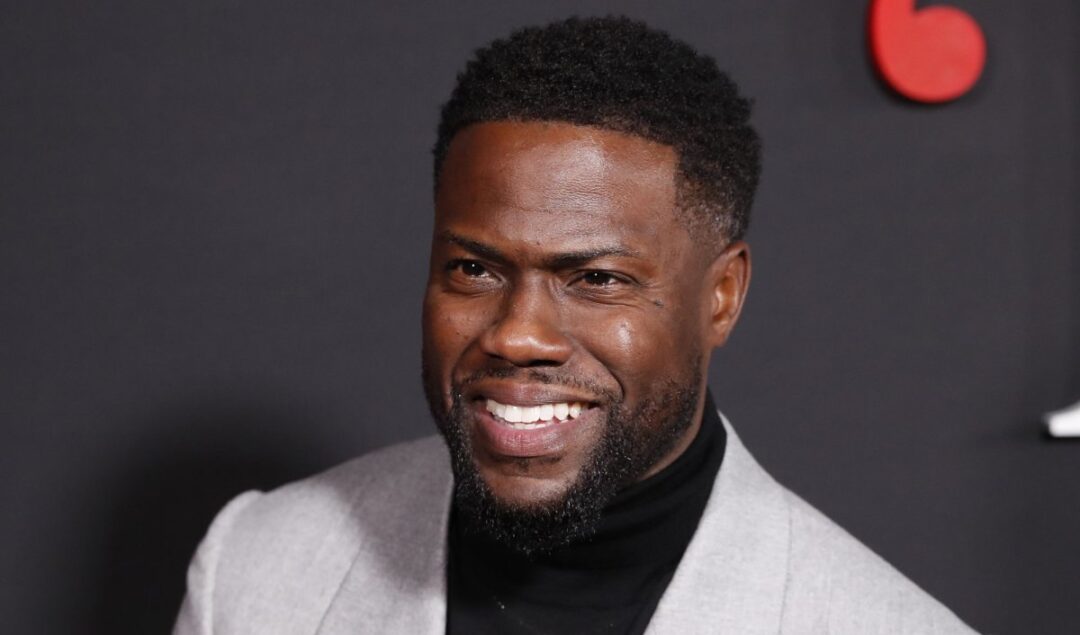

Gran Coramino Tequila, the premium tequila brand co-founded by Kevin Hart and Juan Domingo Beckmann, has disbursed over $1 million in grants to Black and Latine entrepreneurs across the United States to date. The Coramino Fund Since its inception in 2022, Gran Coramino has dedicated a portion of its sales to the betterment of underrepresented business owners, committing $1 from every bottle sold to this cause. The Coramino Fund, established in partnership with the Local Initiatives Support Corporation (LISC), has now dispersed over $1 million in grants. This funding has reached over 100

Verod-Kepple Africa Ventures (VKAV) has announced the closure of its first fund at $60 million. A Pan-African Vision with Global Backing VKAV is a collaborative effort between West African private equity firm Verod Capital Management and Tokyo-based venture capital firm Kepple Africa Ventures. Notably, the fund includes backing from Japanese powerhouses such as SBI Holdings, Toyota Tsusho Corporation, and Sumitomo Mitsui Trust Bank. Nigeria’s SCM Capital and other institutional investors from Japan, including Taiyo Holdings also contributed. VKAV’s investment strategy focuses on digital infrastructure builders, efficiency solvers, and market creators.

In the first quarter (Q1) of 2024, Africa’s startup scene saw another year-on-year and quarter-on-quarter dip in investments – with a notable exception in the mobility and fintech sectors. A drop in funding According to Africa: The Big Deal, Q1 saw $466 million raised through $100k+ deals by 121 startups (excluding exits). This is a 27% decrease from the previous quarter and only half of the amount raised at the same time last year. Techpoint Africa’s analysis of data from Intelpoint notes a 62% drop in African tech startup funding compared

According to Reuters, Bank of America (BoA) has announced an investment in Impact X Capital Partners’ IX Global I fund. The initiative aims to nurture underrepresented innovators, particularly women and founders of color, in sectors like digital technology. Impact X Capital Partners IX Global I Fund Impact X Capital Partners, established in 2019 and headquartered in London, blends financial returns with social impact. The venture capital firm is dedicated to addressing the disparity in capital access for diverse UK and European entrepreneurs. Impact X has several notable founding members, such as Ursula Burns, former CEO

Lagos-based blockchain payments startup Zone has raised $8.5 million in an oversubscribed seed funding round. Nigerian Startup Zone Zone’s fundraising success is part of a growing trend in Africa’s fintech sector, which has recently seen companies like Cleva and Zuvy secure significant investments. Founded in 2008 by Emeka Emetarom, Obi Emetarom, and Wale Onawunmi in Lagos, Nigeria, Zone positions itself as Africa’s first regulated payment blockchain network. Its blockchain-based decentralized payment infrastructure caters to financial service providers across the continent and beyond. The startup has collaborated with over 15 of Africa’s top banks and fintech companies,

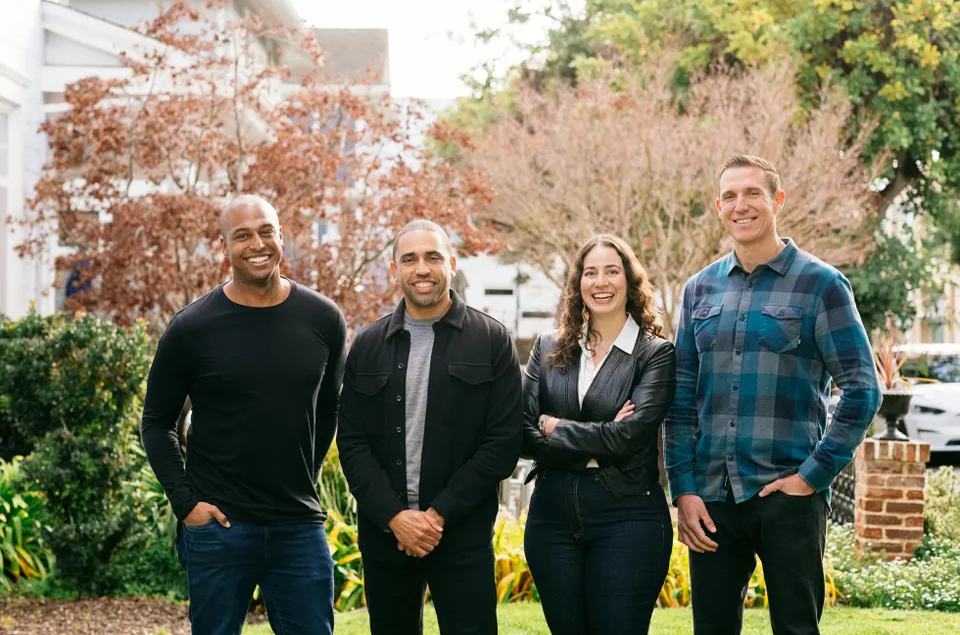

Westbound Equity Partners, formerly Concrete Rose Capital, has raised an impressive $100 million to invest in Black, Latine, and diversity-focused founders. Westbound Equity Partners Spearheaded by Sean Mendy, a former Boys & Girls Clubs of the Peninsula director, Westbound’s mission is to channel resources into startups that demonstrate potential while embodying a commitment to diversity and equitable culture. Mendy’s vision was to create a fund to break the homogeneous investment and entrepreneurship cycle and foster a more diverse and inclusive tech ecosystem. The uniqueness of Westbound lies in its dual approach. On the one

The Russell Innovation Center for Entrepreneurs (RICE), a pivotal hub for Black entrepreneurs in Atlanta, announced a $2 million grant from Truist Foundation and two Truist Trusteed Foundations. RICE positions itself as Atlanta’s home for Black entrepreneurs and an economic mobility engine for the community. Its stakeholders have created hundreds of jobs, generated over $100 million in revenue, and spurred $450 million in total economic activity. This financial endorsement by Truist comes at a critical time. It is set to accelerate RICE’s expansion efforts and elevate the stature of Atlanta-based Black entrepreneurs within and

UK-based Black woman-founded digital health startup SökerData, has been awarded a share of a £6.2 million ($7.8 million) grant from Innovate UK. SökerData Research has found that people of European genetic ancestry represent a disproportionate 80% of participants in genome-wide association studies (GWAS). By contrast, only 2% of participants have African genetic ancestry. This imbalance has profound implications, especially in diseases like breast cancer, where outcomes vary significantly across ethnicities. SökerData’s project focuses on building a diverse biomarker database, a critical resource in the realm of medical research. Biomarkers are

Recent data from Crunchbase reveals that there has been a disproportionate decline in venture funding for Black-founded startups in the United States. A Fall Below The $1B Threshold Last year, these startups secured only $705 million in funding, marking the first time since 2016 that the figure fell below the $1 billion threshold. This sharp decline of 71% in funding to Black-founded companies starkly contrasts with the 37% decrease in overall U.S. startup funding, highlighting a widening gap in investment allocation. This drop signifies a declining share of Black-founded startups

Uber Technologies Inc. is set to invest in Nigerian startup Moove in a funding round that could reach up to $100 million, Bloomberg reports. Moove Founded in Lagos in 2020 by British-born Nigerian entrepreneurs Ladi Delano and Jide Odunsi, Moove has expanded its reach beyond its origins. The duo’s aim is to build the world’s largest integrated vehicle financing platform for mobility entrepreneurs. With its headquarters in Amsterdam, the company now operates across Africa, the UK, the UAE, and India. Moove’s innovative business model revolves around a unique credit-scoring system,