Trez, the first U.S. Latine payroll platform company, is reshaping the financial landscape for Latine businesses in America. Trez Recognized by notable institutions like Techstars, Forbes, Inc., and Stanford GSB, Trez provides specialized payroll, benefits, and financial services solutions. The platform is specifically designed to support the burgeoning Latine business community. Trez emerges at a crucial time when Latine-owned businesses, contributing $500 billion in annual sales and millions of jobs, are becoming vital in the U.S. economy. According to the Bureau of Labor Statistics, Hispanics will constitute 78% of the new workforce entrants between 2020 and

Neon Money Club has launched a new dating app, Score, for people with a credit score of 675 or above. Luke Bailey and Jackie Liao co-founded Neon Money Club as an invite-only money club that aims to empower users financially while bypassing hurdles they often face. Members get access to invest in the US stock market, hyper-relevant financial content, and their recent launch of a Cream Card, making Neon Money Club the first Black-owned business to establish an American Express Card. The Score Dating App Neon Money Club has become the first financial brand

Neon Money Club has partnered with American Express (Amex) to launch the Neon Money Club Cream American Express Card, making it the first Black-owned company to establish an American Express Card. Neon Money Club, co-founded by Luke Bailey and Jackie Liao, is an invite-only money club that aims to create an environment that allows users to become financially empowered while bypassing hurdles often faced. Members get access to invest in the US stock market, hyper-relevant financial content, and now their new Cream Card. The Cream Card Neon Money Club designed

National non-profit organization Black Economic Alliance Foundation has partnered with Deloitte to promote financial inclusion. What is financial inclusion? Financial inclusion allows people of color access to financial services and systems that will better enhance their economic status. Financial inclusion is the bridge between economic opportunities and the racial wealth gap. The more access underrepresented families have to financial services, the easier it will be to help close the racial wealth gap. Deloitte’s partnership with the Black Economic Alliance Foundation Deloitte has committed $10 million over the next five years

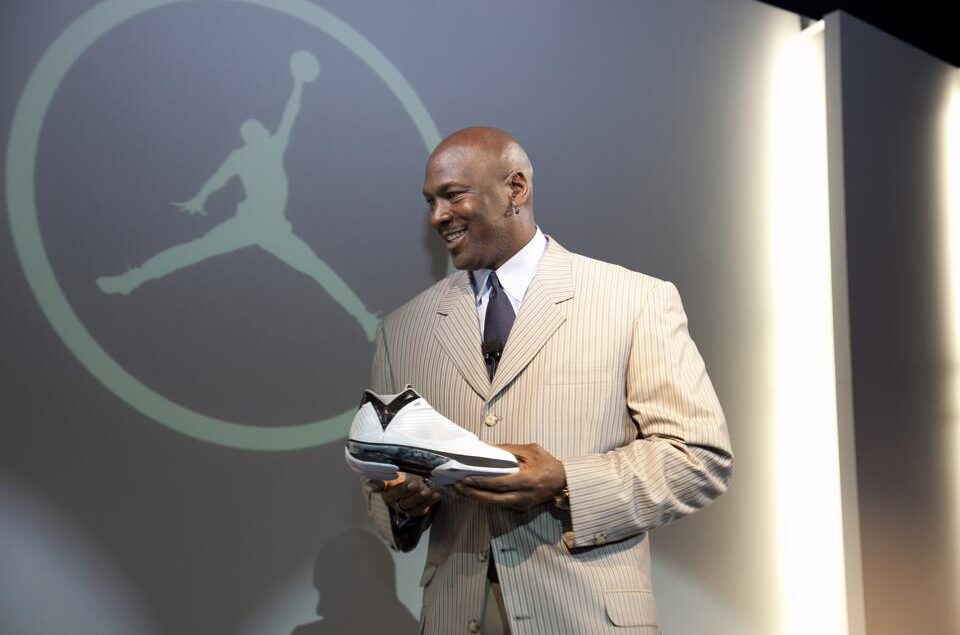

Thanks to a grant from Michael Jordan and Jordan Brand, Next Gen Personal Finance (NGPF) will provide high schoolers with access to life-changing personal finance education. The grant was made through Michael Jordan and Jordan Brand’s Black Community Commitment (BCC), an initiative committed to supporting businesses that commit to building racial equality, and social justice and providing students with greater access to education. The high school program will be modeled after NGPF’s highly successful Finance Equity and Empowerment (FEE) grant program, which NGPF first launched in 2020 to increase financial

US-based fintech startup Deposits raised $5M in seed funding to develop its platform. The funding round led by ATX Venture Partners also included Cabal Fund, Lightspeed Venture Partners, and others. The Dallas-based finance startup, co-founded by Joseph Akintolatyo and Daniel Paramo, is a cloud-based fintech platform that helps credit unions, community banks, insurers, retailers, and brands seamlessly implement digital banking tools onto their platforms. The program also allows companies to put together a package of financial features, including mobile apps, debit and credit accounts, virtual cards, peer-to-peer payments, and lending. Akintolatyo and Paramo launched Deposits

Is there anything the Grammy-award-winning musician can’t do? After releasing his fifth studio album, Kendrick Lamar is moving into new territory with billionaire investor Ray Dalio and comedian ExavierTV to discuss all things money as a part of Cash App’s ongoing “That’s Money” campaign. Popular finance app, CashApp, announced the launch of its new commercial on its YouTube channel. According to the clip, EXavier saved up money to open his franchise but lost it all due to gambling. Kendrick asks for Dalio’s opinion on the situation, and he explains exactly where he

Kinly has announced a new partnership with data aggregation platform MX, a financial data aggregation tool, to help the company build and enhance its custom-built financial tools. The Atlanta-based financial tech company, Kinly, is dedicated to helping Black Americans build generational wealth. The platform offers members a range of benefits, including a Visa debit card and early wage access. In addition, it gives members access to financial education to help them improve their economic outcomes. The partnership with MX will see the platform introduce a range of embeddable user interfaces