Reload launched its flagship product, Epic, this week, following a $2.275 million funding round to provide a management system for autonomous AI agents within software engineering teams. Reporting from TechCrunch indicates that Reload aims to transform ad hoc developer AI usage into a governed corporate system with specific permissions and persistent oversight. This shift is significant because the entity controlling the system of record for AI agents dictates how automated labor is tracked, audited, and integrated across disparate vendor models. Organizations currently face fragmentation as different agents perform isolated tasks

Andreessen Horowitz partner Kofi Ampadu has left the venture firm months after it paused Talent x Opportunity (TxO), the fund and operating program he led, TechCrunch reports. TxO was launched in 2020 amid a wave of corporate commitments to diversity, equity, and inclusion after the murder of George Floyd. The initiative was designed to expand access to capital, networks, and mentorship for founders who fall outside traditional venture pipelines. The Talent X Opportunity Fund In a farewell note announcing his departure, Ampadu framed TxO as a response to the venture

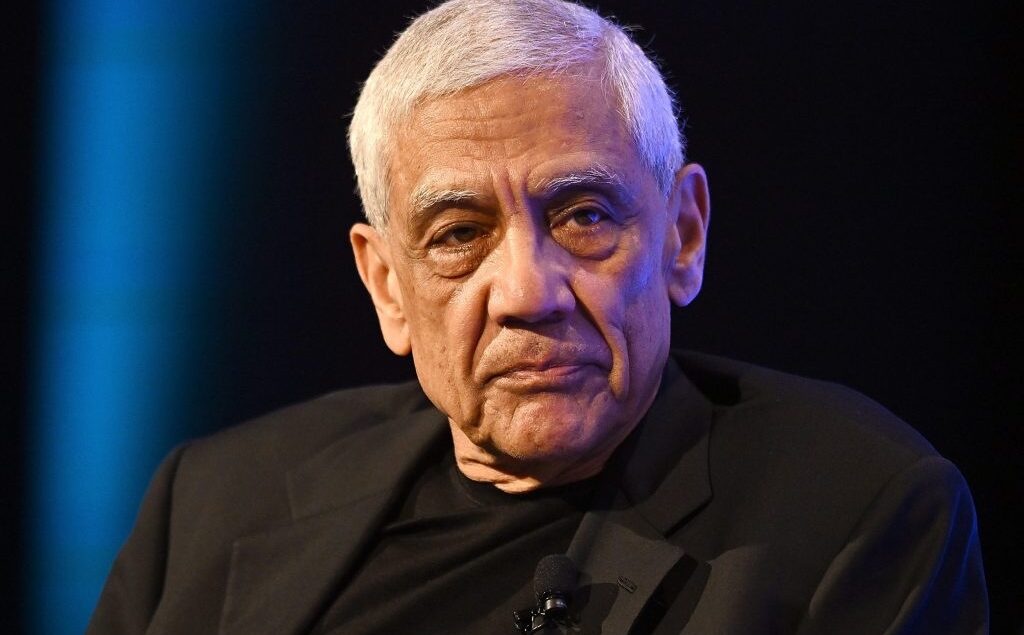

Billionaire investor Vinod Khosla publicly distanced himself and his firm from comments about ICE made by Keith Rabois, a managing director at Khosla Ventures. Rabois had defended federal agents following the fatal shooting of Alex Pretti, a 37-year-old ICU nurse, in Minneapolis. Tech leaders from companies including Google, OpenAI, and Anthropic have also condemned the shooting and criticizing what they described as unnecessary escalation by ICE agents. Rabois’ Remarks Draw Internal Criticism Rabois wrote on X that “no law enforcement has shot an innocent person” and claimed that “illegals are

Skinbrand Topicals has added WNBA star Angel Reese and Nigerian artist Rema as investors in an undisclosed funding round, as the skincare brand navigates a pullback in institutional capital for consumer startups The round reflects a broader shift in how Black-founded consumer brands are financing growth in a more restrictive venture environment. As traditional investors grow more conservative, founders are increasingly treating distribution, cultural reach, and audience trust as strategic inputs alongside cash. Capital, Control, and the Cost of Growth Since launching in 2020, Topicals has raised more than $22.6

Terra Industries, a Nigeria-based defense technology company, raised an $11.75 million in funding led by Joe Lonsdale’s 8VC [Lonsdale is also co-founder of companies including Palantir Technologies, Addepar, and OpenGov], as it emerged from stealth, according to TechCrunch. The round included Valor Equity Partners, Lux Capital, SV Angel, and Nova Global. Terra previously raised an $800,000 pre-seed round. The company said African investors in the round included Tofino Capital, Kaleo Ventures, and DFS Lab. Terra, founded by CEO Nathan Nwachuku, 22, and CTO Maxwell Maduka, 24, builds autonomous systems to

Dria Ventures has launched its first fund with $8 million to invest in pre-seed and seed-stage startups addressing America’s rising cost crisis. Led by Founder and Managing Partner Megan Maloney, the fund is targeting two sectors where “the math is broken”: healthcare and Main Street productivity. In healthcare, costs now make up nearly 20% of the country’s GDP, while small businesses are spending upwards of $120,000 annually on outdated software. Dria is backing founders who are building practical, cost-saving infrastructure to fix these broken systems. A thesis rooted in lived

Workplace surveillance in the Global South is on the rise, according to a new report by Coworker.org, a labor rights nonprofit based in New York. Technologies for tracking and managing staff workers are expanding in scale and sophistication in more than 150 startups and regional companies based in Kenya, Nigeria, Colombia, Brazil, Mexico, and India, researchers said. The term “Little Tech” was made popular by the VC firm Andreessen Horowitz (a16z), which argues that excessive regulation was stifling innovation. The Coworker.org report found that the Little Tech ecosystem, which primarily consists of unregulated, venture

Wave Ventures, Europe’s largest Gen Z-run VC fund, has announced its third fund, which is €7 million ($7.8 million), tripling the size of its previous fund. The fund is supported by a diverse group of investors, such as Slack, Bolt, Skype, Supercell, Wolt, Silo AI, and Smartly.io, as well as European early-stage VCs, and family offices, according to a press release. The fund comes at a crucial time for early-stage investing across the Nordics and Baltics. The quick advancement of generative AI, no-code tools, and open-source technologies makes entrepreneurship more

The Black Economic Alliance Entrepreneurs Fund LP, which is raising $50 million to support young startups, is over halfway towards its goal. As stated in a filing last week with the Securities and Exchange Commission, the fund has currently raised $28.5 million and is led by venture capitalist Melissa Bradley. The Washington Business Journal reported that she shared that the fund’s investment will focus on young companies that specialize in products or services in four key areas: financial inclusion, health and wellness, sustainable communities, and what she called “narrative change”—companies focused

Equator, an Africa-focused venture capital firm, secured $55 million for its first fund to support climate tech startups, particularly in their early stages, as reported by TechCrunch. Africa has less than 3% of global energy-related CO2 emissions but suffers from some of the worst climate impacts. Equator seeks to address that, saying it invests in deals “addressing economic and sustainability challenges emerging from these impacts.” Funding African climate tech startups In African countries, climate tech startups have to navigate a difficult funding landscape compared to their peers in more developed