How COVID-19 has Impacted M-PESA – The Mobile Payments Darling of East Africa

It’s fair to say Kenya’s predominantly informal sector is currently under shock, due to the impact of the ‘rona’ and the measures and mitigations that have followed: quarantines, social distancing rules, curfews, restrictions and possibly lockdowns.

M-Pesa inextricable link with Kenya’s biashara economy [small trader economy] fully exposes it to this shock. Newly appointed CEO Peter Ndegwa of Safaricom and M-Pesa admitted to Reuters , that the mobile payments darling of Africa and East Africa is fully dependent on the economy of Kenya.

It has only been a month of subdued biashara, but the new M-Pesa CEO already expects a 7.3% decline in M-Pesarevenues of upto $52 million this quarter.

Unless a vaccine or cure can be found, and a resumption to the biashara economic levels to Pre-Covid19, M-Pesa revenues are likely to be worse than this first quarter for the foreseeable future.

Here is why

I wasn’t prepared for this virus

Before Coronavirus, income, earnings and cash inflows for biashara people in Kenya’s economy weren’t great. Everyone in the biashara economy – Uber drivers, boda boda riders, gikomba traders, brokers, kiosks, restaurants, car wash and kibandas – was hanging on a shoestring.

It got worse on March 13, after the first reported case of coronavirus in Kenya, biashara began to feel the effects of a shock, and its been that way ever since.

Biashara shocks are not abnormal, – volatility and unpredictable cashflows are part of the operating environment of the informal sector.

But this shock was special because it didn’t matter what biashara line you were in, the ripple effect of Coronavirus was system wide regardless of whether you were selling mitumba clothes in Gikomba, or a mama mboga from the neighbourhood estate, or matatu, boda boda or uber driver – you were now part and parcel of the new Post Covid19 economy.

News trickled in reporting declines in daily cash inflows and earnings for biashara, some by 50%, others by as much as 70%.

Uber drivers say their incomes are down over 50% and some have opted to move up country and wait things out

Over 70% of business is lost as fewer people travel says Matatu Owners Association Chairman Simon Kimutai

Second hand clothes ‘mitumba’ sellers at Kongowea market in Mombasa ponder next move after county government banned business in various markets

86% of Kenya’s tour operators have reported a significant decline in bookings as the coronavirus takes a toll on the country’s tourism sector.”

The first wave of response measures kicked in to control inflows into the country via air or sea. All the biashara people feeding into or from the global supply chain such as traders and wagerers were first to feel the shock.

Halting exports of flowers to Holland risked 30,000 jobs for Nakuru county in Kenya, and the treasury was considering alternative channels of imports for China.

“Top government and private sector officials will hold a series of meetings to explore alternative source markets for supplies in the wake of deadly Covid-19 outbreak that has cut off imports from China” – Import sourcing talks start as virus cuts off China

“Rescue flower industry from coronavirus pandemic, urges Nakuru Governor Kinyanjui as temporary staff who have been sent home by flower firms in the wake of Covid-19 lockdowns in European countries”

The next wave of mitigation measures was more localized such as banning certain types of services providers like tourist resorts, pubs, and clubs that employ thousands upon thousands of young men and women. These ones took an 80% cut overnight, together with all the support staff they employ.

The present wave of mitigation measures such as curfews, restrictions, social distancing rules, closure of business means lower foot traffic for businesses and transporters. To make up for the declines, transporters increase prices which in turn affects the pricing of foods and goods transported by traders for sale and reconsidering travel in general. Curfews and restrictions have meant that traders can no longer move around as they used to and patrons cannot dine out.

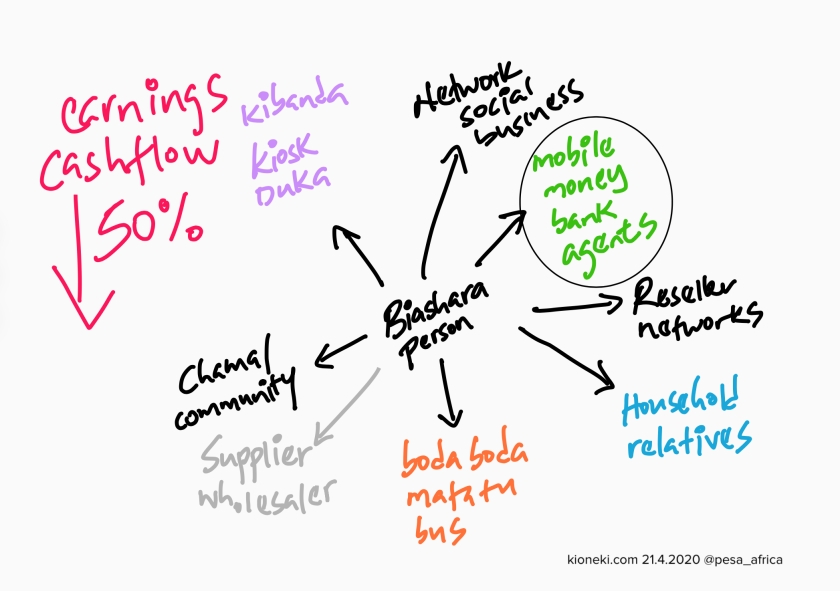

Cumulatively, biashara ripple effects have struck people as individuals, micro and small business, people as part of groups, communities, business networks, social networks, and most crucially households of kids and relatives.

The Ripple of Effects of Covid19 on M-Pesa and M-Pesa Agents

A shock to biashara people ripples through the ecosystem affecting other interdependent actors such as the M-Pesa agent

M-Pesa agents are the pulse of biashara, the frontline workers, how money gets into the M-Pesa system from the hands of the people.

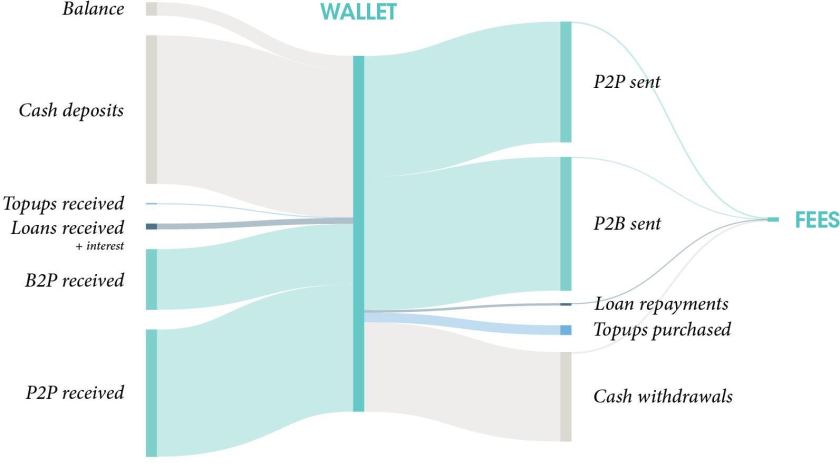

All 150,000 of them are on the ground, exchanging cash deposits into M-Pesa and withdrawals back to cash. In between depositing and withdrawing, people can choose to hold money in wallets, send to someone transfer, save to earn interest and deposits and loans.

This is a map of an M-Pesa and mobile money bank agent as part of the financial service providers supporting biashara people.

When a biashara takes a 50% hit in cash inflow and earnings due to a loss in liquidity, everybody arounds them feels the impact, including the mobile money agent.

Millicent from Eldoret, featured in Covid19diariesKenya by FSD Kenya, said theAmos, husband was no longer sending money home as remittances, a key use case for M-Pesa, because their matatu crew was now making 2,000 Ksh daily, down 70% from 9,000 Ksh.

Millicent herself is receiving less from her business and now from her husband, so the overall household has taken a similar shock. Amos visits the agents less often, has a lower average M-Pesa balance and the economies around Amos and their household in Eldoret and Nairobi take a hit by the same.

She used to send her mother money to help with daily expenses, but she hasn’t sent anything in about three months.

It all adds up when all the biashara people around a busy market take a hit, the M-Pesa agent gets a piece of the burden.

Using a sample of over 1000 users and 20 agents, Caribou data and Microsave this week concluded that business for some agents had reduced by as much as 50%, attributable to lower foot traffic due to restrictions and curfews, and newly passed policy by Central Bank on cashless transactions.

According to the Central Bank of Kenya directive on 16th March 2020 bank cash and banknotes increase the risk of COVID – 19 (Coronavirus) transmisson so the bank waivered transaction fees on bank and M-Pesa to encourage a switch to cashless.

This move effectively encouraged this as a deposit option as opposed to depositing cash at a physical agent location.

Agents cited by Caribou data and Microsave said overall commissions were down by more than 50%; commissions usually shared with M-Pesa.

This explains why some agents said they were re-directing their money intended to float for other businesses or to stock up on provisions for their households in preparation for an imminent complete lockdown

Caribou also cited that there was lower M-Pesa wallet balances versus before Coronavirus – a 50% drop wallet balance.

So lower liquidity in biashara and cash circulations is affecting

- the amounts flowing in and out of M-Pesa for use cases

- The amount or balance in the M-Pesa wallet on average

- Send receive and pay transaction

- M-Pesa wallet related transactions

- Commissions

- Transaction fees

All these collectively add up and lead to lower revenues for M-Pesa and its agents.

This is the new reality

Speaking to Reuters, the newly appointed CEO of Safaricom had bad news for shareholders.

M-Pesa would take a Sh5.5 billion hit on its M-Pesa revenues in the 3 months from mid-March, because of the CBK directed waiver on transaction fees on mobile money transfers under $10 (1,000 Ksh)

The foregone revenue is equivalent to 7.3% of M-Pesa’s annual sales; M-Pesa accounts for about one-third of Safaricom’s Sh240.3 billion revenue.

This is Sh 5.5 billion due to a shock and measures in the first 3 months, from the CBK directive only, before tallying up the revenue losses from biashara losses.

Let’s put things in perspective for Mr. Ndegwa and his shareholder with this neat ltimeline

- On 20th of March Kenya went from pre to Post Covid 19 era. It is now in uncharted waters and can’t say with certainty when it ends.

- The first confirmed case in Kenya marked the start of a decline in cash inflows and earnings for most of biashara, and as measures have kicked in over the last 4 weeks, biashara is down, the lucky ones maybe 25%, others 50% and the worst as much as 80%.

- Some countries like Ghana have attempted to open up the business to near normal. There are no results yet from Ghana, but we know Singapore tried, failed and went back to lockdown. So Kenya could try, and this might have some hope for M-Pesa to revive revenues, even slightly if cash inflows for biashara can pick up again. But will this be enough to lift business back to Pre-Covid19 levels?

- At some point in future we might discover a vaccine, made available universally, this would be a relief as solid plans can be made for recovery

- At some point in future, we will try to kick start a recovery, perhaps the only day Safaricom and M-Pesa can look up to and expect better days and the hey hey hey revenue days of Pre-Covid19.

Even then, such a case assumes we will go back to business as normal. Once people get used to freeing transactions for transactions under 1000 for a full year, will they want to switch back? 5.5 billion could be lost forever out of future revenues.

For now, Mr.Ndegwa has to navigate these key period of the new reality

- Today

- Attempt at normal

- Post Vaccine

- Start of recovery

This will be the real test for M-Pesa because some things are going to happen between now and the start of recovery that put pressure on Mpesa revenues beyond the waiver on transaction fees.

Right now, people have moved to scrape what they can, others have decided to tap into their buffers, like digital lending loans, loans such as fuliza, loans from friends and family and chama sent via M-Pesa.

But there is a concern of higher risk lenders worried about borrowers who might have trouble paying back. One digital lender Tala, raised the processing time for processing digital loans from hours to days.

This will mean lower volumes of the transaction through the M-Pesa wallet, translating to lower revenues beyond this first month.

More people, biashara and households will take a substantial cut in their cash inflows, and be forced to tap out their options and start cutting down.

With kids back home from school, there is pressure on households, forcing them to evaluate expenses based on the most essential and can live without.

Some of the expenses like eating out at restaurants, sports gambling, ecommerce or non- essentials typically go through M-Pesa wallet.

Mr. Ndegwa seems acutely aware of this and why he goes on to say

“When Kenya gets back on track, our business should get back on track, but our business is linked to how the country comes out on the other side”

See you on the other side then!

Follow this author on twitter @pesa_africa