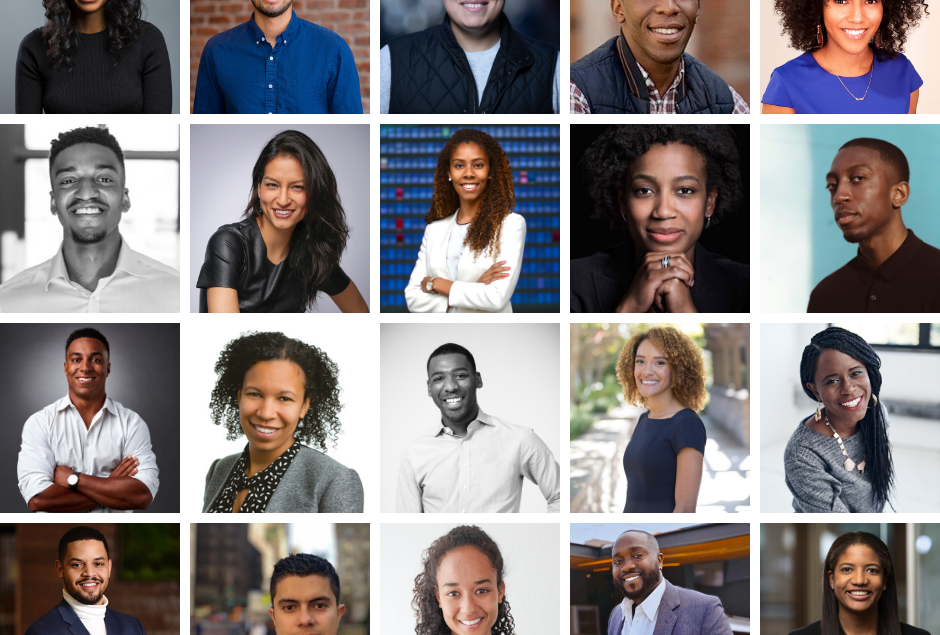

HBCUvc’s 31 Under 31: The Future of Venture Capital – 2020

A lot has changed in the venture capital industry in just the last year. MaC Ventures and the Kauffman Foundation released a publication illuminating positive financial returns in companies with diverse perceived ethnicity, the total number of funds hit an all-star high with a median annual fund size of $90M, and funds targeting diverse entrepreneurs — such as Harlem Capital and Olamina Fund — closed $40M+ raises. Harlem Capital Partners recently released a report analyzing 200 Black and Latino founders who raised $1M+ in VC funding, while e-sports pioneer — Delane Parnell (PlayVS)- made headlines for a $50M Series C raise. Additionally, Jasmine Crowe, Nataya Montgomery, and Dawn Dickson (founders of Goodr, Naza Beauty, and PopCom), each closed early-stage raises totaling over $1M – each.

This momentum brought us into 2020, where we’re thrilled to also celebrate 31 leaders changing the landscape and working to close investment gaps that remain. Our approach to the 31 Under 31 List recognizes the best talent in the industry — but in doing so, amplifies the profiles, strengths and achievements of persons often underestimated. It also responds to a value central to our philosophy, where community connectivity is paramount. Last year’s list weighed heavily on ecosystem builders, recognizing the various sources of support for Black, Indigenous and Latinx entrepreneurs (check-out book recommendations from 2019 honorees); while this year’s selection drills sharply into the traditional investment community, recognizing the associates, partners, and co-founders at the country’s most innovative firms as well as burgeoning ecosystems outside of the usual city-centers.

Selected through a nomination and evaluation process, the following honorees represent the achievements in and promise of the venture capital industry.

They are the investors, fund managers, and organization leaders you need to know.

They are the emerging talent changing the face and impact of the industry.

They are the future of venture capital

Tosin Agbabiaka

Tosin is an Early Stage investor at Octopus Ventures, where he invests in Fintech companies through the firm’s Future of Money pod. Based in New York and occasionally London, he also advises Octopus portfolio companies and broader startup ecosystem on expanding from Europe to the US. He most recently worked as a Special Advisor for Finance and Investment in energy infrastructure for the United States government, before which he invested in pre-seed companies at a South African VC firm. Tosin began his career as an EU policy expert and lawyer, and graduated from Yale Law School, Yale School of Management, and Duke University.

Alexis Alston

Alexis is an Associate at Lightship Capital where she invests in CPG, E-Commerce, Healthtech, Sustainability, and AI-enabled technologies with underrepresented founders. In addition, Alexis leads the investment and portfolio support team for the Hillman Accelerator, the first accelerator focused on underrepresented founders in the Midwest. She began her career at Advantage Capital Partners where she focused on deals in the biotech and CPG space. She graduated from Brown University with a BA in Business.

Mercedes Bent

Mercedes is a Partner at Lightspeed Venture Partners, a venture capital firm based in the Bay Area. Previously she served as an executive at a VR startup and a General Manager at General Assembly (acquired, 2018) where she oversaw a multi-million dollar business line. She has an MBA and a Masters in Education from Stanford University and an AB from Harvard University. She serves as a board member for the non-profit Birthright AFRICA and in her free time she enjoys off-roading in her Jeep. She is an African-American of Bermudian, Grenadian, and Colombian heritage and was named a 40 under 40 for Tech Diversity.

Sukari Brown

Sukari is an associate at Camden Partners, based in Baltimore. Sukari has managed the diligence process for multi-million dollar investments, assisted with sourcing activities and managed the update and distribution of portfolio company valuation data. As an investor Sukari leverages her experiences in engineering and consulting to inform how she approaches the day to day of her job.

Sukari was born, raised, and educated in Brooklyn, NY and after graduating with her degree in Civil Engineering from the NYU Tandon School of Engineering, she moved to Maryland to begin her future as an engineer. Eventually, Sukari pivoted into a career in Infrastructure and Capital Projects consulting at Deloitte where she developed solutions to help several federal clients address some of their biggest infrastructure challenges. After leading a team for an infrastructure project in Puerto Rico, Sukari joined Camden Partners.

Carlton Burrell

Carlton is an investment associate at FTV Capital. Prior to joining the team, he was an investment banking analyst in the financial institution’s group at Bank of America Merrill Lynch, where he worked primarily in the financial technology and insurance services verticals. He graduated from Cornell University in 2016 and received a BS in Industrial and Labor Relations.

Cheryl Campos

Cheryl is a Principal at Republic, a one-stop-shop for founders to raise capital from both accredited and non-accredited investors. She is passionate about the intersection of finance, technology, and social impact. Previously she worked as an analyst in private equity in Connecticut with an emphasis on minority and women entrepreneurs. She started her career in finance at Barclays in the investment banking division. She graduated from Harvard College in 2015 with a major in economics.

Gabby Cazeau

Gabby is a Senior Associate at Harlem Capital Partners where she focuses on deal sourcing, due diligence, and connection building across the tech and entrepreneurship ecosystem.

She is also a second-year MBA candidate at the Yale School of Management and will graduate in May 2020. At Yale, Gabby served as an Innovation Advisor at TSAI City, Yale’s startup incubator and accelerator. Prior to Yale, Gabby worked in R&D and Innovation at General Mills where she created new products for iconic brands like Cheerios, Nature Valley, Epic, and FiberOne.

She is Haitian and originally from Maryland. She holds a B.S. in Chemical Engineering from Washington University in St. Louis where she was a John B. Ervin Scholar.

Tobi Coker

Tobi is currently an associate at The Production Board (‘TPB’), a venture capital firm focused on investing in and building life sciences, consumer, and food/agriculture businesses. Prior to joining TPB, Tobi worked at Morgan Stanley, advising healthcare companies on corporate financial strategy. He graduated from Georgetown University with a B.S. in Biology and Economics.

Tobi is originally from Atlanta, GA but has spent time in Boston, Washington D.C., New York, and most recently San Francisco. Outside of work, he can be found on the mountain, court, or traversing the city with his Sony a7ii.

Jackson Cummings

Jackson is an investor at Salesforce Ventures, Salesforce’s strategic investment arm that invests in innovative enterprise cloud companies, with 250+ portfolio companies across 20+ countries. While at Salesforce Ventures, Jackson has worked on or led a number of deals including Forter, RunaHR, Narvar, Sitetracker, BigID, Tulip Retail, PerimeterX, and Astound Commerce. Previously, Jackson was an Investor at Top Tier Capital Partners, a global venture-focused Fund of Funds, where he invested in fund managers as a Limited Partner, venture secondaries, and direct co-investments. Jackson graduated from Stanford University with a B.S. in Science, Technology and Society and was a member of the varsity football team. Jackson is an active member of BLCK VC and helps support the Employee Resource Groups (ERG) and Startup communities. He is passionate about supporting more diversity in tech and the broader VC community.

Tunji Fadiora

Tunji is the Co-Founder and President at ELEV8, an entrepreneurial community, and platform for underserved entrepreneurs that partners with tech giants like Google, HubSpot, Techstars and more to support entrepreneurs and startups. ELEV8 creates a safe space for founders and startups of all sizes to come build, launch, grow, and create the future by providing assistance, resources, and services to help guide startups from idea to launch, and from launch through their appropriate growth stages.

Solomon Hailu

Solomon is a Principal at Tusk Venture Partners, an early-stage venture fund focused on investing in consumer technology startups operating in regulated markets. Based in New York, Solomon’s responsibilities include sourcing opportunities, evaluating potential investments, executing transactions and fundraising.

Before joining Tusk, Solomon was an M&A Analyst at Lazard where he worked on a variety of advisory assignments. Solomon is originally from Addis Ababa, Ethiopia and grew up in the DC area. He holds a B.S. in Commerce from the University of Virginia.

Solomon is incredibly passionate about increasing diversity within the venture capital and sits on the board of BLCK VC, a non-profit focused on increasing the number of investors of color in venture.

Christian Horn

Christian is an Associate at Cultivian Sandbox Ventures, a food and agtech focused VC fund. He had internships at Northern Trust on their multi-manager solutions team, and JPMorgan on their energy investment banking coverage team. He received a full-time offer from JPMorgan on the power & renewables coverage team where he spent two years after graduation advising clients on M&A and equity transactions. While at JPMorgan Christian also made an angel investment in 4Degrees as part of their $1M pre-seed round. He graduated from the University of Miami (FL) with a BBA in Finance in 2017.

Josiane Ishimwe

Josiane is an Investment Analyst at Intel Capital, focused on growth equity investments in cloud infrastructure, and services, DevOps, enterprise SaaS; and bioinformatics.

Prior to joining Intel, Josiane was a petrochemical research engineer in both the Hydroprocessing & Reforming and Real Time-Online Optimization groups at ExxonMobil. She also has notable research experience from the Harvard University School of Public Health. Josiane is originally from Butare, Rwanda and moved to the United States when she was six years old. She earned a bachelor’s degree in both chemical engineering and computer science from Howard University.

Tadia James

Tadia is a senior associate at GingerBread Capital. She is passionate about identifying top female founders and equipping them with the resources they need to develop and scale thriving businesses.

Tadia started her career at J.P. Morgan in the Investment Bank in Sales Strategy covering the Latin American region before moving to the Cybersecurity Threat Intelligence team. Working at the intersection of business and technology, she was responsible for operationalizing and managing the distribution strategy of timely, actionable, and highly secure threat intelligence data to all lines of businesses at J.P. Morgan Chase. She holds an MBA from the Stanford Graduate School of Business and a BS in Finance from the University of Florida.

Brittni Johnson

Brittni is Head of Strategic Partnerships at GE Ventures. Her expertise spans both engineering and business. She holds a BS and BA in Civil Engineering and International Relations from Stanford University; and a MBA from Columbia Business School. She brings domain expertise across global markets, finance and strategy. Before transitioning into technology strategy, Brittni worked as an Engineer at Schlumberger in the Middle East and then as an investment banker, at JP Morgan Chase in their Technology practice in San Francisco.

Nathan Jones

Nate is the Co-Founder of the Village Micro Fund, a foundation backed social enterprise where he sits as board chair. He has been active in the startup scene as a founder, accelerator manager, investor, and advisor to early-stage companies in Atlanta and the Bay Area before moving back to Texas for business school. Previously, Nate has worked for Goldman Sachs, Kapor Capital, and ATX Venture Partners. He has been featured on NPR, Huff Post, and the Bitter Southerner. He graduated with honors from Morehouse College and is currently an MBA candidate at the University of Texas at Austin.

Kylan Kester

Kylan (he/him/his) is an Atlanta-based entrepreneur, consultant, and community builder. He currently serves as Community Coordinator at Startup Atlanta and as a support resource to Accenture’s venture practice in the south as an Accenture Ventures Ambassador. In 2019, Kylan joined a historic graduating class at Morehouse College who received a generous donation made by technology investor and billionaire Robert F. Smith. He immediately found ways to plug into the global startup community with experience working for startups as a Community Manager for Jopwell from 2016–2018 and as a Founder In Residence at the European Innovation Academy in 2018.

Morgan Mahlock

Morgan is an investor at IQT, the strategic venture capital arm of the Intelligence Community, on the West Coast Investment team. The work In-Q-Tel does bridges the gap between the challenging technology needs of the national security agencies, the rapidly changing innovations of the startup world, and the venture community that funds those startups. Morgan previously spent time at the NFL and at Lockheed Martin. She graduated from Stanford University with a BS in Product Design and MS in Management Science and Engineering, where she was on the lightweight rowing team and started Stanford Women in Design. She works with a variety of nonprofit organizations including BLCK VC and EVCA, and in her free time, enjoys running, rowing, playing piano, and traveling.

Chandler Malone

Chandler is a two-time entrepreneur who is now investing in early-stage companies through Atento Capital. His journey began as a college student, building six-figure events business before launching his first software company that he exited in 2019. He is an angel investor in Atlanta-based MedFlik and St. Louis-based Ideate and has a passion for helping underrepresented entrepreneurs and using technology to improve quality of life.

Megan Maloney

Megan is an investor at General Catalyst, a venture capital firm with approximately $5 billion in capital raised. At General Catalyst, Megan focuses on early-stage investing and spends most of her time in enterprise SaaS, healthcare, and blockchain technology. She currently serves as a board observer at Livongo, Samsara, Grammarly, and Audius. She has also helped source or lead the firm’s investments in Sleeper, Coda Protocol, Carbon, and Celo. Prior to joining General Catalyst, she worked at Morgan Stanley in the firm’s Technology Investment Banking Group in Menlo Park and the Institutional Equities Group in New York. Megan graduated from Columbia University in New York where she studied Economics and Music.

Aaron McClendon

Aaron is an Entrepreneur-In-Residence at Detroit Venture Partners, where he focuses on sourcing and diligence on new consumer business opportunities, as well as advising DVP’s consumer portfolio on audience development, organic growth, and partnerships strategy. Fascinated with how content gets monetized, he writes a newsletter called FaintFlex, documenting insights within modern media, personality-driven startups, and the creator economy as a whole.

Jose Carlos Murguia Davalos

Carlos Murguia serves as Arrowhead Innovation Fund’s (AIF) Associate Fund Manager. He is responsible for overall fund operations, including the development and implementation of business support programs and industry ecosystems to help startups maximize growth and success. Carlos recently completed the HBCUvc fellowship, a program that provides fellows with venture capital skills training, mentorship, and the opportunity to build professional relationships with seasoned investors and entrepreneurs. He earned a Masters of Science in Industrial Engineering from NMSU. Carlos is a 2017 NMSU Outstanding Graduate awardee.

Jaisa Minor

Jaisa is an investment analyst at New Voices Fund. As a rising New Voices investor under the leadership of SheaMoisture founder Richelieu Dennis, she is grateful to be able to continue the work of building companies at the forefront of innovation and opportunity. Companies she works with include The Honey Pot Company, Beauty Bakerie, Sweeten, and more.

She is a Jamaican-American raised in Atlanta and takes great pride in her passion for seeing the potential in problems and connecting business outcomes with societal change. She believes that entrepreneurship is a critical element of building generational wealth in underserved communities and has found her purpose in helping underrepresented groups gain access to the resources needed to create and scale their businesses. She is committed to supporting entrepreneurs and is intentional about using her own talents to nurture long-lasting partnerships built on trust, authenticity, and uncompromising mutual respect.

Terrance Orr

Terrance is a Portfolio Associate at Techstars Chicago, where he is responsible for helping to build and grow the next amazing batch of startups from early-stage to venture-backed companies. Additionally, Terrance is a Venture Capital Fellow at GlobalX Ventures, an emerging early-stage fund focusing on influencer marketing, eSports, and distributed ledger technology. Prior to supporting and investing in entrepreneurs, Terrance spent nearly 7 years working at Dell Technologies in Product Management, Business Development, and Strategic Consulting. He is currently in graduate school at Northwestern University, holds an MBA in Global Business from Johnson & Wales University and a BS from Claflin University.

Jessica Patton

Jessica is a partner at the Cultural Leadership Fund at Andreessen Horowitz. Her goal is to create economic equality for people of color.

Prior to joining Andreessen Horowitz, Jessica worked at startups and mature companies on strategy, business development and operations. She also started her own food company. Jessica started her career in private equity, investing and working with consumer companies on operational improvements. Jessica is a proud graduate of Howard University and Stanford Graduate School of Business.

Ebony Pope

Ebony is a Principal at Rethink Education, a venture capital firm focused on education technology. Most recently, she served as the Director of US Ventures at Village Capital, where she was responsible for finding and supporting US start-ups for the fund’s five sectors. Prior to this, Ebony was Education Director for the Social Venture Fund. Ebony has also spent time in her hometown of Detroit, managing charter schools at New Urban Learning and began her career as an Account Strategist at Google. Ebony holds an MBA from the University of Michigan’s Ross School of Business and a B.B.A in Finance from Howard University.

Mario Ruiz

Mario is a FinTech investor at PayPal Ventures where he sources and executes investments in the U.S. and globally. Previously, Mario was an investor at Napier Park in New York, where he helped deploy over $650 million in growth equity and real asset investments. Mario started his career as an investment banking Analyst and Associate at Barclays in New York.

Born and raised in the Bronx, NY, Mario received his BBA from Baruch College and his MBA from the Yale School of Management. At Yale, he was a Managing Partner at First Round Capital’s Dorm Room Fund (NYC Chapter) where he co-led the ideation and execution of the Blueprint Project, a nine-week program that empowered ten diverse founders by providing masterclass sessions from developing an MVP to raising venture capital.

Aia Sarycheva

Aia is a Senior Associate at Revolution’s Rise of the Rest Seed Fund, where she supports entrepreneurship and innovation across the United States by investing in early-stage technology companies located outside of Silicon Valley, New York City, and Boston. In her work, Aia focuses on investment sourcing, due diligence, and working with over 130 portfolio companies. Prior to joining Revolution, Aia was an investment banker at Goldman Sachs in New York City. Aia graduated from Yale University with a B.A. in Ethics, Politics, and Economics and serves on the Advisory Board of Chess-in-the-Schools, a NYC-based nonprofit providing chess education to public school children.

Dujon Smith

Dujon is the Midwest Lead for Accenture Ventures, forming bridges between Global 2000 companies and the startup ecosystem. He has worked within Accenture’s Innovation Architecture for the past few years. Previously, he was with the Operations Studio where he focused as a growth catalyst for Operations clientele, the $6 billion business unit that provides business process services across more than 40 industries. Dujon has traveled, worked, and studied in 50 countries and is passionate about connecting technology, culture, and education within communities. Additionally, he is the Director of Development for Definition Theatre, the Treasurer of the Scenemaker’s Board of the Goodman Theater, and an active mentor in Chicago’s startup community.

Luke Thompson

Luke is a founding member of the early-stage venture capital firm, Maschmeyer Group Ventures, where he has worked since its inception in August of 2017. Prior to MGV, Luke worked on the Growth and Product Marketing teams at Dropbox. Originally from Connecticut, he studied English Literature and Poetry at Stanford University. In his free time, Luke enjoys watching movies, twitch.tv streams, and reading novels.

Jillian Williams

Jillian Williams is an Investment Principal at Anthemis, an early-stage venture firm. Jillian has played an active role in growing the firm’s footprint across North America, helping to open the US office. She is responsible for sourcing new companies, conducting due diligence on potential investments, connecting with potential co-investors and later-stage investors and acting as a spokesperson for Anthemis in the media and at industry events. She also led the launch of the Female Innovators Lab, a venture studio partnership between Anthemis and Barclays that looks to support female founders in the fintech space at the earliest stage.

Prior to Joining Anthemis, Jillian was at Barclays in New York in the investment banking division, where she focused on financial institutions and natural resources. Jillian has a BA in Economics from Yale University.

Originally posted here on Medium.