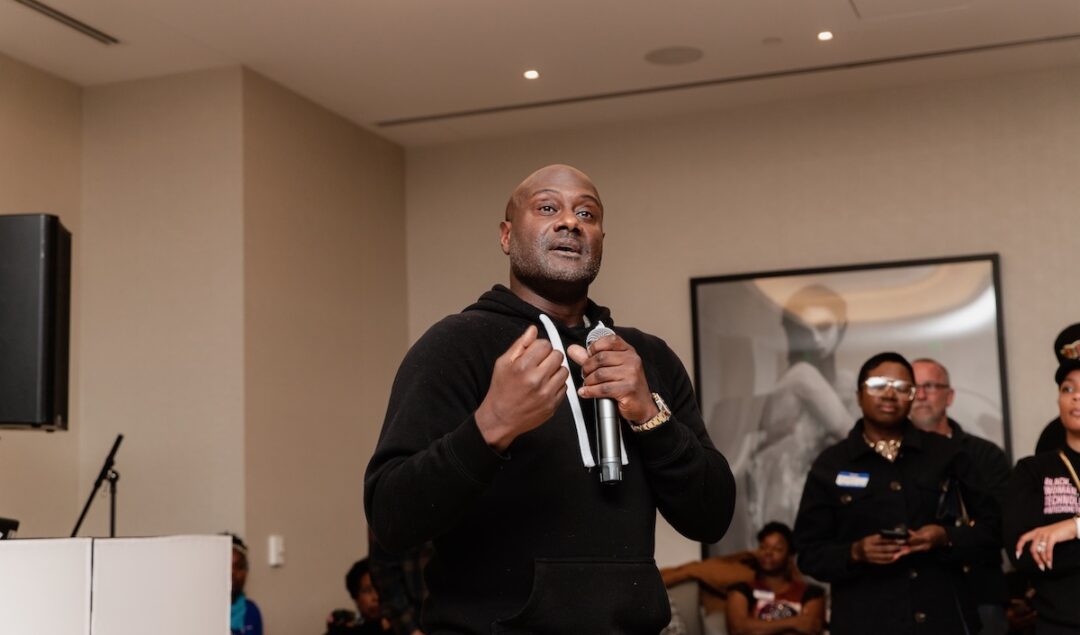

Westbound Equity Partners, formerly Concrete Rose Capital, has raised an impressive $100 million to invest in Black, Latine, and diversity-focused founders. Westbound Equity Partners Spearheaded by Sean Mendy, a former Boys & Girls Clubs of the Peninsula director, Westbound’s mission is to channel resources into startups that demonstrate potential while embodying a commitment to diversity and equitable culture. Mendy’s vision was to create a fund to break the homogeneous investment and entrepreneurship cycle and foster a more diverse and inclusive tech ecosystem. The uniqueness of Westbound lies in its dual approach. On the one

Latimer Ventures has announced plans for a mini-accelerator, Latimer House, for Black and Latinx founders to strengthen businesses, attract investment, and build a network. In honor of Lewis Latimer, Luke Cooper founded Latimer Ventures in 2022. The venture capital firm is focused on helping the next generation of Black and Hispanic enterprise SaaS unicorns. Latimer House Latimer House is an 8-week intensive program for Black and Latinx founders, aiming to help them get to their next growth stage, whether that’s funding or their first enterprise customer. The program also aims to help founders gain

Latinx people make up one-fifth (20%) of the US workforce but account for 8% of people working in science, technology, engineering, and mathematics (STEM), according to Pew Research. Data from Built In also revealed that between 2007 and 2020, Latina and Hispanic women made up only 2% of computing-related jobs. Given the underrepresentation of Latinx professionals in tech, here is a roundup of some of the organizations and communities ensuring they have the tools and support needed to thrive in the industry. Supporting Latinx Professionals SHPE (Society of Hispanic Professional

Angeles Investors have announced the winners of this year’s Estrellas award. The line-up features a collection of the top 40 funders and venture capital firms investing in Hispanic and Latinx startups. This year’s cohort exemplifies leadership in investing in top startups and Hispanic and Latinx founders, among the fastest-growing segments of the U.S. economy. “It’s exciting to see the number of top funders and venture capital groups investing in Latino startups grow,” said Adele Cepeda, Angeles Investors Board Chair and Director at BMO Financial Corporation. “In 2020, we started

Venture capital firm, LatinxVC, has opened applications for the third cohort of LatinxVC fellows. The eight-week program prepares participants for a successful analyst, associate, and senior associate role at a venture capital firm. In addition, the program will equip Latinx candidates with the tools needed to succeed and break into the investment world. LatinxVC was founded in 2019 by Rami Reyes, Maria Salamanca, and six other Latinx professionals. It works to grow the number of Latinx professionals in venture capital by helping them develop their careers and network. Their eight-week program

Miami-based cybersecurity startup, Lumu, has closed an $8 million investment round. The funding round led by Panoramic Ventures also included SoftBank Group’s SB Opportunity Fund, KnowBe4 Ventures, Land Bess, a former Zscaler, and Tom Noonan, former CEO at Internet Security Systems. Lumu, founded in 2019 by Ricardo Villadiego, is a cybersecurity company that helps businesses identify and isolate cyber-compromise in real-time. The platform identifies and isolates potential threats, attacks, and adversaries affecting enterprises. As more nation-state criminal groups continue targeting everything from business IP to government secrets, Lumu’s services have proven to

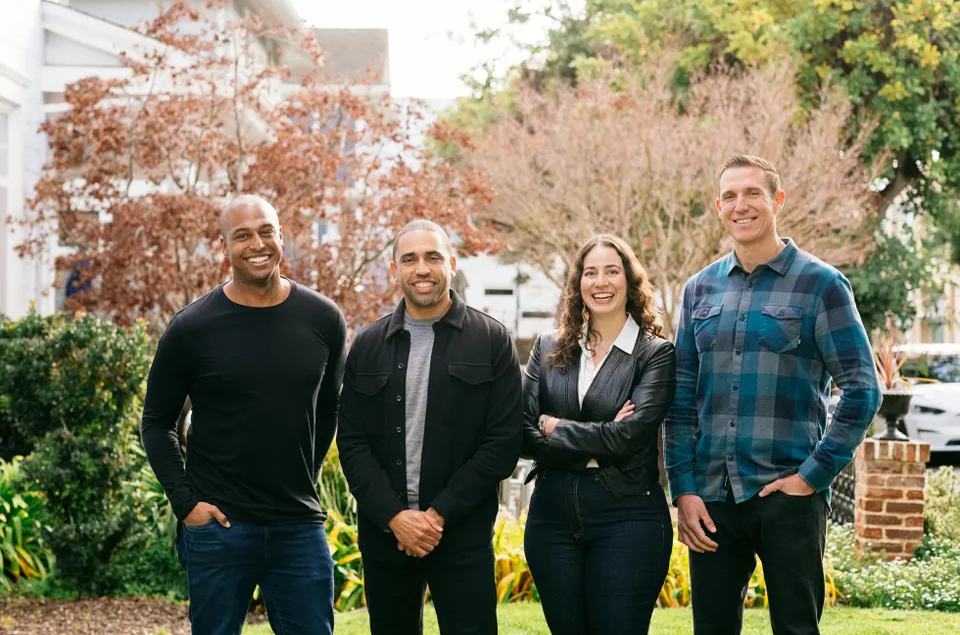

California-based VC firm, L’Attitude, has launched its new fund to support early-stage Latino founders. The investment firm raised $100 million from big-name investors, including Bank of America, Trujillo Group, Barclays, Cisco, Royal Bank of Canada, and a “strategic anchor investment” from JPMorgan Chase. According to the outlet, Latino business owners have grown 34% over the last decade. Yet, despite this, 72% of Latino entrepreneurs face funding shortfalls, with a large majority relying on personal savings, and only 1.8% are venture-backed. L’Attitude, founded in 2019 by Kennie Blanco and Sol Trujillo,

Tech giant, Apple, has launched its inaugural Entrepreneur Camp for Hispanic/Latinx founders and developers. This year’s program will specifically focus on supporting Latinx founders and will encourage leaders and developers from nine app companies in the US, Brazil, Guatemala, and Portugal to build the next generation of apps. “We are so excited to bolster the impact of Entrepreneur Camp with the addition of this new cohort for Latin technologists,” said Lisa Jackson, Apple’s vice president of Environment, Policy, and Social Initiatives. “It’s an honor to support these founders and

Mexico City-based fintech platform, Arrenda, has raised $26.5 million in a pre-seed funding round of equity and debt. The funding round, which Fasanara Capital and Kube Ventures led, also included ODX Ventures, Toehold Ventures, Wharton Fintech, Lightspeed Venture Partners Scour Fund, PRMM Inmobiliaria, and a range of angel investors. Arrenda, founded in 2022 by Joe Merullo, is a revenue-based startup that works to provide market-specific insurance and financial products to the real estate markets and landlords of Latin America. Not only does it offer advance payments to landlords, but it

Financial giant, Mastercard, has officially announced the class of this year’s Start Path program, an award-winning engagement program aimed at providing global support and mentorship to the brightest late-stage startups. According to a press release, Mastercard selected three early-stage startups led by underrepresented founders and four late-stage fintech innovators looking to scale their businesses for this year’s program. “As we continue our eight-year legacy of successful collaboration with startups around the world through Start Path,” said Blake Rosenthal, executive vice president, Fintech & Segment Solutions at Mastercard. “The companies we selected are on