The Biden-Harris administration and the U.S. Economic Development Administration (EDA) have granted $51 million to the Tulsa Hub for Equitable and Trustworthy Autonomy (THETA). Led by Tulsa Innovation Labs, the initiative aims to enhance the region’s capabilities in autonomous systems through advanced manufacturing and technology deployment. Tulsa’s Legacy of Innovation Tulsa is one of 12 regions awarded funding from the 31 designated “Tech Hubs” last fall. This federal investment leverages Tulsa’s strong history in aerospace and manufacturing to push U.S. leadership inequitable and trustworthy autonomous systems. The city’s focus areas

MoviePass, a Black-owned movie-theater subscription service, has received an equity investment from Forecast Labs, a consumer venture group owned by Comcast. As first reported by Variety, this investment will help MoviePass attract new customers through targeted TV ads using Comcast’s media reach. The financial details were not disclosed. The company was recently the subject of the HBO series “MoviePass, MovieCrash.” The Rise, Fall, And Rise of MoviePass Launched in 2011 by Stacy Spikes and Hamet Watt, MoviePass allowed subscribers to buy one movie ticket daily for a monthly fee. Despite

Crunchbase has announced the expansion of its Diversity Spotlight feature to include companies in Europe. This expansion will allow up to one million additional companies on Crunchbase to add Diversity Spotlight tags to their profiles, enhancing the visibility of diverse founders and investors across the continent. Crunchbase’s Diversity Spotlight Crunchbase introduced its Diversity Spotlight feature in 2020 to centralize and highlight data about companies with diverse leadership and the investors who fund them. This feature indicates diversity in an organization’s leadership team, including founders and CEOs for startups and managing

OpenseedVC has reached the first close of its $10 million fund for operator-led startups in Africa and Europe. Founded by former Octopus Ventures and Oxford Seed Fund investor Maria Rotilu, OpenseedVC is a new solo General Partner (GP) that aims to be the first check for startups. OpenSeedVC: Filling a Crucial Funding Gap According to Sifted, Rotilu is Europe’s first Black solo GP and one of the first female solo GPs in the region. Rotilu’s strategy with OpenseedVC is to back startups even earlier than the pre-seed stage, at a

Angeles Ventures, a Latine and woman-led early-stage VC fund, has announced an equity investment from Bank of America. This investment aims to accelerate Angeles Ventures’ mission to find, fund, and grow Latine ventures across the United States. Addressing the Funding Gap for Latine Entrepreneurs Even though Latine Americans make up over 20% of the U.S. population and are the most entrepreneurial group in the country, they receive less than 2% of venture capital funding. Angeles Ventures aims to change this by focusing on tech-enabled B2B and B2C startups at the

Terri Burns, 26, the youngest partner in GV’s history and its first Black female partner, is launching her firm, Type Capital, according to Fortune. Breaking the Heat Cycle During her time at GV, formerly Google Ventures, Burns witnessed a recurrent issue within VC funding strategies: the reliance on “heat” from other investors before committing to a deal. “A lot of investors are driven by heat, versus being driven by true innovation,” she told Fortune. “[Founders are] talking to amazing investors, they’re getting some interest, but no one’s really willing to take the leap

Audible has recently welcomed four new minority-owned businesses into its Newark, NJ-based Business Attraction Program. The initiative, launched in August 2023, aims to bolster the local economy by supporting startups through financial backing and expert mentorship. Empowering Diverse Founders The focus on minority-owned companies, especially those led by Black women, comes at an important time. Nationally, Black-owned businesses receive one percent of venture funding. Audible’s program seeks to change this disparity by offering each company up to substantial non-dilutive grants of $250,000. These funds are allocated for office space, relocation, and local

Reddit Co-Founder Alexis Ohanian took to X, formerly Twitter, to thank Snoop Dogg for being one of the platform’s earliest investors during its spin-out and turnaround. Reddit Reddit, a social media platform and online community, ranks among the top 20 most visited sites worldwide and went public in March 2024. American internet entrepreneur and investor Ohanian is best known as the platform’s former executive chairman and co-founder, along with Steff Huffman and Aaron Swartz. He is also the husband of tennis legend and venture capitalist Serena Williams. Huffman and Ohanian began building Reddit for fun while roomates

Techish host Michael interviews VC and founder Andy Ayim! About Andy Ayim: Former product leader, entrepreneur, angel investor. Ex Managing Director of Backstage Capital London [founded by Arlan Hamilton] Listen on Spotify or Apple podcast also. Watch On YouTube:

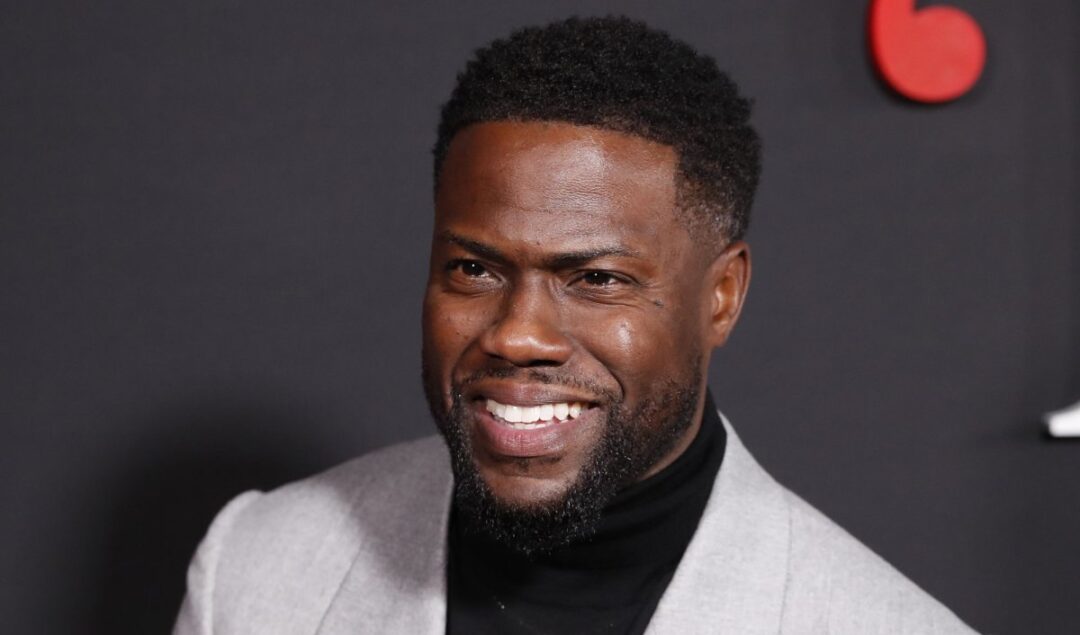

Gran Coramino Tequila, the premium tequila brand co-founded by Kevin Hart and Juan Domingo Beckmann, has disbursed over $1 million in grants to Black and Latine entrepreneurs across the United States to date. The Coramino Fund Since its inception in 2022, Gran Coramino has dedicated a portion of its sales to the betterment of underrepresented business owners, committing $1 from every bottle sold to this cause. The Coramino Fund, established in partnership with the Local Initiatives Support Corporation (LISC), has now dispersed over $1 million in grants. This funding has reached over 100