#BlackTwitter Is Unapologetic About Using Klarna To Book Their Next Vacation But Can Klarna Be Problematic?

Klarna was trending on Twitter after the public discovered airlines now allow customers to buy flights on a payment plan and it’s fair to say Black Twitter loved the news.

How exactly does it work? Book your stay and pay with Klarna at checkout. The website says “by spreading the cost you can think about upgrading or even staying a bit longer.”

Here are some of the community’s reactions after finding out:

But it’s important for us to note a few things about Klarna.

With ‘buy now pay later’ schemes such as Klarna on the scene, it is becoming easier than ever to buy yourself a whole new wardrobe – or holiday – whenever you feel like it. But how much damage is this actually doing?

Klarna is a Swedish bank that has massively risen in popularity over recent years, especially during the lockdown, and it’s now a payment option at hundreds of online stores.

But it can be an easy way to spiral into debt if not used carefully and the popularity of Klarna amongst some who want instant gratification and don’t control their spending could result in a really bad experience.

We’re not saying don’t use it but it’s important to be mindful.

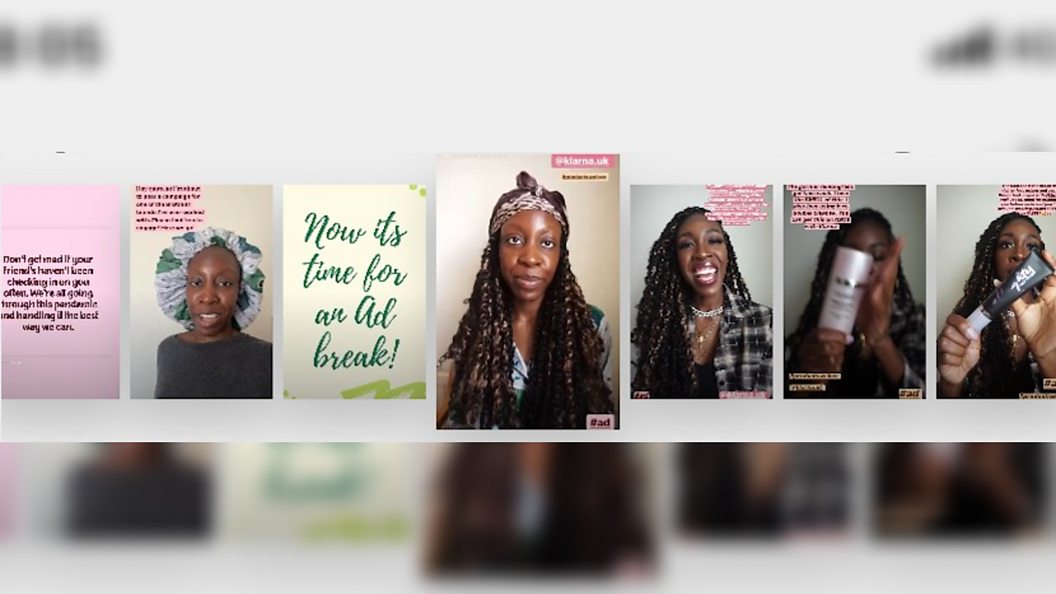

Four “irresponsible” Instagram posts promoting buy now, pay later service Klarna were banned during the pandemic by the Advertising Standards Authority.

The posts were made by ‘influencers’, who had been paid by Klarna to promote the service and appeared on the social media network in April and May 2020.

They presented buying beauty or clothing items as ways of “lifting” or “boosting” your mood during the UK lockdown, and featured prominent references to Klarna.

The ASA said future ads “must not irresponsibly encourage the use of Klarna’s deferred payment service, particularly by linking it with lifting or boosting mood.”

But there’s one Black influencer who decided to stop working with Klarna altogether.

Oghosa Ovienrioba, known to her followers as @SincerelyOghosa, was thrilled when she got an email to work with Klarna.

Her posts were within advertising guidelines, but a lack of clarity about how the service operates – and the potential drawbacks – ultimately left her with regrets about her decision to work with Klarna.

“I was really excited to be approached by Klarna. They’re a big brand and they work with a lot of my favorite companies – and so I started working with them last year.

“I’d used Klarna before and I’d always paid back all my purchases on time. But I wasn’t aware of how some people, especially younger people, use Klarna.

“I was asked to create video content for my Instagram Stories about my ‘go-to beauty items’ that I’d been using more in lockdown. These were products that could be purchased using Klarna on beauty websites,” she told BBC3.

“The turnaround for the content was quite fast and once it was done, I spoke to a friend about the opportunity that had come along to work with the brand.

“We had a long conversation and she sent me lots of articles about why Klarna can be problematic as a way to shop.

“I read about how some young shoppers who bought items with Klarna had gone into debt and were struggling to get their credit score back under control. I was horrified at what I learnt and I felt this incredible pang of guilt at what I’d done, and what I’d supported and promoted.

“I knew I had a lot of younger viewers who looked to me for advice and I couldn’t believe my ignorance had meant I’d potentially encouraged them to make bad financial choices.

“Unfortunately by the time I’d found out all the relevant information, it was too late. I’d signed the contract and the content had to be put out.

“My stomach was in knots. I knew, even as I posted, that I couldn’t work with them again.

“I was approached by them again but I told them that I couldn’t work with them and I listed my reasons why.

“Shortly after that, I was paid by Klarna for the work I’d done, and I knew I couldn’t sleep with that money in my possession, it just didn’t feel right. So I decided I’d give the funds to my followers by sending grocery vouchers to followers who’d lost their jobs.