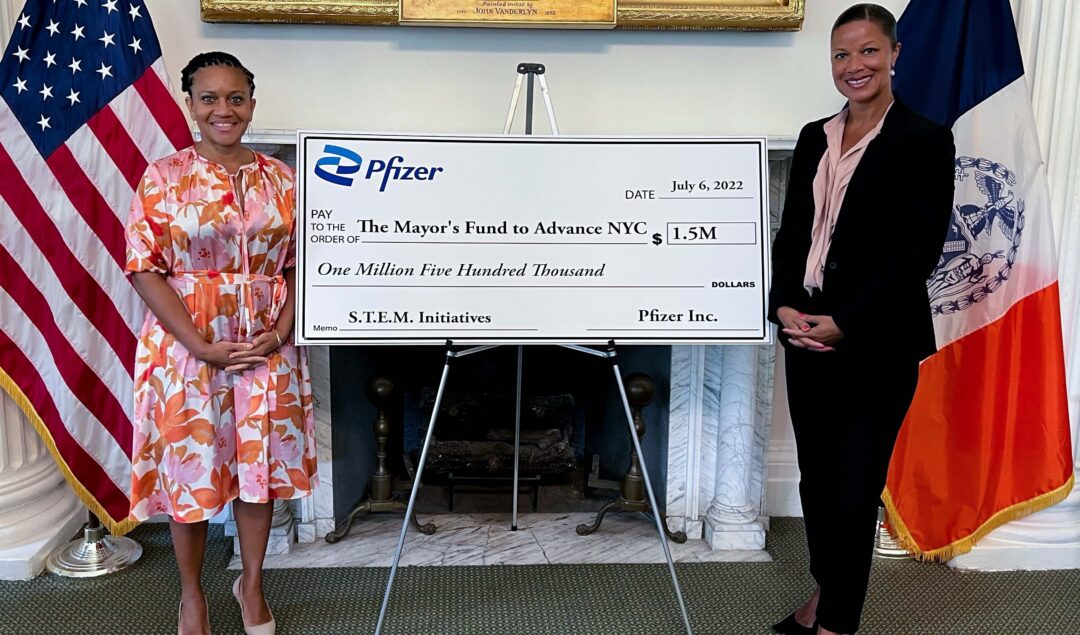

On July 11, New York’s mayor, Eric Adams, announced that the city will be boosting its STEM programs with the help of a $1.5 million grant from Pfizer, a biopharmaceutical company known for developing a COVID-19 vaccine. Pfizer’s donation to the Mayor’s Fund to Advance New York City will specifically support students in two STEM-related initiatives, Exploring Futures and College Now for Careers. The programs help support the city’s science, technology, engineering, and math (STEM) educational programs. The extra funding will also go towards building a career pathway for students to help them break into the industry. “Thanks

Marketplace website MinorityBiz has a 51-page directory to find, compare, and hire minority- and Black-owned businesses across the U.S. to service your company’s needs. It’s not the only directory out there that’s trying to shine a light on Black professionals and their ventures. Here is a list of online directories to help you find the right Black-owned business partners for your needs. We will continue to update this list as we find more resources. Official Black Wall Street Official Black Wall Street hosts a variety of local and online consumer products as well as business

Senegal-based fintech startup, Wave, raises a syndicated loan of $91.5 million from International Finance Corporation (IFC), Blue Orchard, Symbiotics, responsAbility, and Lendable. Wave Mobile Money, founded by Drew Durbin and Lincoln Quirk in 2018, has quickly grown to become the largest mobile money remittance in Senegal. In 2021, the company closed the most extensive Series A round for an African fintech at $200 million. The digital fintech platform uses technology to build a radically inclusive and affordable financial network. As a result, Wave has built a life-changing economic infrastructure for

Kenyan and Canadian-based solar energy platform, Solar Panda, has raised $8 million in Series A funding. The funding round was led by investors Oikocredit and Electrification Financing Initiative. The pay-as-you-go solar home system was founded by Andy Keith in 2016, to help provide clean, affordable solar energy to rural communities in Africa. The platform has already provided more than 200,000 solar home systems to households across Kenya from its 37 retail branches. “We are excited to partner with leading global impact investors Oikocredit and EDFI ElectriFI and thankful that this

Black-founded startups recently saw record amounts of investment, with quarterly funding commitments nearing or even topping $1 billion. But according to new data from Crunchbase, venture capital funding has dropped significantly in the second quarter of 2022, down to just $324 million. So far in 2022, only 100 U.S. startups with a Black founder have received funding, with $100 million invested in seed rounds, $591 million in early-stage rounds, and approximately $876 million in later-stage rounds. Startups with at least one Black founder received 1.9% of deal counts and 1.2% of

NFL Star Jonathan Taylor has invested $6 million into Sports Tech company Strive in a Series A funding round. The funding round, led by venture capital firm, Future Communities Capital, included a range of investors, including SeaChange Fund and Seed to B Capital. NFL quarterback Troy Smith and Jonathan Taylor were new investors who also participated. Strive, founded by Nikola Mrvaljevic in 2016, aims to provide accurate muscle data to athletes and teams. Mrvaljevic decided to launch the company after seeing that college coaches welcomed his ideas on using data

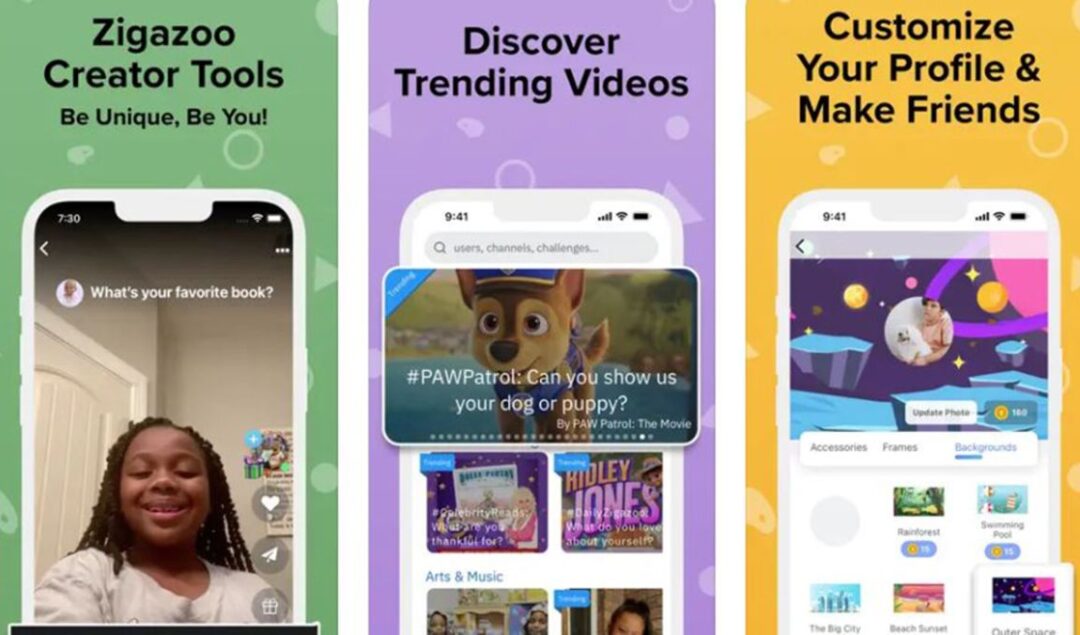

Children’s social media platform Zigazoo has raised $17 million in Series A funding. Liberty City Ventures led the funding round, which included the National Basketball Association (NBA), Causeway Capital Management, Dapper Labs, OneFootball, Medici VC, Animoca Brands, and Lightspeed Venture Partners. Zigazoo, founded by Zak Ringelstein in 2020, has become one of the leading platforms for children’s short-form videos. The digital program, which has recently launched a non-fungible token (NFT) collection, aims to provide children with a safe and positive community where they can find joy, develop healthy online relationships,

Black-led fintech startup, Moove, raises $20 million in investment funding from the British International Investment (BII) program, formerly known as the CDC. The investment reflects the BII’s plans to build a resilient market in Nigeria, providing access to various economic opportunities for upcoming businesses while simultaneously accelerating the country’s limitless entrepreneurial spirit. Moove, co-founded by Jidi Odunsi and Ladi Delano in 2020, is a mobility fintech platform that provides revenue-based vehicle financing to mobility entrepreneurs across Africa. The co-founders, both British-born Nigerians with degrees from the London School of Economics

African-based distribution platform, Afrikamart, has raised $850,000 in seed funding. The funding round, led by Bloc Smart Africa and managed by Bamboo Capital Partners, saw a range of investors participate, including Bamboo Capital Partners, Orange Ventures, Launch Africa, and Teranga Capital. Afrikamart, co-founded by Albert Diouf and Mignane Diouf in 2018, is a digital distribution platform that works to provide services to farmers. The brothers launched the tech platform to address farmers’ problems with poor market access and late payment from intermediaries using technology to collect products from thousands of

Black-owned beauty and tech company Mayvenn has announced that it raised $40 million in a Series C funding round. Leading investments came from Chicago-based venture fund Cleveland Avenue, with participation from the Growth Equity business within Goldman Sachs Asset Management and a16z. Mayvenn allows consumers to search for and book hair stylists in their local area. In addition, stylists are able to operate their businesses on the platform, including selling products and marketing their salon-based services. The company says it is now home to over 50,000 hair stylists across the