’s bars. Spearhead, co-founded by UK-based entrepreneurs Chris Federick and Damola Timeyin in 2021, is a multi-award-winning business with an extensive portfolio working with premium brands. The company launched to challenge the cultural basis and the lack of African representation in the spirits industry. Their award-winning Premium African Spirits, Vusa Vodka and Bayab Gin, are made solely from African products and capture Africa’s premium craft and creativity.

Black-owned money movement, Zazuu, has raised $2 million in investment funding in a new venture round. The startup, which works to build a more robust remittance for residents in the diaspora, has quickly evolved to become the world’s first cross-border payment marketplace. Zazuu, co-founded in 2018 by Kay Akinwunmi, Korede Fanilola, Tola Alade, and Tosin Ekolie, is on a mission to ease the difficulty of sending money back home, which is currently expensive, slow, and unfair to millions of migrant customers. The platform has helped empower customers by building an

On July 12, New York City Hall launched the first-ever Digital Games Industry Council to discuss supporting talent in that space. Participants included Deputy Mayor Maria Torres-Springer and several members of the mayor’s office. The council came together to discuss how to expand the city’s digital games industry. The digital committee, designed to build a robust talent pipeline for talent in the digital games industry, aims to attract game development studios across five boroughs and help businesses operate and thrive in New York City. The meeting occurred following the announcement

Black Ambition, owned by world-renowned singer and producer Pharrell Williams, recently announced its $3 million investment in content curator platform Trend. The pre-seed funding round was led by venture capital firm Flybridge and included a range of investors, including Techstars Ventures, live-streaming service Twitch, famous anime brand Crunchyroll, and reviewer platform Rotten Tomatoes. The investment firm, Black Ambition, which was founded by Pharrell in 2020, is dedicated to supporting Black and Latinx business owners. The non-profit organization aims to bridge the gap to success for entrepreneurs of color working in

How do you allow — and make it easier for — anyone to start a company? That’s the question driving Pulley, the cap table and equity management platform that has just raised $40 million in Series B investment funding. The new investment brings Pulley’s total funding to $50 million to date. The funding round was led by Keith Rabois at Founders Fund, including investors Stripe and Elad Gil. The latest investment fund comes a year after the company’s rapid growth, supporting over 1,600 companies across 80 countries. The serial investor

Black-owned investment accelerator, 1863, has unveiled its investment strategy for “New Majority” entrepreneurs, a term that they use to describe Black and Brown business owners who have been historically marginalized. The investment funding will go towards helping early-stage entrepreneurs develop their businesses to achieve generational wealth and hit their target goals. 1863, founded by Melissa Bradley in 2020, is a business development program designed to bridge the gap between entrepreneurship and equity. The platform works with marginalized entrepreneurs to help accelerate them from high potential to high growth. The firm

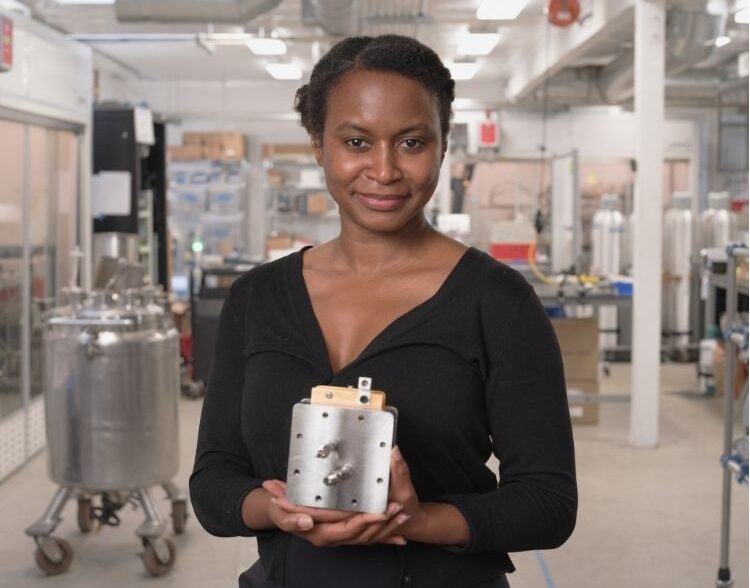

Carbon transformation company Twelve has raised $130 million in Series B funding to further support the engineering and manufacturing industries. The funding round was led by DCVC and included Series A investors Capricorn Technology Impact Fund and Carbon Direct Capital Management. Breakout Ventures, Munich Re Ventures, Elementum Ventures, Microsoft Climate Innovation Fund, and other investors participated in the funding round. The new funding will deploy the world’s first carbon transformation product. The product, designed to create a wide range of products with a lower carbon footprint, will use transformative technology