The Black founded start-up with a mission to make culturally competent healthcare accessible for minority communities has announced that it raised $1.6 million in seed funding led by the Female Founders Fund with participation from Serena William’s venture firm. Founded in 2018, HUED’s database now features over 600 healthcare providers tailored specifically towards communities of color and has developed a digital training curriculum for healthcare systems and stakeholders. The curriculum provides tools to dismantle structural and policy barriers that prevent these communities from accessing the care they need. Other round

Black Tech Twitter is good for many things – from shining a light on the rising talent in the sector, helping members of the community land their dream jobs, to updating those who are keen to get into the industry on the latest events happening around the globe. But one thing it’s increasingly becoming well-known for is being a safe space to ask for advice and get “absolute gems” in return. Here at POCIT, we’ve broken down some of the latest advice from Black Tech Twitter this month. Just go

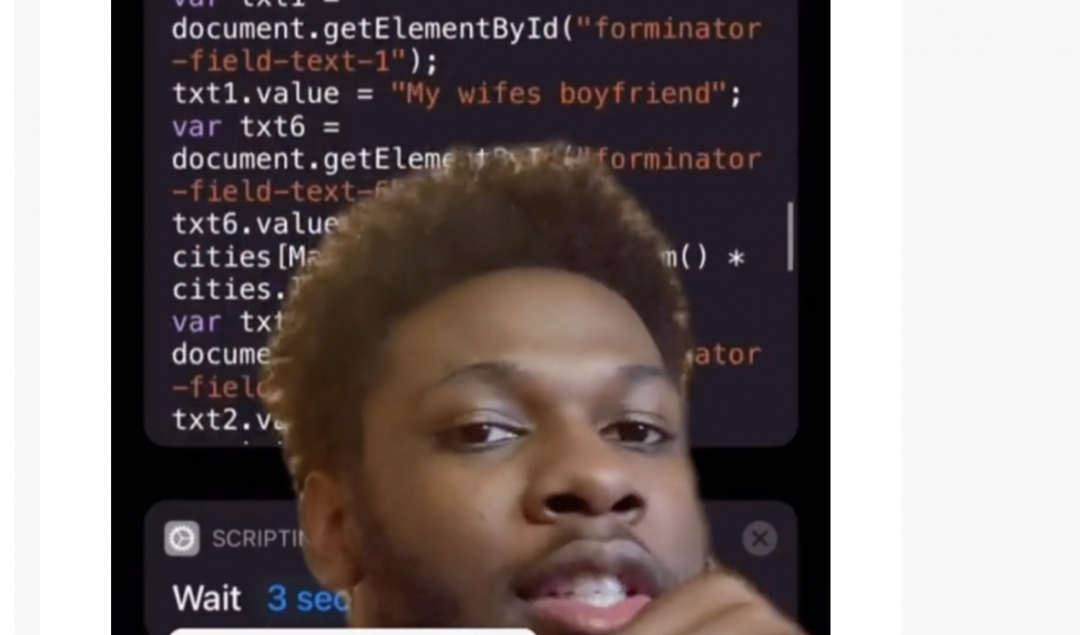

A Black Tiktok coder is going viral today after creating a code to oppose a Texas law banning women from having an abortion after six weeks of pregnancy. The law, which has already received backlash from dozens of people in the state, relies on private citizens to sue anyone who helps a woman get an abortion after a fetal heartbeat is detected. While some have protested or turned to social media to share their frustrations – Sean Black, known as “black_madness21” on the popular social media app, wrote a computer

Create Lab Ventures has teamed up with Trill or Not Trill to launch the world’s first artificial intelligence Afro-Latina, A. I robot, who made her debut at school systems worldwide on Monday. C.L.Ai.R.A was first introduced through Trill or Not Trill; a Black founded institution to provide innovative strategies and solutions that speak “to the culture.” Founders Jeff Dess and Lenny Williams joined forces with a social venture – Creat Lab Ventures – to continue their mission of providing underserved communities with the resources and skills needed to thrive in the media and

Facebook has announced a $100-million commitment to a program that supports small businesses owned by women and minorities by buying up their outstanding invoices. This means that small businesses, who otherwise could have had to go months without getting paid by their customers, will be able to pay off their staff or bills. The tech media giant’s ‘Invoice Fast Track program’ is its latest effort to build its relationship with small businesses, which use its social media platform for business and advertising. Although the program isn’t necessarily new because it

When it comes to Venture Capital, the UK is far from meeting the necessary targets for diversity, particularly when it comes to the Black community. But Black VCs up and down the country are not staying silent anymore, and many of them are becoming more and more vocal on the lack of diversity in the sector, with some taking matters into their own hands to make an active change. From blogs and podcasts that advise new founders, group mentoring sessions to even launching their own firms specifically for Black aspiring VCs

Arlan Hamilton has paved the way for hundreds of underrepresented founders for just over half a decade. Her firm, Backstage Capital, one of the first Venture Capital companies to invest solely in start-ups led by minorities, now celebrates its 6th year. With 180 deals already – the firm has invested in a range of startups since its launch on September 15, 2015 – from online beauty retailers to satellite internet companies. Outside of Backstage Capital, Arlan has committed personal capital to more than 20 emerging fund managers. And since the

Barclays Eagle Labs has partnered with Foundervine [CEO Izzy Obeng pictured] to launch its second 12-week virtual accelerator program designed just for Black-founded early-stage tech businesses. The program, which officially kicks off on November 22, was created to help new startups founded by one or more black entrepreneurs access resources to help them with sales strategy, operations, product development, and leadership. According to Barclays, applications are now open for the Accelerator to UK-based digital and tech start or scale-ups with a “minimum viable proposition for their business and with one or more

Jessica Clemons, also known as the ‘culture’s psychiatrist,’ has just landed a podcast deal with Audible Original, where she’ll talk about everything from anxiety, bipolar disorder to substance use disorders and how to know when to seek treatment. She described the achievement as a “long time coming” and revealed to her Instagram followers that her interactions with them inspired the podcast. Ms. Clemons, who has developed a reputation for being the bridge between the Black community and mental wellness, also thanked them for trusting her with their own mental health journeys.

Issa Rae has joined forces with American Express and the U.S. Black Chambers Inc. to help push their joint mission to expand their ByBlack initiative by launching the “first national certification program exclusively for Black-ownership designation.” The free platform, which was designed as a directory for Black-owned businesses, will now offer Black business-owners the opportunity to easily obtain approved accreditation that their customers and other companies can trust when spending with them. “Black businesses are American businesses,” Rae said, adding, “I think it’s one thing to support them during a very specific time when