Aphonzo Terrell, who was laid off from Twitter last year, confirmed that his app Spill, which gained popularity within the Black community, has recently raised a $2M extension round and had celebrity investments. The Spill App Terrell and DeVaris Brown – CEO and CTO of Spill – are both former Twitter – now known as X – employees. The two met on their first day working at Twitter after noticing they were the only Black guys on their team. However, when Elon Musk bought Twitter, Terrell was laid off from

Shero Comics, a LA-based multimedia company, is raising funds to bring video games to life that feature women and girls of color. Shero Comics LA-based Shero Comics aims to help women and girls of color find their superpowers in geekdom by building diverse IPs leveraged with technology. The company was founded in 2016 by award-winning writer, creator, and Shero CEO Shequeta L. Smith. After witnessing the lack of Black women and girls in comics and comic book movies, Smith launched Shero Comics, intending to create a renaissance of Black standalone

MM, a dating app that merges technology with real-life experiences, has raised £600K ($750K) in seed funding. The Dating App MM MM, launched in 2019, is a dating and events technology app merging AI with real-life events designed to help singles connect both in the app and in person. The company hosts events and experiences tailored for members to meet and network in person while doing the things they enjoy. MM is available to and has members from all races and genders but considers key cultural nuances within African, Caribbean,

Neon Money Club has partnered with American Express (Amex) to launch the Neon Money Club Cream American Express Card, making it the first Black-owned company to establish an American Express Card. Neon Money Club, co-founded by Luke Bailey and Jackie Liao, is an invite-only money club that aims to create an environment that allows users to become financially empowered while bypassing hurdles often faced. Members get access to invest in the US stock market, hyper-relevant financial content, and now their new Cream Card. The Cream Card Neon Money Club designed

Wellington Access Ventures (WAV) has raised $150 million for its debut, with the backing of limited partners, including state pension plans and banks. Led by four Black investors, WAV seeks to become a go-to investor for early-stage founders from underrepresented backgrounds. Wellington Access Ventures Founded in 2021, Wellington Access Ventures is the corporate venture capital arm of Wellington Management, based in Boston, Massachusetts. Investors include the fund’s leaders, Jackson Cummings, Frederik Groce, Van Jones, and Sasha McKenzie. All four investors were involved in some capacity in BLCK VC, the non-profit

As he retires from the NBA, former professional basketball player Andre Iguodala is set to lead Mosaic, his venture capital (VC) fund. Iguodala had an established reputation for nearly two decades as one of the NBA’s most versatile players, an All-Star, and an Olympic gold medalist. He has now announced his retirement from pro basketball to DealBook to focus on his other career as a startup investor. “It’s been a blessing to play for that long,” he told DealBook. Mosaic Mosaic is Iguodala’s $200 million venture capital fund raised with

Black-owned beauty-tech company Myavana is using AI to provide personalized insights and hair regimens that work for women of color. Myavana is the brainchild of computer scientist Candace Mitchell Harris. Her natural hair journey led her to seek data-driven, intelligent hair care solutions everywhere, from the lab to the Metaverse. The Science of Hair Data reveals that Black consumers drive the global hair-care market, spending nine times more on hair-care products than other racial groups. Black women, in particular, spend about $1.7 billion annually on hair-care products. While studying computer

Black-owned tech startup Slinger has raised £500,000 ($600,000) in pre-seed funding to shake up the hospitality industry’s hiring process. Brexit and COVID-19 have left the UK’s hospitality industry struggling with staff vacancies – industry vacancies are still 72% higher than pre-pandemic levels. As a result, the industry is having to turn away £25 billion ($30.3 billion) worth of business in the UK. Slinger aims to change this. Group Chat To Google-backed Founded by Theo-Lee Houston, Slinger aims to make hospitality hiring processes easier and fairer, connecting talent with businesses in

Grammy-winning artist John Legend has co-founded his first-ever tech startup, It’s Good, to give users personalized food, travel, and experience recommendations. The company, co-founded by tech entrepreneur Mike Rosenthal, recently raised $5 million in a seed funding round led by Lightspeed Venture Partners. Legend previously co-founded Cravings – a food e-commerce site – with his wife, Chrissy Teigen. The “It’s Good” App It’s Good is an invite-only platform that delivers travel, food, and experience recommendations from people you know and critics, celebrities, and influencers. Launched in March with a select

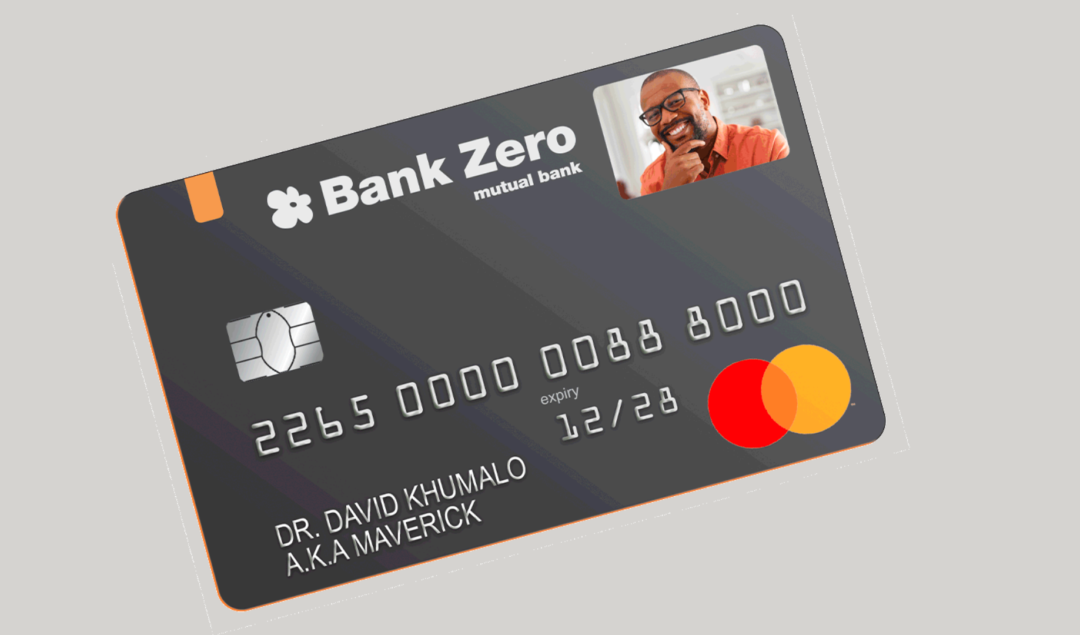

A South African digital bank, Bank Zero, has expanded into commercial banking with the launch of its zero-cost business banking app. Disrupting Traditional Banking Bank Zero was founded by tech entrepreneur Michael Jordaan, banking innovator Yatin Narsai, and five other co-founders. Founded in 2018, the company entered the South African market three years later and is now 45% Black-owned and 20% women-owned. The co-founders have a combination of deep and diverse banking and technology skills, with extensive experience in and knowledge of banking through previous roles. Bank Zero aims to disrupt