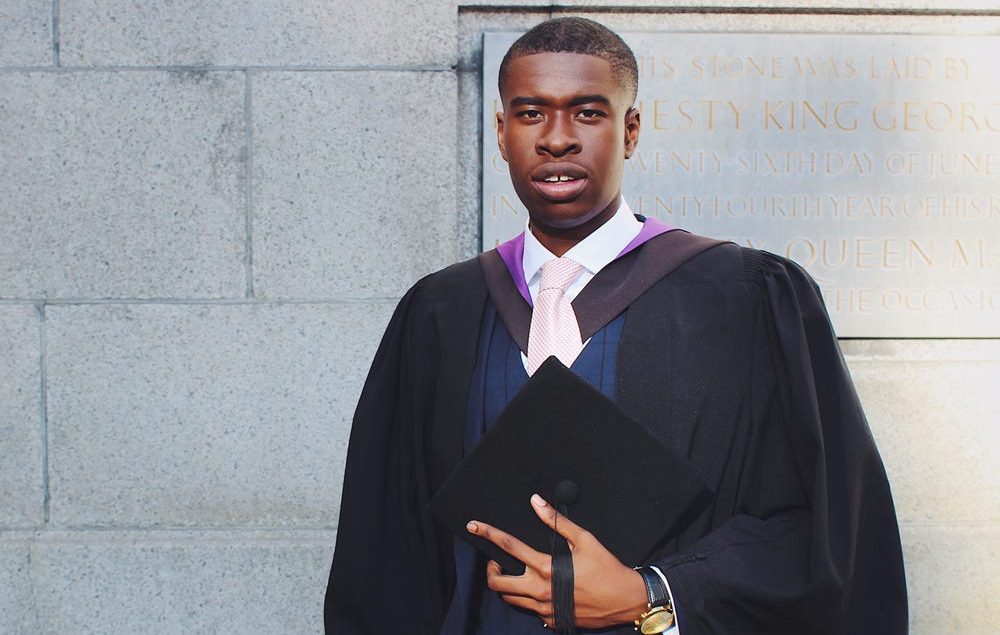

Kela Ivonye is trying to solve the tech diversity issue through his new organization and micro fund, Protégé. After all, it was the connections he fostered as a founder, coupled with his determination and supportive network that led him to a successful exit from his innovative mailbox company Mailhaven Inc. in 2019. Now he’s using his experience, expertise, and knowledge to help Black entrepreneurs succeed by connecting them with Super founders for mentorship and investment. He co-founded the platform, a nonprofit and micro fund, to cultivate community among black founders in

A minority-owned platform that allows you to compare colleges, course options, and tuition fees all in one go has just managed to raise $1M in a pre-seed round that will go towards improving its search and recommendation technology. Craydel was launched earlier this year by co-founders Manish Sardana, John Nguru, and Shayne Aman Premji. It was inspired by the lack of a reliable portal in Africa to guide the big decisions on which college and course selection students will take. The trio then decided to bring to life a platform that would eliminate this

MFS Africa, an inter-operability hub connecting mobile network operators across the continent through a single API, has raised $100 million in a Series C round. That’s a pretty significant number for a Series C funding round, and it’s split between $70 million equity and $30 million debt. Private equity fund AfricInvest FIVE co-led the round with existing investors Goodwell Investments and LUN Partners Group. New investors CommerzVentures, Allan Gray Ventures, Endeavor Catalyst, and Endeavor Harvest joined in while ShoreCap III returned as an existing investor with other funds. For someone who spent more than

A Black-owned startup providing non-intrusive audio ads within mobile games has just raised $14M in its series A round. Makers Fund and Lightspeed Venture Partners led the round. Also participating in the fundraising was the Sequoia Scout Program and Google. The total investment for AudioMob to date is now at $16 million. From kicking off in 2020, founders Christian Facey, CEO, and Wilfrid Obeng, CTO, have seen recent client successes with artists including Ed Sheeran and Nas alongside brands like Intel, Jeep, and KitKat who all saw relative metric achievements

Like many industries, the tech sector still has some way to go in addressing diversity and bias issues and although there has been some progress with big companies like Google creating initatives specifically for minority communities – the work shouldn’t and doesn’t stop there. After diverse intake in companies – what roles are they being given, the salary disparity once in the role, the treatment among colleagues and the handling of racism allegations. We’ve heard countless of stories of Black employees and their allies being sidelined for speaking out against

Brandwatch is hiring on pocitjobs.com Having worked at digital consumer intelligence platform Brandwatch for six years, Tara Seney has been Global Workplace Planning Manager for the past 20 months. Her time in the role has coincided with the pandemic, and as such, a lot of her work has focused on the company’s transition to remote work. In this interview, Tara talks about how Brandwatch has maintained a sense of community within the context of hybrid working and how they’ve evolved their diversity and inclusion initiatives in this new reality. Hey

Emory University is ready to shake up the VC world with its first student-run venture capital fund focused on minority entrepreneurs. The Peachtree Minority Venture Fund (PMVF) was launched at The Roberto C. Goizueta Center for Entrepreneurship and Innovation at Emory University’s Goizueta Business School. The fund, funded by the Goizueta Business School endowment, was made to support Black, LatinX, and Native American entrepreneurs. It currently has $1M in assets under management, and students are responsible for souring companies, conducting due diligence, and making investment recommendations to the Peachtree Investment Committee, reported

Backstage Capital founder Arlan Hamilton has reportedly set up a new company, dubbed Hire Runner, that focuses on fractional and temp-to-hire operations and HR talent for inclusive startups. Here we break down what we know so far In a tweet made by the start-up’s Twitter page, they said: “To match customers w/the best operations talent there is, we select only ~10% of Runner applicants. Once you’re a Runner (entry-level, exec assistant, COO, HR lead, etc.), you’ll work w/growing, inclusive startups while curating your career with flexible scheduling & pay.” What

Yonas Beshawred, the CEO of StackShare and countless other ventures, is a man not afraid to tell it as it is and this skill has worked in his favor. His venture, StackShare, a platform that allows software developers and tech companies to share their tools and how they use them, has gone from strength to strength since its launch in 2014. What first started as a side project on a WordPress blog, StackShare has raised $7 million and reached 1M developers, engineers, CTOs, VPEs, architects, and founders. Although the journey

Arlan Hamilton has paved the way for hundreds of underrepresented founders for just over half a decade. Her firm, Backstage Capital, one of the first Venture Capital companies to invest solely in start-ups led by minorities, now celebrates its 6th year. With 180 deals already – the firm has invested in a range of startups since its launch on September 15, 2015 – from online beauty retailers to satellite internet companies. Outside of Backstage Capital, Arlan has committed personal capital to more than 20 emerging fund managers. And since the