Flutterwave, Eversend And Other Fintech African Startups Shut Down Virtual Card Service

Flutterwave, a Nigerian tech giant under immense heat due to several allegations by former staff, will cease its offering of virtual dollar card services.

It comes a week after a Kenyan court froze more than $40 million in accounts belonging to fintech firm Flutterwave under the country’s anti-money laundering laws.

And while the latest announcement may be unrelated to the freezing of assets – the startup is struggling to stay out of the headlines as of late.

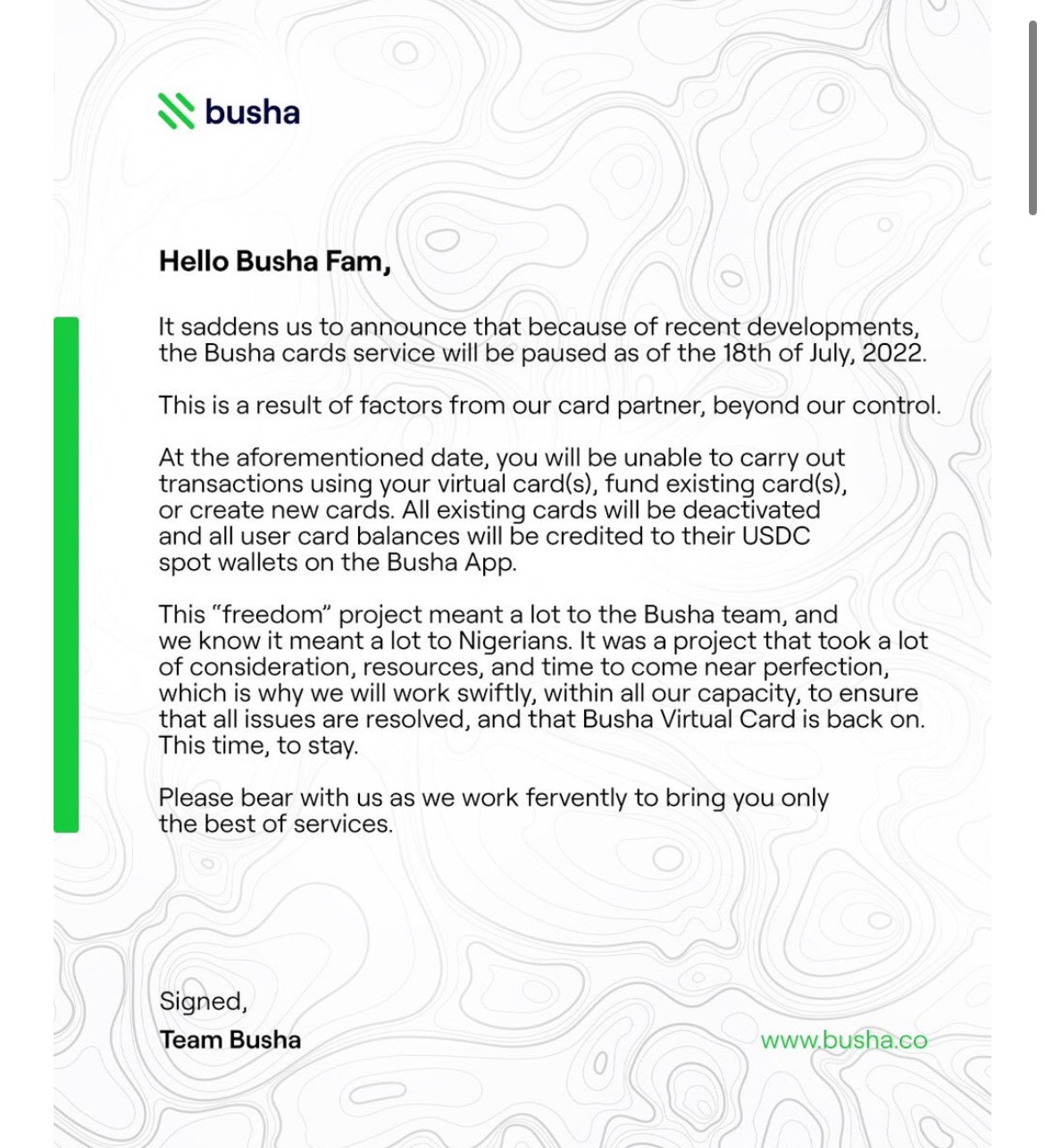

Other fintech startups, including crypto exchange Busha, Rwanda-headquartered Payday, and Ugandan Eversend also issued similar notices.

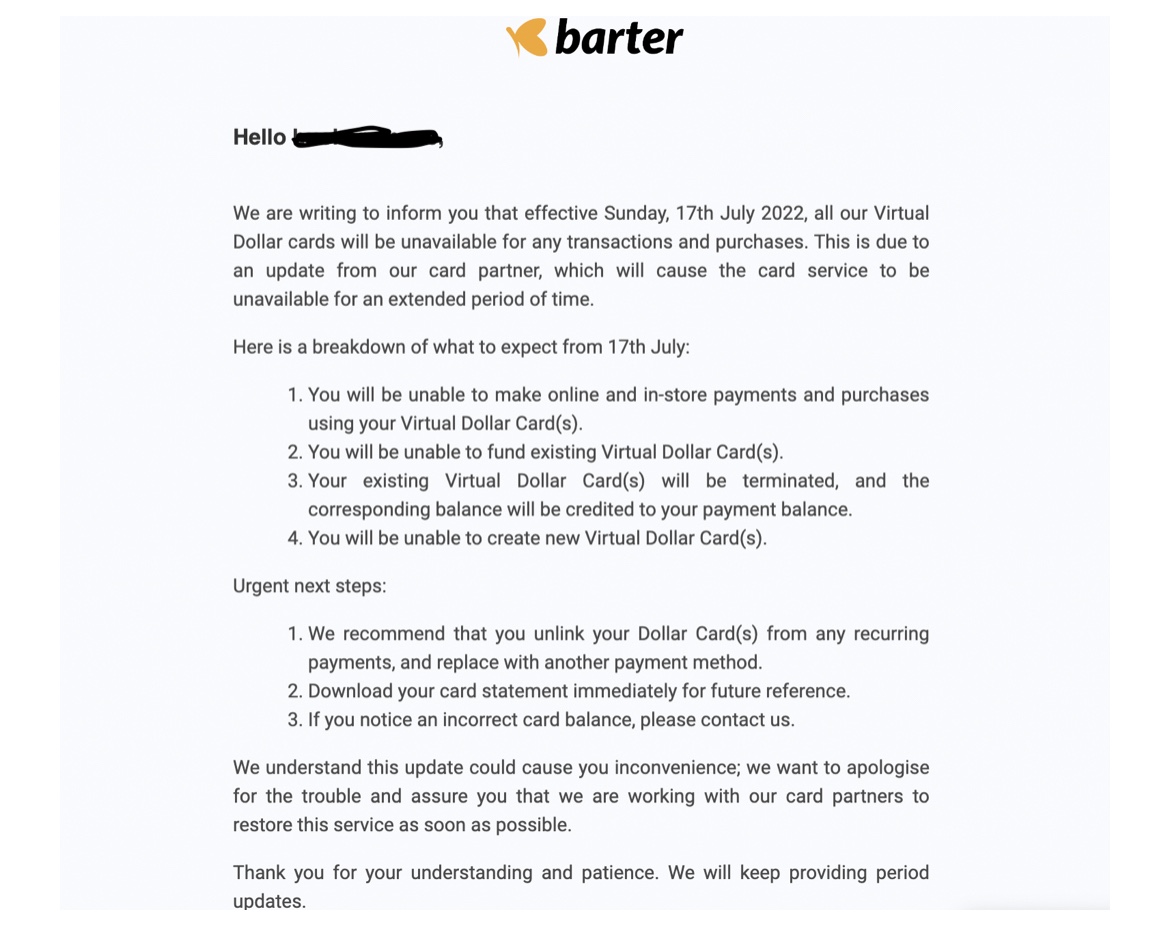

An email sent to Barter customers by Nigerian-born unicorn Flutterwave read, “…effective Sunday, 17th July 2022, all our Virtual Dollar cards will be unavailable for any transactions and purchases.”

The payments giant attributed the reason for this suspension to “an update from the company’s card partner,” according to Techcabal who published the report.

Barter is a Flutterwave consumer-facing virtual card platform that launched in early 2017.

It’s not clear which “card partner” Flutterwave and the other fintech startups are referring to, but these platforms have issued virtual cards powered by MasterCard and Visa—two leading global card issuers.

We’re unsure as to what led the card “partner” that is referred to – to take this decision.