Why Do Black And Latine Tech Employees Own Less Equity?

Black and Latine startup employees own less equity than their counterparts – here’s why it matters and what we can do about it.

December 8 marked Latina Equal Pay Day: Full-time and part-time Latinas only earn 54 cents for every $1 earned by white, non-Hispanic men. Similarly, the following equal pay days remind us of the wage gaps faced by women of color compared to white men.

- AANHPI Women: 75 cents (May 3)

- Black Women: 64 cents (September 21)

- Native and Indigenous Women: 51 cents (November 30)

But should we also be talking about equity compensation?

What is equity compensation?

Equity compensation refers to the non-cash pay offered to employees which gives them some ownership in the company. The startup world commonly uses equity compensation, such as stocks and performance shares, which can leave employees with earnings larger than their salaries.

Ownership and equity management platform Carta describes the startup economy as an “ecosystem” as equity ownership can be a powerful way of recycling capital. Employees who earn money from equity payouts can then use this to start or invest in another business, creating more job and ownership opportunities.

Carta’s Annual Equity Report 2022, in partnership with #ANGELS, gives a demographic analysis of ownership in US private markets. Here’s what we learned about equity distribution in the startup ecosystem.

Black and Latine employees own less equity

Like salary, equity is unequally distributed among startup employees.

Black and Latine workers comprise 30% of the US population but only 16% of equity-receiving employees in 2022. In addition, Black and Latine employees received a mere 9% of all initial equity grants. This figure has seen little change despite a focus on DEI efforts since 2020.

There are also more Black and Latine employees in administrative and customer support roles, which tend to result in lower equity holdings than those in technical and leadership positions.

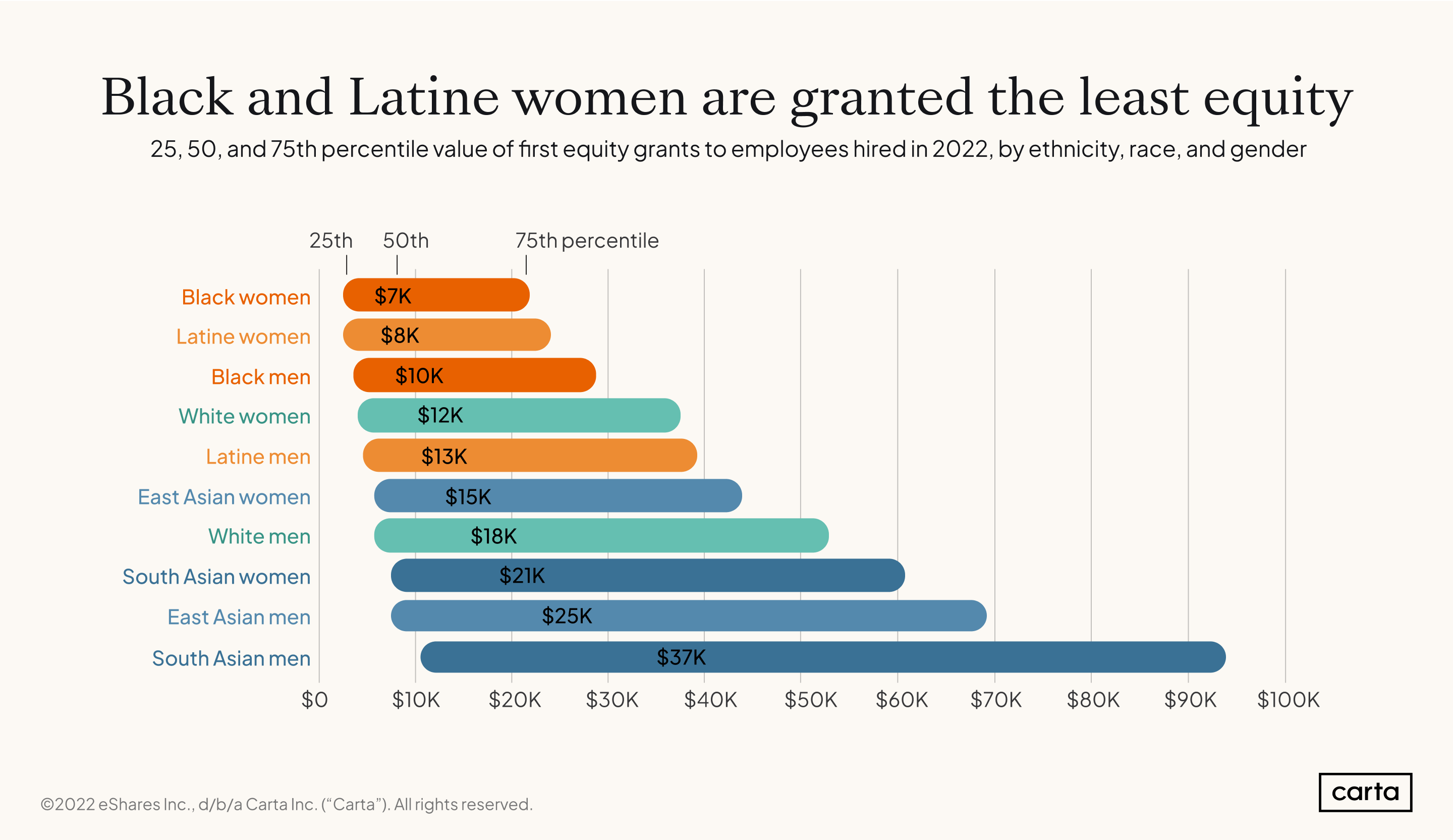

South Asian men received the highest value of equity grants, and Black women the lowest. Parenthood adds another dimension to these disparities. Dads—but not moms—tend to get a bump in equity compared to their colleagues who do not have children.

The other way Black and Latine folk in the startup ecosystem can get equity is by founding their own company. While white men make up nearly half (48%) of founders, there is more racial diversity among younger founders.

Why does this matter?

Research suggests that equitable distribution of company stock can play a major role in narrowing the racial wealth gap. For example, the National Center of Employee Ownership found that POC who participate in employee stock-ownership plans had 30% higher income and higher household wealth than their peers who didn’t.

Some also find that participating in equity compensation schemes provides them with experience in managing stocks.

Read: WOC In The Workplace - What We Learned From The Largest Study Of Women In Corporate America

Participating in her company’s employee stock-purchase plan gave DC-based software engineer Stephanie Assi the necessary experience to expand to more extensive and diversified holdings.

“I think a good part of my portfolio is where it is now thanks to that,” she told the Washington State Journal. “I wish more companies did that.” Assi later co-founded a ride-hailing company in her home country of the Ivory Coast.

Closing the gap

Employers can make concerted efforts to remove biases in distributing equity among employees. For example, Divvy Homes has taken the approach of formalizing equity compensation. At Divvy, equity is never negotiated. Instead, CEO Adena Hafets explains that they set compensation bands, make an initial offer, and allow promotions and raises early in employees’ careers.

“Companies have an obligation to make sure that they are bringing in underrepresented minorities as well as women onto their board, Hafets said at Carta’s Annual Equity Summit. “You have to make it a concerted effort. You’ve got to do those detailed searches. Hold yourself accountable. That’s the most important thing.”

Read: Solo Ceesay On Why Venture Diversity Initiatives Continue to Fall Short

Companies can also offer all employees stock at the outset, which would help underrepresented workers cash out more easily. Economic sociologist Joseph Blasi also suggests companies focus on training employees from underrepresented backgrounds so they can advance in roles that receive larger equity grants.

Dana Settle, co-founder and managing partner at VC firm Greycroft believes investors have a responsibility to prioritize equitable equity, too.

“Especially during times like this when things get tougher, people need equity,” Settle explained at Carta’s Annual Equity Summit. “They need to have skin in the game in order to really want to continue, to dig in and get through the hard times.”