Mastercard has purchased a minority stake in mobile operator MTN Group’s fintech business. MTN is Africa’s largest mobile network operator, sharing the benefits of a modern connected life with 272 million customers in 19 markets across Africa and the Middle East. Established in 1994 in South Africa, the company provides voice, data, fintech, digital, enterprise, wholesale, and API services. Mastercard’s Minority Stake In MTN Last year, in 2023, Mastercard announced it would purchase a minority stake in the MTN, and now, six months later, they have. In a statement, MTN said it had

Black-owned tech accelerator Plug In Ventures has secured a new $1 million grant from the California Office of Small Business Advocate (CalOSBA). Plug In is the space for Black and Brown entrepreneurs and VCs to reimagine the innovation economy across the US and beyond. Founded by Derek Smith in 2014, the accelerator investing mentors and expands early-stage entrepreneurs. Since 2019, companies in his firm’s ecosystem have raised over $22 million in VC dollars from climate, sustainability, the creator economy, and athletic apparel. The Funding Plug In Ventures will receive $250,000 annually from CalOSBA over

Latimer Ventures has announced plans for a mini-accelerator, Latimer House, for Black and Latinx founders to strengthen businesses, attract investment, and build a network. In honor of Lewis Latimer, Luke Cooper founded Latimer Ventures in 2022. The venture capital firm is focused on helping the next generation of Black and Hispanic enterprise SaaS unicorns. Latimer House Latimer House is an 8-week intensive program for Black and Latinx founders, aiming to help them get to their next growth stage, whether that’s funding or their first enterprise customer. The program also aims to help founders gain

Last year, African startups raised $2.9 billion in deals worth $100,000 and above (excluding exits). Although this amounts to a 39% drop compared to 2022, the continent is showing signs of resilience. Shifting investor landscape In 2023, Techstars was the top investor with 56 deals, surpassing Launch Africa. Other key players included Founders Factory Africa, Ventures Platform, Norrsken, and Y Combinator. All but Norrsken did fewer deals in 2023 than in 2022. For example, YC added only 12 African startups to its 2023 cohorts, compared to 43 in 2022 and

Young Black people are more likely to invest in stocks than their white counterparts, according to a recently published survey by Ariel Investments and Charles Schwab. The survey, conducted in 2022, found that 68% of Black respondents under 40 invested in the stock market, compared to 57% of white under 40s. More Black Americans Investing In Stock The 2022 survey compared Black and white survey respondents with an average household income of $99,000 and $106,000. The study found that overall, the stock market participation is higher among younger Black Americans,

Investment firm Compass Diversified has acquired a majority stake in Beatrice Dixon’s plant-derived feminine care brand, The Honey Pot Company. The Honey Pot Co. was founded in 2012, offering products across the feminine hygiene, menstrual, consumer health, and sexual wellness categories. It can be found in more than 33,000 stores across the US, including Target, Walmart, CVS, and Walgreens, with annual sales estimated to be around $120 million. The Honey Pot Co.’s distinct approach to product formulation, using plant-derived ingredients and clinically tested formulas, has fostered a loyal and diverse customer base over the years.

Several celebrities, including Quavo, Lil Wayne, Alberto Pujols, and Robert Griffin III, have invested in the Proto platform and its hologram device. Proto delivers a lifelike holographic experience, so viewers see, hear, and interact with others anywhere in the world. It’s the world’s first holographic communications platform with an end-to-end system for creating, managing, delivering, and playback interactive hologram content. Proto Hologram Proto is best known for being the Los Angeles-based provider of a patented hologram device. It is a platform that makes holoportation a reality in enterprise, entertainment, education,

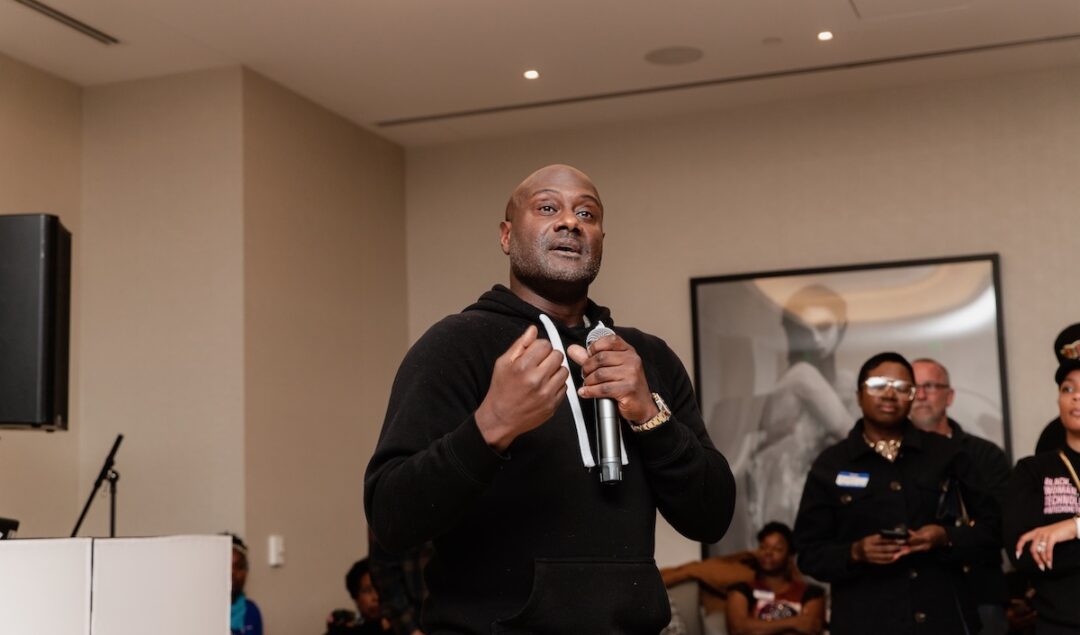

SoftBank is selling its Open Opportunity Fund to its chairman and managing partner, Paul Judge, and Marcelo Claure, who is being appointed the fund’s vice chairman and general partner. The Open Opportunity Fund SoftBank Group is a Japanese multinational investment holding company focusing on investment management. It announced the launch of its second fund under the Opportunity Growth Fund this year, rebranded as the Open Opportunity Fund (OOF). Judge took the reins as chairman of the second fund. Claure, who initially launched OOF, previously served as SoftBank’s COO until 2022

Digital news platform UrbanGeekz has unveiled UrbanGeekz 50, its inaugural list of Black disruptors who are leaving a mark on the innovation economy. Presented by Atlanta-based MHR International, the list spotlights gamechangers in tech, venture capital, and entrepreneurship and is set to become an annual tradition. Industry gamechangers The largest category on the list is ‘Community Builders & Ecosystem Warriors,’ showcasing founders and leaders such as those from Goodie Nation, Black Women Talk Tech, and The Gathering Spot. The Venture Capital category brings together familiar names for POCIT readers, such

For almost six years, I’ve sat in on investor meetings and made deals with startup teams committed to disruption. I’ve seen entrepreneurship in its greatest form, and as an early-stage investor, I’ve been part of getting exciting ideas off the ground and into the marketplace. Uniquely, my career as a founder-turned-investor has been surrounded by nuanced advocacy for social equity and fair opportunities, driving me to relentlessly champion underrepresented voices and create a level playing field for all. Early in my career, I worked closely with the leadership gender gap