Black Twins Secure £15M Credit For Their Insurance Tech Unicorn

Prioritizing affordability, inclusivity, and leveraging technology, Black-owned insurance tech unicorn Marshmallow is challenging traditional insurance practices and extends coverage to underserved communities.

Now, Marshmallow has landed a £15 million 3-year revolving credit facility from Triple Point Private Credit, one of the largest non-bank lenders in the UK, to expand its product offerings.

“[We] are excited to be working with a management team that have successfully launched and scaled an insurance business so impressively,” said Triple Point’s Head of Structured Finance, Gavin Maitland Smith, per Tech Funding News.

“More importantly, their commitment to increasing affordability and accessibility for underserved segments of the community mirrors Triple Point’s purpose-driven approach to investing.”

A Trailblazing Black-founded Unicorn

Founded in 2017 by identical twins Oliver and Alexander Kent-Braham, along with David Goaté, Marshmallow was born out of the founders’ mission to provide more affordable insurance options to individuals outside the traditional “good risk” profile.

Their inspiration came from witnessing a friend face outrageous insurance quotes upon moving to the UK. Marshmallow recognized the unfair premiums imposed on individuals with driving licenses from outside the UK.

Their mission became to revolutionize insurance by making it faster, more affordable, and more inclusive.

In 2021, Marshmallow achieved unicorn status with a valuation exceeding $1 billion through a recent $85 million Series B funding round. This milestone made Marshmallow the UK’s second unicorn founded by someone with Black heritage, just weeks after Zepz (formerly WorldRemit), founded by Ismail Ahmed, became the first.

Marshamallow has since grown to over 200 employees, opening a second office in Budapest, and earning itself second place on the Financial Times’ list of Europe’s fastest-growing companies.

Disrupting the Insurance Space

Unlike traditional providers, Marshmallow uses technology and data analytics to offer accurate risk assessments and personalized quotes based on individual circumstances. This approach means provides fair coverage to individuals who may have been overlooked or faced higher premiums due to factors like nationality or occupation.

“We started with the idea of the power of data and using a wider range of resources [than incumbents], and using that in our pricing led us to be able to offer better rates to more people,” Oliver Kent-Braham told TechCrunch in 2021. In contrast, their more traditional counterparts are “stuck in their ways”.

“These companies have been around for decades, some for centuries. Change is not happening quickly.”

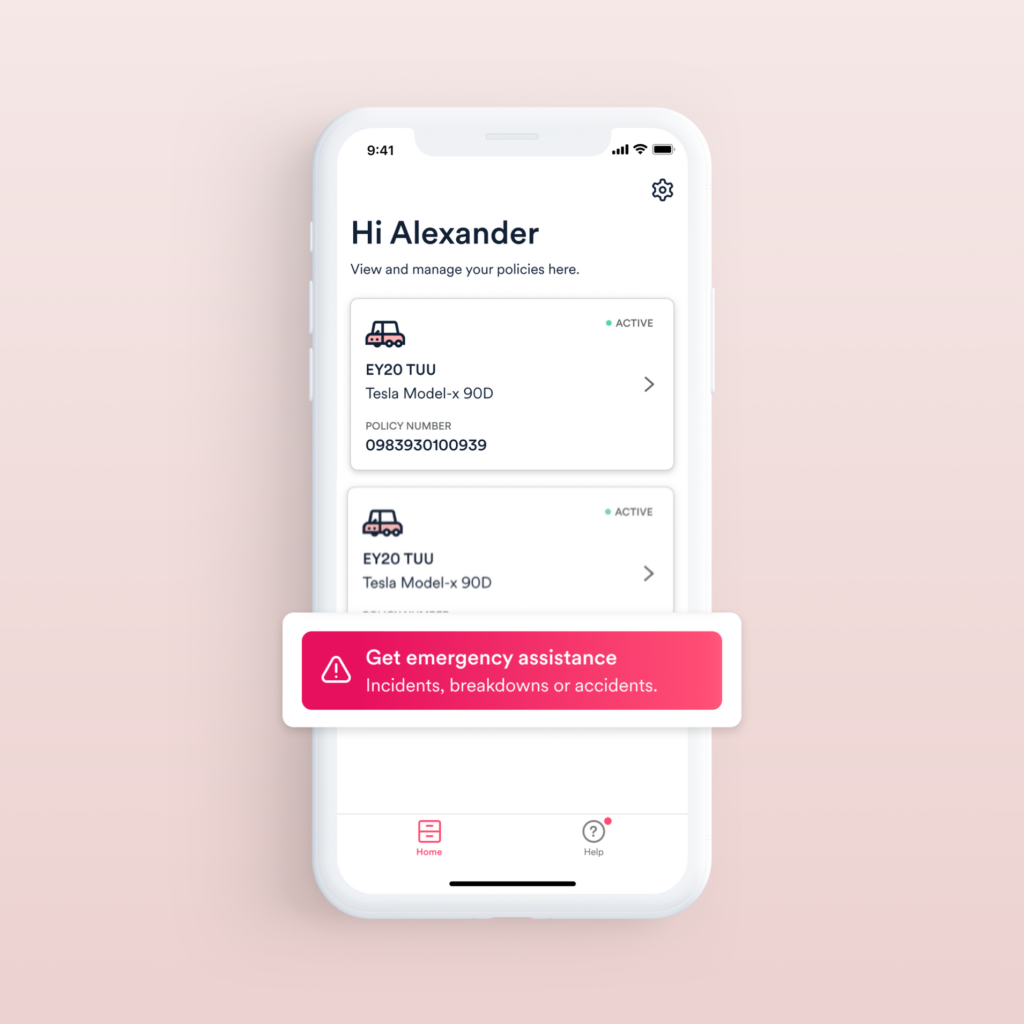

Marshmallow’s online platform also enhances the customer experience by offering quick quotes, transparent policies, and streamlined policy management.

What’s next?

Marshmallow updated its mission statement in September 2021, emphasizing its commitment to reducing distress caused by accidents and disasters while investing in technology to prevent them.

“For as long as I can remember, I’ve felt optimistic that technology companies have a real chance to improve the health and wealth of humanity,” wrote Alexander Kent-Brahan in a blog post.

Read: Incredible Health Reaches Unicorn Status With $80M Funding Round

“As a licensed insurance company made up of technologists, we are economically incentivised to help our customers avoid disasters and we are technologically equipped to take on the problem.”

The company envisions expanding its insurance offerings beyond car insurance to protect various aspects of everyday life in multiple geographies – all driven by technology.

“I recognize this isn’t a mission that can be achieved overnight,” he continued. “This is something that requires focus for decades. But we recognise that it‘s often the worthiest problems that take the longest time to solve.”