Danish investment firm, Unconventional Ventures (UV), recently announced the launch of their new fund of €30 million (approx. $30.5 million) to support underrepresented founders across Europe. The fund was launched by UV to get more money into the pockets of “unconventional founders,” will work to address the lack of diversity in Europe’s start-up ecosystem. Nora Bavey, Tea Messel, and Bradley Leimer co-founded UV in 2017 with the aim of shaking up Europe’s VC space for good. The team, which has formed an extensive pool of diverse investors and advisors, will

Black-led fintech startup, Moove, raises $20 million in investment funding from the British International Investment (BII) program, formerly known as the CDC. The investment reflects the BII’s plans to build a resilient market in Nigeria, providing access to various economic opportunities for upcoming businesses while simultaneously accelerating the country’s limitless entrepreneurial spirit. Moove, co-founded by Jidi Odunsi and Ladi Delano in 2020, is a mobility fintech platform that provides revenue-based vehicle financing to mobility entrepreneurs across Africa. The co-founders, both British-born Nigerians with degrees from the London School of Economics

Minority-owned early-stage cannabis fund, JourneyOne Ventures, has closed a $10 million fund to invest in businesses within the growing cannabis industry. The fund includes a range of investors like Paul Bown, founder of Bowen; Elizabeth Yin, general partner at Hustle Fund; Eric Manlunas, general partner at Wavemaker Partners and Fred Kang, a former partner at Andreessen Horowitz. JourneyOne Ventures, founded in 2017 by Helene Servillon, is committed to building a community of genuinely talented entrepreneurs. The investment company, 100% women-led and minority-owned, invests in bold performers within the cannabis industry

London-based venture capital firm, Octopus Ventures, has launched its first £10 million ($12 million) pre-seed fund to support fresh startups in the fintech and health sectors. The firm, founded in 2007, works to fill the growing gap in early pre-seed funding for European founders. Kirsten Connell and Maria Rotilu, veterans of Seedcamp and Uber, will lead the company’s first-ever investment fund. They will bring their extensive experience and knowledge of growing firms from the beginning to the job, enabling them to work closely with start-ups in their early years. Octopus

Olympian Allyson Felix‘s footwear brand Saysh, co-founded by her brother and business partner Wes Felix, has secured an $8 million investment in its series A funding round. The funding round led by Iris Ventures, with participation from Redpoint Ventures saw Gap Inc. acquire an equity stake in Saysh. Additionally, Athleta, a subsidiary of Gap Inc., has agreed to showcase Saysh footwear on their website in partnership with the footwear brand. The news comes after Allyson Felix announced her departure from Nike in 2021, due to claims the company was not doing enough to support pregnant female athletes and

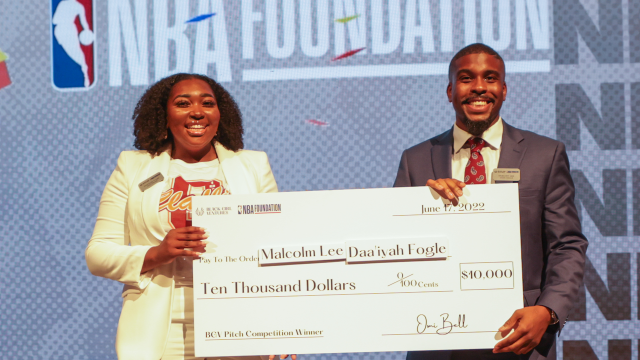

Entrepreneurs Daa’iyah Fogle, a Claflin University alumnus, and Malcolm Lee, a graduate of Virginia Union University, are the winners of the NBA Foundation’s first-ever pitch competition in partnership with Black Girl Ventures. The joint competition, held in Cleveland, allowed college-aged entrepreneurs from HBCUs across the US to participate and pitch their business ideas to a panel of judges. The entrepreneurs eligible to participate in the competition were all Black Girl Ventures’ NextGen Program members. The scheme was created to support the next generation of Black and brown business leaders attending

First National Bank has announced that it’s making a $2.5 million equity commitment to Black Tech Nation Ventures, a majority Black-owned VC fund based in Pittsburgh, which provides funding and resources for Black-led technology startups and firms with diverse founders. The investment is part of FNB’s broader commitment to promoting economic equality. Launched in 2021, the BTN venture fund is more than halfway to its initial $50 million fundraising goal. The VC intends to build a portfolio of 20 to 30 early-stage tech companies that have diverse founding teams and focus on

NALA, a Tanzanian cross-border payments company that recently pivoted from local to international money transfers, has raised $10 million in a new fundraising round. It comes almost three years after NALA secured a seven-figure pre-seed round led by Accel in 2019. It received funds from an impressive group of angel investors — Jonas Templestein, co-founder and CTO of Monzo; Vladimir Tenev, Robinhood co-founder and CEO; Deel founder Alex Bouaziz; Laura Spiekerman, co-founder of Alloy; Peeyush Ranjan, the head of Google Payments and early employees at Revolut and TransferWise. Sheel Tyle,

Rihanna’s Savage X Fenty has reportedly raised $125 million in a Series C funding round, thanks to investments from a consortium of private equity firms, led by Neuberger Berman. As she sings in Pour It Up, all Rihanna sees are dollar signs. Timed with the opening of the company’s first-ever brick-and-mortar over the weekend, Savage X Fenty has just raised millions from several big0time investors. Neuberger Berman was joined by previous investors L Catterton, Avenir, Sunley House Capital, and Jay-Z’s Marcy Venture Partners. The recent funding round comes on the back of a Series B

Europe is “solidifying its place as a global tech power”, according to Atomico’s annual State of European Tech 2021 report. However, research still shows women and minorities are not being given enough investment. European tech is projected to cross the $100B milestones of capital invested in a single year, close to 3 times the level in 2020, reported Dealroom. The total number of tech companies that have scaled to $1B+ in Europe has jumped from 223 last year to 321. Large rounds ($250M+) are now the norm in Europe —