Black-owned money movement, Zazuu, has raised $2 million in investment funding in a new venture round. The startup, which works to build a more robust remittance for residents in the diaspora, has quickly evolved to become the world’s first cross-border payment marketplace. Zazuu, co-founded in 2018 by Kay Akinwunmi, Korede Fanilola, Tola Alade, and Tosin Ekolie, is on a mission to ease the difficulty of sending money back home, which is currently expensive, slow, and unfair to millions of migrant customers. The platform has helped empower customers by building an

They’ve been spat on, called racist names, harassed in grocery stores, and violently attacked. Since the emergence of COVID-19, some combination of misinformation, disinformation, and conspiracy theory has been weaponized to target people perceived to be Chinese. The violent consequences of online disinformation targeting Asian American and Pacific Islander communities demonstrate the power of the internet to stoke racial resentment. Misinformation, disinformation, and online hate speech have led to widespread violence in India, Myanmar, and Sri Lanka in the past several years. Conspiracy theories targeting the AAPI community have caused upswells in hate crimes

This week, the world saw the “deepest, sharpest infrared view of the universe” ever taken by the U.S. Space Agency, NASA. The milestone project was led by Gregory Robinson, a Black scientist at the agency. At NASA, Robinson, 62, is a rarity: a Black man among the agency’s top managers. Robinson was comfortable at another job working as an Associate Deputy Administrator for Programs at NASA when he was asked to take over a stalled NASA project in 2018 after billions of dollars were sunk into the program without yielding

Flutterwave, a Nigerian tech giant under immense heat due to several allegations by former staff, will cease its offering of virtual dollar card services. It comes a week after a Kenyan court froze more than $40 million in accounts belonging to fintech firm Flutterwave under the country’s anti-money laundering laws. And while the latest announcement may be unrelated to the freezing of assets – the startup is struggling to stay out of the headlines as of late. Other fintech startups, including crypto exchange Busha, Rwanda-headquartered Payday, and Ugandan Eversend also

From financial impropriety and conflict of interest to operating without a license, Nigerian fintech company Flutterwave is no stranger to allegations. Most recently, the Kenyan High Court officially granted the Asset Recovery Agency (ARA) permission to freeze over $50 million in 52 accounts belonging to the fintech giant following allegations of money laundering in Kenya. According to local media reports, the ARA believes that the platform “concealed” the nature of its business by providing a payment service payment without approval from the Central Bank of Kenya. The assets recovery agency claims the accounts

Senegal-based fintech startup, Wave, raises a syndicated loan of $91.5 million from International Finance Corporation (IFC), Blue Orchard, Symbiotics, responsAbility, and Lendable. Wave Mobile Money, founded by Drew Durbin and Lincoln Quirk in 2018, has quickly grown to become the largest mobile money remittance in Senegal. In 2021, the company closed the most extensive Series A round for an African fintech at $200 million. The digital fintech platform uses technology to build a radically inclusive and affordable financial network. As a result, Wave has built a life-changing economic infrastructure for

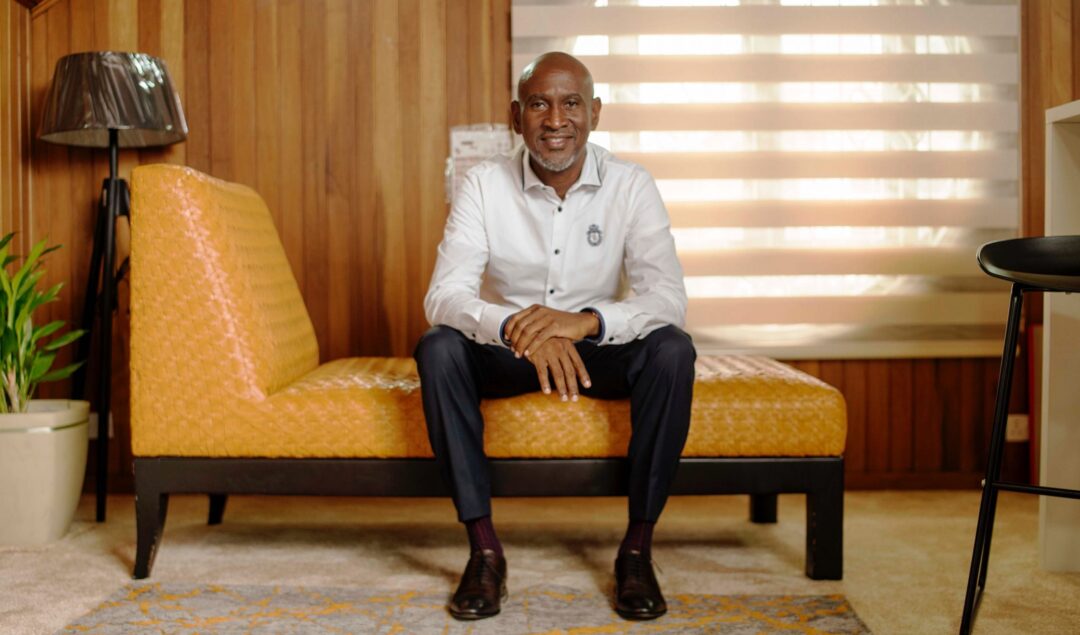

Changing the continent’s narrative will entail solving old problems while also harnessing the power of new technologies, says Akintoye Akindele, a serial entrepreneur and investor on a mission to build a new Africa. Akindele is also the chairman of Platform Capital, a venture capital outfit that invests in tech companies across the world, but mostly in Africa. In May 2022, Platform Capital announced an investment in Zuri Health, a company that connects patients with affordable healthcare services via SMS, WhatsApp, and a dedicated app. Speaking ahead of receiving the African

Earlier this year, on February 13th, Sporting Lagos FC played its first-ever football match, which ended in a draw. The club, which currently plays in the Nigerian National League, the country’s second tier, is the brainchild of Shola Akinlade, co-founder and CEO of financial technology company Paystack, which he says was acquired for more than $200 million in 2020 by Irish American financial services company Stripe. Akinlade says he intends for Sporting Lagos to be a platform for community development and social change. But managing a football club in Nigeria is often

Instagram has partnered with Brooklyn Museum and writer Antwaun Sargent to debut this year’s #BlackVisionaries program. The initiative, designed to help invest in and support Black talent, will include a grant of $650,000. The support program, co-founded by the social media giant, writer Antwaun Sargent and the Brooklyn Museum in 2021, is designed to help uplift and champion underrepresented voices within the creative industry. Last year, five Black designers and Black-led small design businesses were awarded $205,000 in grants last year. The funding allowed each participant to pursue their biggest

The cryptocurrency market has drastically fallen over the years, with the market decreasing in value by more than $1 trillion. The recent downfalls have shaken the entire cryptocurrency market and resulted in many Black investors experiencing severe losses. One of the most popular cryptocurrencies, Bitcoin, fell below $20,000 for the first time in 2020 and has been steadily declining by more than 70%. Over the past seven months, its value has shrunk more than ever, consequently impacting millions of investors in the cryptocurrency market. According to the Financial Times, 25%