This was originally posted here: http://ahvc.school/blog Yesterday, a friend of mine shared with me the great news that he was planning on starting a family and asked: “what is the one skill that you would love to teach your daughter as she grows up?” Almost immediately I answered, “the ability to make smart decisions on a consistent basis when I am not in the room.” One trait that I believe has shaped me profoundly in the decisions I make in my career, with my family and in life, is the

As we near the end of Black History Month in the UK, our hope is that black British history surpasses a month’s celebration to become an integral part of British history. There are dozens, if not hundreds, of unsung black heroes across British history, from Alice Kinloch, the South African activist who came to Britain and founded the African Association, which created the first Pan-African conference in London in 1900. To others, such as modern-day educator, rapper, entrepreneur, and activist Akala. The renowned author of The Sunday Times Best Seller

Over the last 12 months, several people have reached out to me asking the question, “How can I get a job in Venture Capital?” I don’t have a silver bullet to answer to this question, but I will share useful steps to consider when breaking into venture. What this post won’t cover are common routes into venture through doing an MBA or moving from an M&A role at an Investment Bank into venture capital. Those routes are well documented and very much conventional. 1. Learn the Fundamentals It is essential

A few months ago, over lunch a friend mentioned: “I first came across your name from your writing [articles] but I had no clue that you had this experience and your story was so unique.” That comment was the catalyst for writing this post. In this post, I want to break down the components that led me to start writing and how traveling, entrepreneurship, product management, and diversity in tech has provided me with a satisfying career to date as well as rare experiences. These seemingly unrelated themes have been

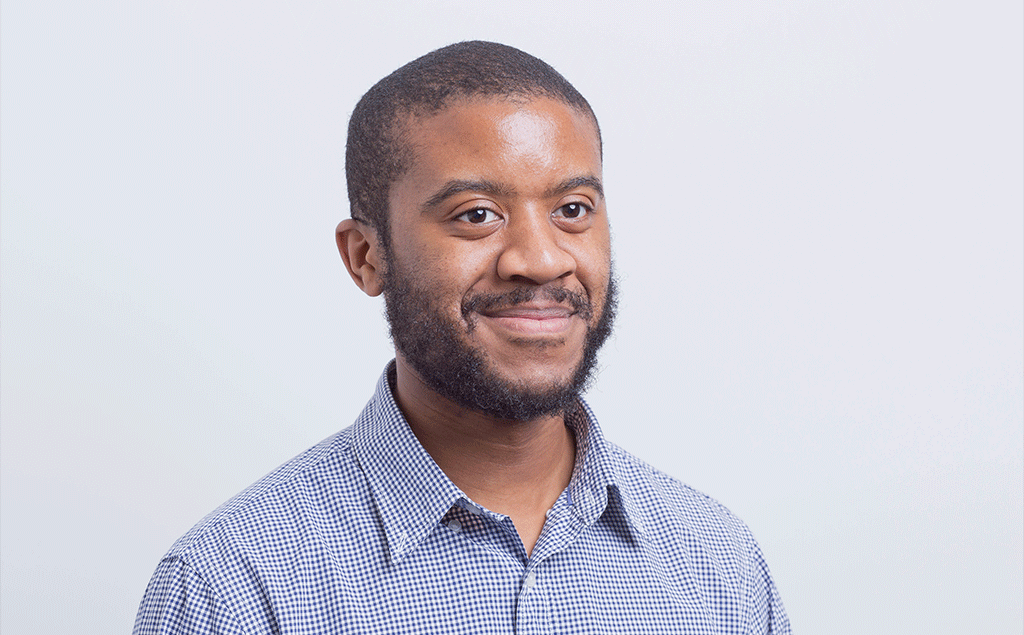

Andy Ayim is the Managing Director of Backstage London. This is the first in a series of stories introducing the Backstage Accelerator team in London. Amplifying Voices Last year, through some chance, frustration, and a stroke of genius, I had arrived at an inflection point in my writing. I began to share stories about what I was learning in tech with a tone of voice that came from the streets I was raised in. It was sometimes assertive, always authentic, and very unapologetic. I wanted aspiring founders to have access

This year I have been fortunate enough to be invited into numerous communities of startup founders. Equally, it is a breath of fresh air when I am in more diverse circles discussing things like parenting, wildlife, and spirituality. It is in these moments when I get away from tech when I remember the first principles that still hold true when executing on ideas. Overwhelmingly much of the content shared in the startup communities are opinions on articles from top tech publications and VCs. From Hackernews to TechCrunch or YC’s latest

Earlier this week, I decided to leave the London-based Pre-seed accelerator programme, Entrepreneur First (EF). I was a member of the 10th London cohort. EF is a startup accelerator backed by Reid Hoffman (founder of LinkedIn), Greylock Partners, Mosaic Ventures, Founders Fund and Lakestar. Their USP is that they invest pre-team and pre-idea (truly pre-seed in every sense). I originally joined EF, because I bought into the opportunity presented that ‘EF is one the best place to find a co-founder and build a globally important company.’ It is important to

It is awesome to see the progress in the last 12–24 months women are starting to make to stand up and have their voices heard and acted upon in tech. It is encouraging to see success stories from the US such as Vanity Fair’s showcase of 26 Women of Color Diversifying Entrepreneurship in Silicon Valley. These are compelling stories of empowerment, encouragement, and identity. Everyone wants to see others they can identify with reach positions of success they too can aspire towards. We hear all the time that hard work

Recently Aytekin Tank, founder of JotForm wrote a compelling piece titled, “Why startups are dying left and right.” In this article, he shared the less glamorized view of entrepreneurship where he demystifies the experience. The slow, patient road, at times, bootstrapped, always tough, riddled with lessons from failure and prioritizing profit over growth. I shared this article with the community at ustwo Adventure. It was encouraging and enlightening to see some of the common strands that resonated with this collective of ‘less glamorized’ entrepreneurs. In this article, I have shared the top 3 of

Consider the story of investors such as Kirsten Green, founder of Forerunner Ventures and one of two women who featured on The Top 20 VCs Worldwide list by The New York Times. She represents diversity as she had never worked at a Venture Capital firm before starting her own in 2012, and she is also a woman in a male-dominated field. She achieved two billion dollar exits with Jet.com (acquired by Walmart) and Dollar Shave Club (acquired by Unilever), demonstrating the value she brings as an inclusive investor. Alternatively, there are