Subscribe to the Techish Podcast on Apple Podcasts, Spotify, And Other Platforms. Episode Content: In this weeks Techish Abadesi and Michael discuss key chapters in Arlan’s brand new book Its About Damn Time. 💰 Turning yourself into money🙋🏾♀️ Writing your own invitation 🤔 Curiosity is king Pre-order your copy of Arlans amazing new book Extras: Techish on Patreon: Advertise with Techish: Please rate and review the Techish podcast

My nascent investment thesis — of sorts It is hard to be optimistic about tech these days. If in the early 2010s we were all keen and positive, now we’ve seen the consequences — albeit unintended — of big tech. The tech-lash is real and governments are scrambling and scratching their heads for solutions. Senator Warren wanted to break up big tech. Andrew Yang wanted to give every American a universal basic income to help the country deal with the challenges of automation. I am not blind to any of

In honor of Black History Month, a group of Black founders, VCs, and tech professionals put together the most comprehensive list of US-based venture-backed Black founders ever. In honor of Black History Month ✊🏾, a group of Black founders, VCs, and tech professionals put together the most comprehensive list of US-based venture-backed Black founders ever. We hope this will be an inspiration to a generation and serve as a running historical record of Black founders, both past and present. The release of Jessica Livingston’s book “Founders At Work” has inspired

TL;DR We don’t have a diverse, equitable, and inclusive (DEI) tech industry. We need one to serve the market better, take the money that’s being left on the table, and produce outsized returns for all. There’s a lack of dollars going to underestimated founders and companies addressing underserved communities, and a lack of diverse check writers. How can we make it a DEI tech industry? Approaches can include, but are not limited to: Increasing the number of underestimated tech talent (also promote, sponsor, and pay well) Increasing the dollars going

Originally published here by HBCUvc. At HBCUvc, we don’t put too much stock in “best of” lists or other league tables that purport to sort people by merit. Ranked lists don’t do a good job of assessing an individual’s worth or accurately measuring her contributions to an industry like venture capital where feedback cycles are long and the best contributors often work behind the scenes to help entrepreneurs succeed. On top of this, the lists tend to focus on the accomplishments of White men at the expense of other contributors.

“Every American should have a fair shot at starting a small business. The only things that should determine whether a new business succeeds are the strength of the idea and the hard work of the owners and employees.” – Elizabeth Warren She’s right. And the 7 billion dollar grant Senator Warren is proposing would certainly go a long way to make this happen — maybe. I was recently interviewed by Forbes for my thoughts around what the grant would mean to minority entrepreneurs, and my response may not have been

Going viral. It’s the coveted achievement every company, agency, firm, person posting on social media hopes for. It’s the attention founders need to build a brand, and I’ve been fortunate enough to have had well-shared efforts in the past. From my call-out article about INC. Magazine, to the ‘fundraise’ for the AI company I founded — I’ve had my share of social media wins. And now, as I’ve pivoted my focus from being a founder to a funder, It’s happened again! This time it was completely organic. I tweeted this

This past summer I had the opportunity to intern in the infamous California Bay Area (otherwise known as Silicon Valley) for Accenture. I worked in Accenture’s Ventures division, where they partner and strategically invest in the most promising innovations in the market. Being in Silicon Valley taught me valuable lessons that I could not have picked up anywhere else. Network The network in The Valley is incredible. I was able to network with venture capitalists, tech entrepreneurs, and corporate innovation groups. The individuals I met took my learnings to the

Over the last 12 months, several people have reached out to me asking the question, “How can I get a job in Venture Capital?” I don’t have a silver bullet to answer to this question, but I will share useful steps to consider when breaking into venture. What this post won’t cover are common routes into venture through doing an MBA or moving from an M&A role at an Investment Bank into venture capital. Those routes are well documented and very much conventional. 1. Learn the Fundamentals It is essential

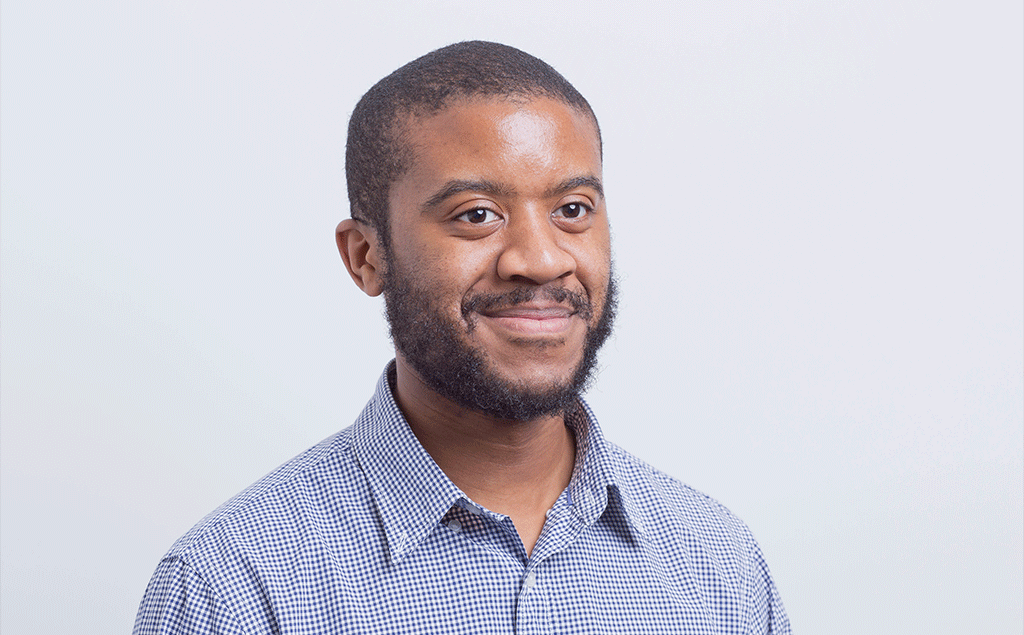

A few months ago, over lunch a friend mentioned: “I first came across your name from your writing [articles] but I had no clue that you had this experience and your story was so unique.” That comment was the catalyst for writing this post. In this post, I want to break down the components that led me to start writing and how traveling, entrepreneurship, product management, and diversity in tech has provided me with a satisfying career to date as well as rare experiences. These seemingly unrelated themes have been