5 Black Founders In Fintech And Blockchain You Need To Look Out For This Year

We’ve started a new weekly series looking at founders from different communities absolutely killing it in the tech space. Following on from our ‘Meet 3 Standout Latinx Founders Using Data And AR To Do Some Pretty Cool Things‘ feature piece – we’re now taking a deep dive into Black founders in fintech and blockchain that you should look out for this year.

These financial technologies (fintech) companies use the internet, blockchain, and software technologies, as well as algorithms, to offer or facilitate financial services traditionally offered by banks.

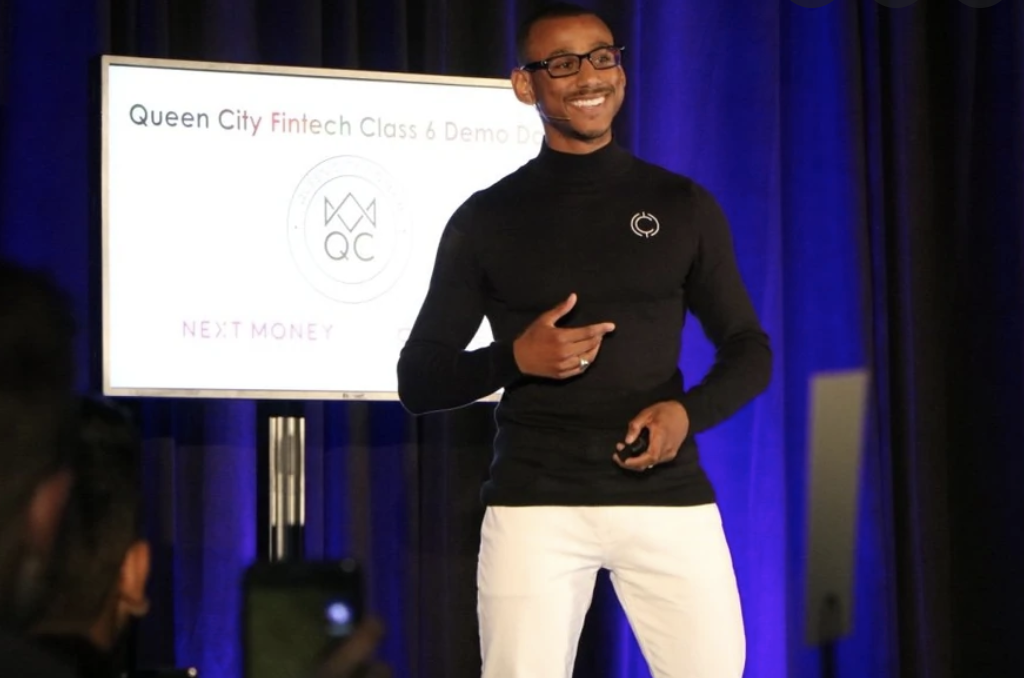

David Potter

Co-founder of Curu, a SaaS lead recovery platform that enables lenders and marketplaces to recover lost and rejected loan opportunities by boosting applicant eligibility in areas such as credit score and debt-to-income ratio.

The startup announced the close of its $3M seed round led by Vestigo Ventures, a leading fintech firm based in Boston, MA last year.

Vestigo Ventures was joined by Harlem Capital, Matchstick Ventures, Carolina Fintech Ventures, Techstars Ventures, Holt Accelerator, Chingona Ventures, and Upscale Fund.

Potter says Curu is committed to solving the applicant retention problem for lenders by helping them to expand their total available market, reduce their customer acquisition costs, and fund more loans by improving applicant eligibility in as little as 90 days.

The fintech startup intends to utilize seed funding to scale its solution via integrations with banks, credit unions, and online lenders across North America.

Tavonia Evans

Founder of Guapcoin, a blockchain company and cryptocurrency created to amplify the economic voice of the Black community.

“Knowing the full impact of our spending will motivate and inspire us to concentrate our money within our communities. Using Blockchain as a tool to empower our voice and to unify us ( with a decentralized alternative to a financial system that is not a benefit to us collectively) is one of the most revolutionary acts we can do in these tumultuous times,” it states on its website.

Evans is the sole founder and lead engineer of GUAP Coin, which she created to help close the wealth gap and support black-owned businesses in the United States. Despite being hospitalized with the virus and facing funding cuts, Evans says that her company accomplished more last year than ever before.

“We’ve onboarded hundreds of women of color into the Masternode space, an area of crypto that is largely male-dominated,” she told Cointelegraph. 70% of GUAP nodes are owned by women of color, “she told CoinTelegraph.

Olayinka Odeniran

Olayinka Odeniran is the founder and Chairwoman of the Black Women Blockchain Council (BWBC), which is working toward increasing the number of black female blockchain developers to half a million by 2030.

Last year – the BWBC partnered with blockchain software company Consensys to help African people throughout the globe get involved in crypto.

This year – Odeniran plans to host a month-long event for Women’s History Month in March and release a new program to teach African women about NFTs and blockchain.

Boris Moyston

Co-founder of Black Men Talk Tech and fintech startup Fundr, a platform designed to automate, diversify and democratize seed funding.

The Austin-based financial technology company, a portfolio startup of accelerator Sputnik ATX, is an investment platform that uses artificial intelligence to create a diversified portfolio of startups for investors.

The business automates the fundraising process by connecting founders and investors with its proprietary algorithm. It also automates the seed-investing process from the investor side by condensing the discovery and deal-closing process, while also enabling long-term relationships between founders and investors.

Lauren Washington co-founded the startup in 2018 with Boris Moyston and Chief Technology Officer Jean-Philippe Desmontils.

Last year – it announced that it was raising $1 million on its own platform. The company previously received $100,000 in a SAFE note when they were accepted into Sputnik ATX’s summer 2020 cohort, marking its total funding haul to date.

Sheena Allen

Founder and CEO of CapWay, a mobile banking and fintech company with the mission to restore trust and provide a fair opportunity to learn and grow wealth for all.

We previously interviewed Sheena about her journey with Capway: here.

With a CapWay Money Account and CapWay Visa (virtual and physical) debit card, benefits include the ability to make online transactions, send and receive money, and round-up change per transaction to direct towards “Money Goals.”

Prior to launching, the company had amassed a lengthy waitlist of individuals interested in opening an account, which CapWay onboarded over the summer last year.

Now open to all, consumers can download the CapWay mobile app or visit the website to open a CapWay Money Account; create, save, and collaborate on Money Goals; consume financial content, and enroll in financial programs.

Capital led the pre-seed funding round for CapWay, Inc. CapWay’s seed round included investors Y Combinator (S20), Khosla Ventures, Softbank Opportunity Fund, Commerce Ventures, Fearless Fund, Valor Ventures, Indicator Ventures.