Closing the Funding Gap: How a Frustrated Tweet Reaffirmed My Faith in Self Reliance

Going viral. It’s the coveted achievement every company, agency, firm, person posting on social media hopes for. It’s the attention founders need to build a brand, and I’ve been fortunate enough to have had well-shared efforts in the past. From my call-out article about INC. Magazine, to the ‘fundraise’ for the AI company I founded — I’ve had my share of social media wins. And now, as I’ve pivoted my focus from being a founder to a funder, It’s happened again!

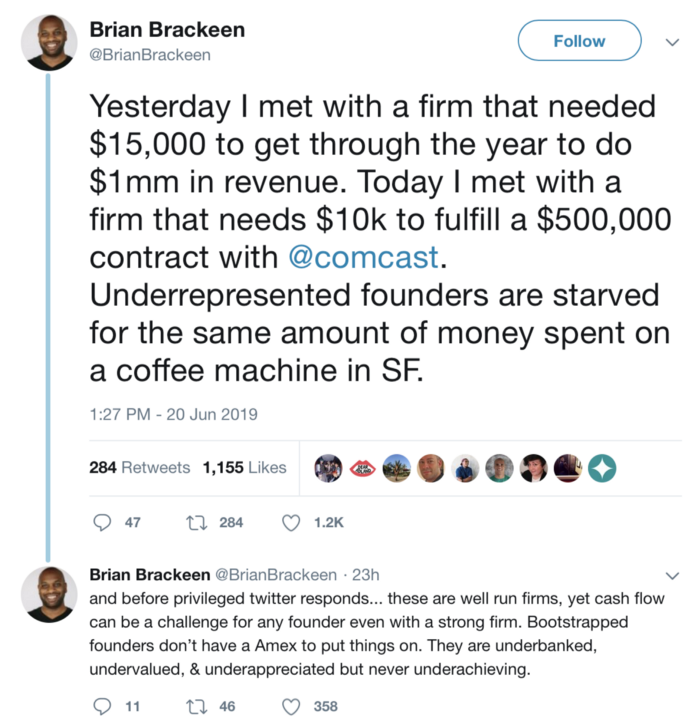

This time it was completely organic. I tweeted this out of the maddening frustration I feel around the funding biases faced by so many minority-led companies…

I’d like to think, in retrospect, that I was being dramatic. I wasn’t. The more underrepresented founders I meet with, the more clear it becomes to me that these founders are literally starved for capital. And they’re not bullshit companies looking for a sympathy check. They’re viable businesses with contracts and strong revenue, who’ve found themselves out of runway, yet staring at take-off directly ahead. Founders who’ve forgone quarterly or annual financials for more detailed, realistic, 13-week projections in order to be completely transparent — exposing holes in the road ahead that will likely need to be filled with capital, or in some cases — apologies.

That said, while this kind of transparency may give investors cause to pause, the truth of the matter is, lines of credit, loans from friends, factoring, hell even overdraft protection — are necessary to keep the lights on for the best of founders. Factor in that these are minority-led companies, then consider the very real fact that underrepresented founders are far less likely to have access to these necessities while existing even further from access to venture capital.

So what do they do? They scour the internet looking for a firm or program who will give them a chance. And they are landing on my desk. By the hundreds. So as I went about powering through introduction emails, accelerator applications, etc., there were three founders who stood out to me as clear winners. One just a few doors down from my house, one an intro from a friend who runs a startup in Cuba, and the other, an introduction from a fund based in Amsterdam. These deals are near and far, yet have one appalling commonality…

Their asks. Underrepresented founders from all over the world who run successful businesses are on the verge of collapse — over as little as $10k in bridge capital.

TEN THOUSAND DOLLARS!

There were three companies that really stood out to me as examples of great businesses who would if denied access to a small amount of capital — would be “left behind”…

At media startup kweliTV, the founders bootstrapped and have been able to get great traction with a 9% conversion to their paid plan and 50% of subscriptions being annual. That’s damn good — still — opportunity costs money. When offered a big deal with Comcast for her streaming service for access to 25mm subscribers, they required all of the company’s content be closed captioned. The cost to achieve this is 10k, which they simply do not have access to. Yet, we calculated that the contract has no less than a $500,000 value. And that’s conservative. At Lightship, we do our own projections, because founders are notoriously optimistic in their projections:-)

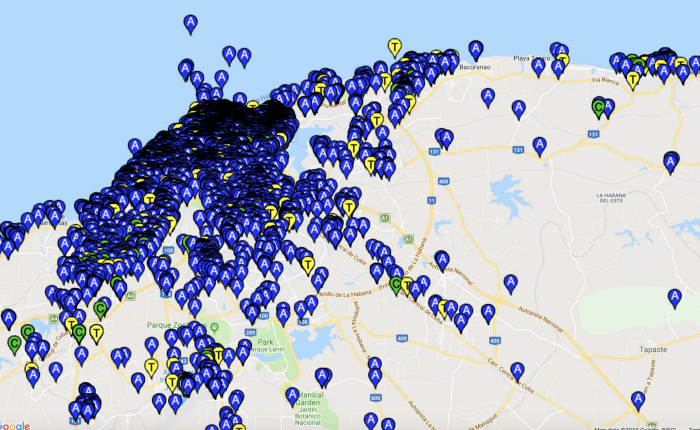

Launched in Cuba, Sube, which translates to “hop in!” in English, is a ridesharing service for drivers and passengers who speak Spanish as their primary language. Sube has gained amazing traction by serving this market — with over 10,000 ride requests in the first week after launch. The founders quickly realized the need for such a service in the US and is in the process of expanding Sube’s operations to cities like Miami and Los Angeles, where dense populations of native Spanish language speakers reside.

Sube was founded, bootstrapped and launched by Eduardo Sunal and Claudia Cuevas at the same time the Cuban government authorized 3G internet for use in the country. Sube is now the ride-sharing market leader in Cuba and is seeking just $10k in investment in order to file necessary legal documents for trademark and incorporation.

Black Owned, the Cincinnati based unisex apparel, and lifestyle brand, was founded by two young Black men aiming to promote unity and diversity through fashion. Since its 2011 launch, Black Owned has evolved to become a highly popular and respected presence Cincinnati, the community that hosts their brick and mortar operation. Recently, the brand has expanded its presence in major cities like Atlanta, GA, Chicago, IL, and Los Angeles, California in addition to experiencing success with their online shop — becoming a hit with media personalities like Cardi B, Rick Ross and many more. Black Owned has been consistently profitable year over year and is currently seeking around $15k in bridge money to complete production of their Spring/Summer 2019 line.

These are just three examples of countless minority-led small businesses who have a product, traction, and a clear path to success, who are held back by being financially incapable of keeping up with their growth.

We’re committed to being part of the actual solution.

I say “actual” solution because there has been a lot of recent attention to the systematic hardships underrepresented founders face when seeking funding — yet very little overall capital commitment to resolve the problems. As the founder and CEO of a startup, I was acutely aware of the biases, gaps, and predatory practices which occur in early-stage funding — however, I had no real idea of the sheer volume of businesses — great businesses — whose doors will close and do close as a direct result of the lack of such nominal amounts of capital.

As an entrepreneur turned Venture Capitalist, I’m now on the other side of the table, and aside from being stunned by what I’m seeing in the market, I’m fully committed to making this kind of low risk, low allocation opportunity available to more investors, thereby making more funds available to the startups who desperately need them. Because if underrepresented startups continue to be on the precipice of success, yet on the outside of access to capital and network resources — none of the change so highly publicized and recognized as necessary, will actually occur.

To learn more about our Syndicate initiative and how you can be part of the solution, too, head over to Lightship Capital 🌊

Originally posted here