The other day, I posted a poll on what post I should write next, and 57.1% voted for a “founders resource guide.” And because I’m working on a first-time founders course, I thought I’d focus the guide on first-time founders. Here we go… In this post, you’ll find: Founder Basics A Note for Underestimated Founders Resources And although the concepts that I share in the Founder Basics are simple, in the +1,000 startups I’ve reviewed for investment, I’ve seen first-time founders skip these foundational blocks, spend a lot of time and money, and

Hi there! You’ve likely landed on this page because you heard that, along with my co-founder Jesse Middleton, I launched a venture capital fund called The Community Fund. You’re likely wondering “what is this fund about and who is Lolita Taub?” Well, the short of it is that through the fund, we’ll invest in community-driven companies destined to become unicorns through an investment team, taking a page from XFactor’s playbook. As for me, I’m an unlikely VC fund manager. Yes, I have fourteen years of experience as an operator and investor in

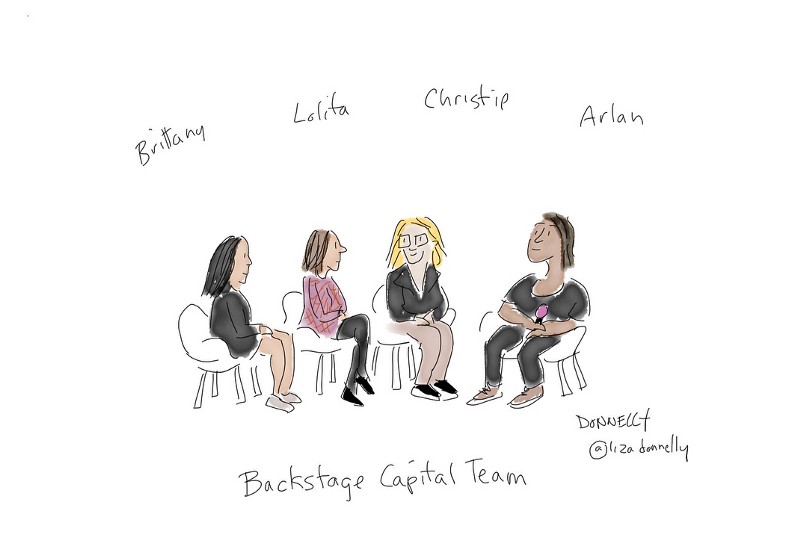

Latinx founder numbers are growing at a faster rate than any other group and we’re expected to yield $1.4 Trillion in US GDP. A couple of years ago, I started my journey in supporting Latinx founders as an investor at Backstage Capital through the Accelerator and with this post. And I believe what I wrote then even more now! TL;DR Latinx entrepreneurs are a strong force to be reckoned with! With capital and support, we can grow our businesses to produce in the trillions — trillions that can better the lives of our

TL;DR We don’t have a diverse, equitable, and inclusive (DEI) tech industry. We need one to serve the market better, take the money that’s being left on the table, and produce outsized returns for all. There’s a lack of dollars going to underestimated founders and companies addressing underserved communities, and a lack of diverse check writers. How can we make it a DEI tech industry? Approaches can include, but are not limited to: Increasing the number of underestimated tech talent (also promote, sponsor, and pay well) Increasing the dollars going

Arlan Hamilton — founder and managing partner at Backstage Capital — summarized best why investing in Black Female Founders (BFF) isn’t just important, but could produce high yields: “Less than 0.2 percent of all early-stage venture funding goes to Black women, while we make up approximately 8 per cent of the U.S. population and are one of the fastest-growing entrepreneur segments in the country,” Arlan wrote. “It is my firm belief that because Black women have had to make do with far less for centuries, equipping them with early-stage capital that is

On a daily basis, I get inquiries on and around the world of venture capital (VC) and Backstage Capital. So, when Mario Avila, an aspiring VC, reached out to me and expressed interest in typing up a few questions that could help many others, I took him up on it. I told Mario I’d answer his questions and post them. In this post, we explore my role as a Principal, diversity in venture capital, portfolio management, and how to break into venture capital. Mario: Thank you for taking the time