Black-Owned Chicago AI Startup Lands $100K In Latest ‘Northwestern Mutual Black Founder’ Accelerator

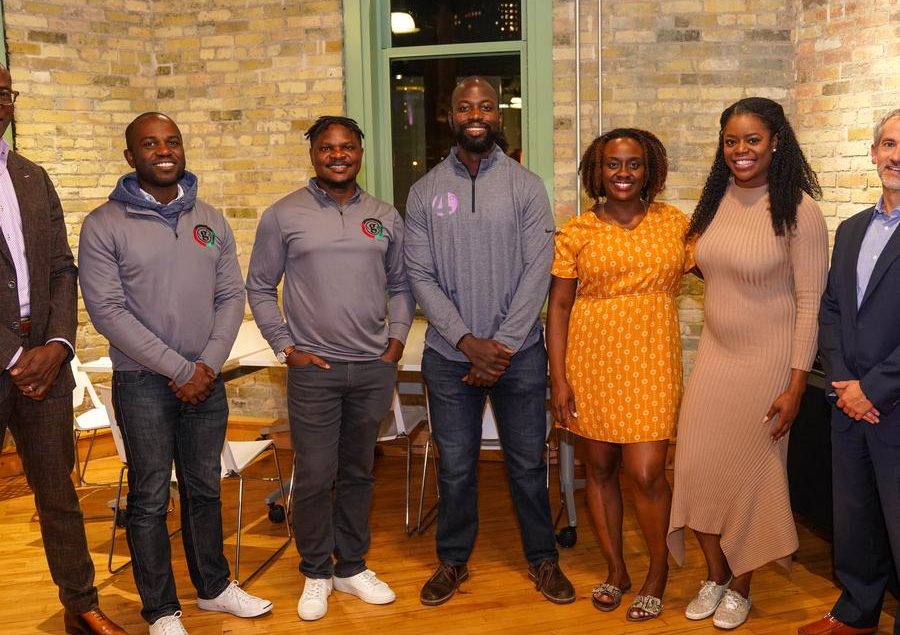

A Chicago startup that uses AI to help people better leverage their professional network is part of the newest cohort of startups selected as part of the Northwestern Mutual’s Black Founder Accelerator program.

4Degrees, led by CEO Ablorde Ashigbi and CTO David Vandegrift, will receive a $100,000 investment as part of the 12-week program.

It will also work alongside Northwestern Mutual and its accelerator partner gener8tor to help grow its business.

The company, launched by Ashigbi and Vandegrift, two former investors at Pritzker Group Venture Capital, back in 2017 was created as a tool to build better connections and stronger professional relationships.

The startup’s software gives companies a better way to track, maintain and collaborate on deals and relationships.

Its platform then identifies the right connections that users should focus on and helps strengthen those relationships over time.

4Degrees reportedly has more than 200 companies using its software, and it’s doing over $1 million in annual recurring revenue, according to local media.

It joins four other startups from across the country in Northwestern Mutual’s program.

Abim Kolawole, vice president of client experience with Northwestern Mutual, said: “The Northwestern Mutual Sustained Action for Racial Equity Task Force is looking at racism and inequality from every perspective to bring about meaningful, lasting change across each of the communities we proudly serve.

“The Black Founder Accelerator is core to that mission, closing the funding gap for Black entrepreneurs and ensuring they have the resources and support needed to help their companies thrive.”

Each startup in the latest cohort will receive a $100,000 investment and will work with gener8tor and Northwestern Mutual throughout the 12-week accelerator to grow their business.

Founders are also paired with executive mentors from Northwestern Mutual and receive individualized coaching and mentoring from industry-leading insurance and financial professionals.

Other companies on the list include:

Bobola Odebiyi: CEO

CrossKudi (Milwaukee) offers a secure international money transfer platform for immigrants. CrossKudi is powered by blockchain infrastructure, making international money transfers affordable, instant, and safe. CrossKudi is a Milwaukee-based Delaware C-Corp. CrossKudi has conducted beta testing and established product-market fit.

Kevin Barrow: CEO

Mark Labs, Inc. (Washington, D.C.) helps investors better link their capital allocations to real-world outcomes. Through its ESG Engagement Engine, Mark Labs helps asset managers meet the demands from both clients and regulators for making sustainable investments and operating in a transparent, ESG compliant manner.

Devyn Mikell: Co-Founder

Qualifi (Indianapolis) powers the fastest phone interviews in the world. High-volume recruiters use Qualifi’s automated phone interviews to make the hiring process more efficient, reducing initial screening time from weeks to minutes. Qualifi has conducted over 10,000 interviews, secured contracts with 27 employers, and surpassed $247k ARR.

Fonta Gilliam: CEO

Wellthi (Washington, D.C.) provides a B2B2C embedded social finance software designed to help institutions increase the lifetime value of customers by turning each customer into a community of customers. Customers use Wellthi to supercharge their financial goals in a social banking community of people they know and trust and that is connected to all of their accounts. Wellthi is a venture-backed fintech company that has raised over $1.7M to date.