The Windrush Legacy: The Caribbean Tradition Inspiring The Fintech App Pardna

Today marks 75 years since more than 800 passengers from the Caribbean travelled to the UK onboard a ship called the Empire Windrush. These passengers had been recruited to help rebuild Britain after WWII and became known as the ‘Windrush generation.’

Windrush Day has been celebrated in the UK every year since 2018, and it has become a time to appreciate the cultural, social, and economic contributions that were made to the UK. One such contribution can be seen in fintech app Pardna.

What is Pardna?

Pardna, or pardner, is an informal and collaborative money-raising scheme that originated in the Caribbean, but similar schemes can be found in communities around the world.

When the Windrush Generation came to the UK, they brought with them the financial tradition as they faced financial discrimination and exclusion from banks and lending institutions.

Pardna enabled, and continues to enable, individuals to pool their resources within a close-knit group, allowing them to save together and have access to their funds quickly when needed.

A Pardna works when a group of people pay into a common fund over a fixed period, typically several weeks or months. At regular intervals, one person from the group receives the full payout. The process continues until everyone member of the group gets their money back.

Without the reliance on traditional banking systems, the practice had to rely on trust and the strength of their community at the time.

Today, the practice has evolved into an innovative mobile app, still offering the alternative to traditional banking systems, this time in the midst of a cost of living crisis.

Pardna App

Pardna was founded by Paul Henriques who has a connection with Windrush as his parents were immigrants during this era.

Henriques told Devon Daley on BBC Radio that he remembers every Saturday, his mom used to give him an envelope, he would jump on a bus with the envelope and hand over the money.

“It was like a secret mission I was sent on every week,” he said.

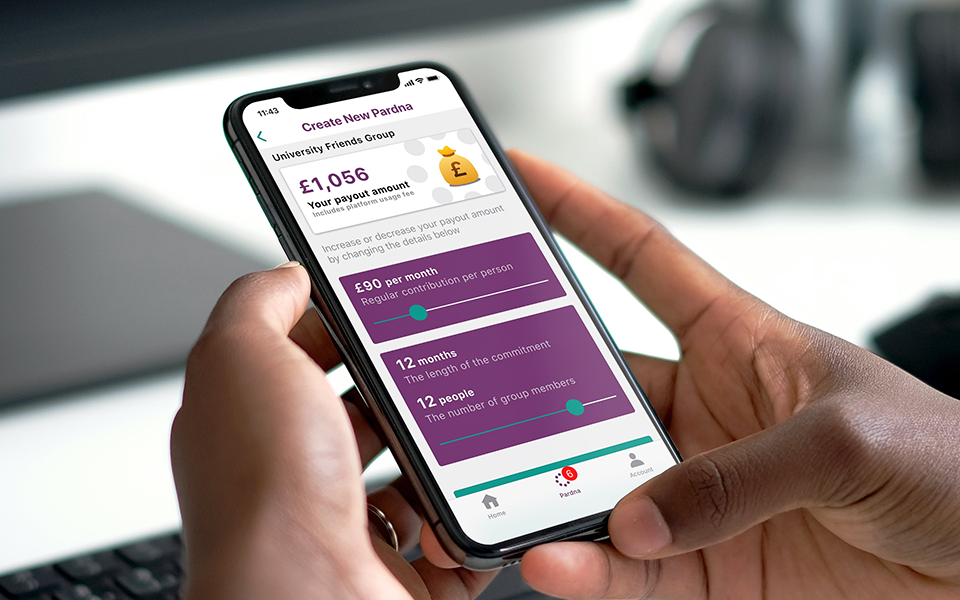

The app aims to modernize the traditional Pardna practice by digitizing the entire process and leveraging the latest technology to do so.

The app empowers users to take control of their finances and work collectively to achieve their financial goals.

“We were denied loans, couldn’t get access for credit and even in these times, for some credit is hard to come by. Pardna was useful then and I’m telling you, it is useful now,” said Henriques.

How does the app work?

On the app, there are instant identity checks and secure bank connections to ensure safe and efficient transactions within the user’s Pardna group.

It has been described as an “alternative to short-term, high-cost credit” as the cost of living crisis continues, the need for alternatives is essential.

The app will offer a solution that helps users avoid the pitfalls of traditional credit systems by providing a communal, trust based financial platform.