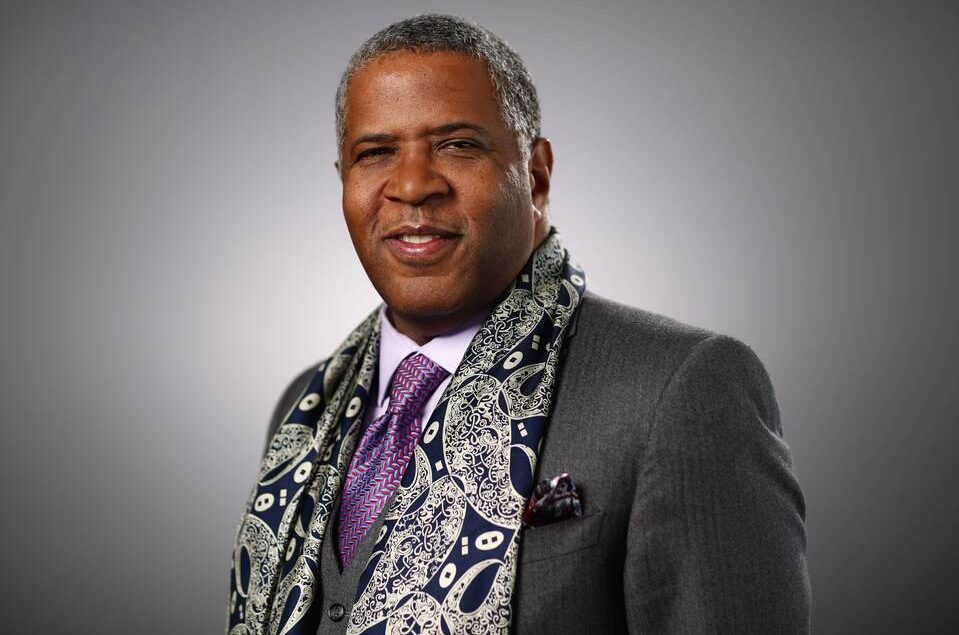

Billionaire philanthropist Robert F. Smith recently announced the launch of the Student Freedom Initiative, a program designed to provide paid internships to HBCU students. Robert F. Smith will launch the Student Freedom Initiative’s HELPS Program in partnership with financial regulation company Prudential Finance. The partnership will address Black students’ disproportionate financial loan burden, which often hinders their career progression. The program aims to provide science, technology, engineering, and mathematics (STEM) HBCU students with $1.8 million in microgrants, which will act as a contingent fund alongside their traditional college loans. Robert F. Smith, famously known

Black-owned acceleration organization /dev/color recently announced its partnership with visual discovery platform, Pinterest, to help support its mission of changing the tech industry for good. The $3 million partnership launched last year is dedicated to elevating Black technologists and leaders throughout the tech industry. Both companies will provide coaching and mentorship programs to help empower Black software engineers, executives, and entrepreneurs, giving them the tools they need to succeed within the tech industry. Also, HBCU students will benefit from this partnership as both platforms look to invest in the Black

Black-owned serverless startup, Baselime, has raised $1.5M in pre-seed funding. The funding round, which Sequoia Capital led, also included venture capital firms Antler, Forward Partners, and Octopus Ventures. The London-based company, founded in 2021 by Boris Tane, works to reduce the challenges developers often experience. Businesses can embrace automated observability ecosystems through their platform, which is highly beneficial for remote teams. The platform also claims to offer highly flexible technology at a reduced cost by encouraging developers to run applications and manage servers on behalf of customers without needing to

San Francisco-based fintech company, TomoCredit, has raised $122 million in funding and debt financing. The funding round was led by Morgan Stanley’s Next Level Fund and included Morgan Stanley’s Next Level Fund, MasterCard, and debt from Silicon Valley Bank. The funding will help the platform expand its credit product offerings to help support immigrants with no credit history in the US. TomoCredit, co-founded in 2018 by Kristy Kim and Dmitry Kashlev, is a fintech platform dedicated to providing the next generation with a credit card designed to help millennials boost

Mexico City-based fintech platform, Arrenda, has raised $26.5 million in a pre-seed funding round of equity and debt. The funding round, which Fasanara Capital and Kube Ventures led, also included ODX Ventures, Toehold Ventures, Wharton Fintech, Lightspeed Venture Partners Scour Fund, PRMM Inmobiliaria, and a range of angel investors. Arrenda, founded in 2022 by Joe Merullo, is a revenue-based startup that works to provide market-specific insurance and financial products to the real estate markets and landlords of Latin America. Not only does it offer advance payments to landlords, but it

Bizao has raised $8.15 million in Series A funding. The funding round was led by AfricInvest, Adelie, and Seedstars Africa Ventures and will help the platform accelerate its expansion, helping them provide services to citizens across the continent. Bizao, founded in 2019 by Aurélien Duval-Delort, helps companies accept all local payment methods across Africa. The tech platform uses powerful APIs and advanced financial flows to simplify the challenge of getting Mobile Money, Visa/Mastercard, and Airtime payments. The outlet powers all businesses: local retailers, online merchants, international digital content providers, money

American rapper and lead MC of hip hop group The Roots, Tariq Luqmaan Trotter, also known as Black Thought, recently announced his journey into venture capital. According to HipHop DX, the lyricist has joined early-stage tech venture firm Impellent Ventures as a general partner. Black Thought will work alongside the team to help recruit and encourage entrepreneurs to help them continue growing their new business while giving them the tools they need to build a longstanding business. His role as a partner at Impellent Ventures will help him elevate Black entrepreneurs

Financial giant, Mastercard, has officially announced the class of this year’s Start Path program, an award-winning engagement program aimed at providing global support and mentorship to the brightest late-stage startups. According to a press release, Mastercard selected three early-stage startups led by underrepresented founders and four late-stage fintech innovators looking to scale their businesses for this year’s program. “As we continue our eight-year legacy of successful collaboration with startups around the world through Start Path,” said Blake Rosenthal, executive vice president, Fintech & Segment Solutions at Mastercard. “The companies we selected are on

Njeri Muhia teamed up with Steven Wamathai to shake up the VC industry. In a sector where VC and startup relationships are formal, the pair said that they hope to have relaxed connections with founders. After spending years in London, matching Kenyans in the diaspora with investment opportunities back home, and later on as a credit portfolio manager at Barclays bank, Muhia sought a greater challenge within Africa. Together with Wamathai, who has vast experience in the investment management industry during the middle of last year, they started an early-stage

Black-owned digital platform, InterApp, has raised $1.2 million in its pre-seed funding round. The funding round was led by Columbia-based investment firm WP Capital Group, an organization that focuses on emerging technologies for consumer engagement. InterApp Inc., co-founded in 2016 by CEO William Brown, is an image recognition app that aims to make augmented reality (AR) a necessary tool for consumers. Their work, specifically designed for graphic designers, transforms print into interactive AR experiences for consumers to enjoy. The platform transforms print packages and apparel graphics into augmented reality, ultimately transforming