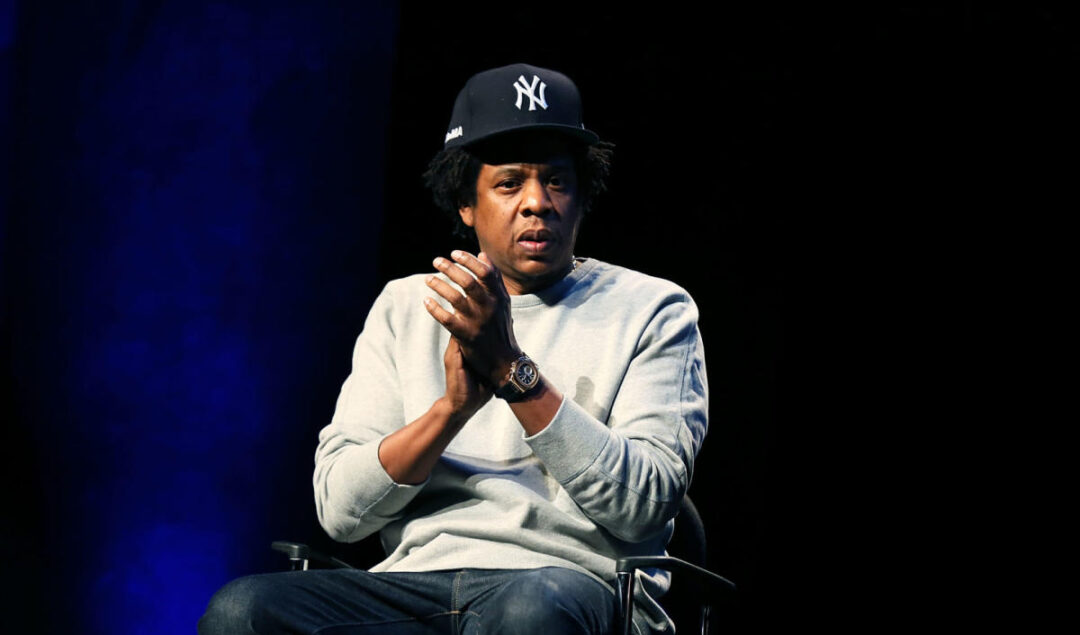

Marcy Venture Partners (MVP), co-founded by “Jay-Z” Carter, is reportedly nearing a significant merger with Pendulum Holdings’ investment arm Merger Talks According to Bloomberg, the merger could create a new entity with over $1 billion in assets under management. Sources close to the discussions, who preferred to remain anonymous, have indicated that the merger between these two California-based powerhouses is almost finalized. Both entities have declined to comment on these speculations. Culture-driven investments Marcy Venture Partners, established in 2018 by Jay-Z alongside Jay Brown and Larry Marcus, has demonstrated an eye for culture-driven investments. Its

Camelback Ventures has announced Shawna Young’s appointment as its new Chief Executive Officer (CEO), starting in early April 2024. Camelback Ventures Camelback Ventures is a New Orleans-based nonprofit social venture fellowship that aims to increase access to opportunity for entrepreneurs of color and women. Founded by Aaron T. Walker in 2015, Camelback Ventures has supported over 133 undervalued entrepreneurs with social impact ventures around the country. Its business model involves providing its Fellows with the “friends and family” stage of funding. The Fellows then reinvest in Camelback through grants or convertible notes. Meet

Alinea Invest has received $3.4 million in seed funding just in time for the launch of their virtual AI assistant to help users with their investing needs. Alinea Invest After interning at Goldman Sachs, Eve Halimi and Anam Lakhani, co-founders of Alinea, realized the need for a female-focused investing app to guide women in making investments and managing their wealth. “The pain point we saw is that people like us who are young women, Gen Zs, children of immigrants, they have no idea where to start,” Lakhani told TechCrunch. “Financial literacy is a massive pain

Copenhagen-based Unconventional Ventures has announced the second close of its €30 million fund ($32 million), dedicated to investing in diverse founding teams and founders. Unconventional Ventures According to Tech Funding News, Unconventional Ventures (UV) is the only European fund with a diversity impact at its heart. It is an impact-focused investment firm investing in early-stage startups led by underrepresented founders in Europe. Launched by Thea Messel and Nora Barvey in 2018, UV has a VC structure and invests across the Nordics in healthcare, women’s health, diversity tech, sustainable fashion, food

This article was first published by Rumbi Makanga on Medium. I was asked to give a talk by a London-based company for Black History Month in October 2022. Initially, I was going to title my talk Your Silence Will Not Protect You after the eponymous collection of essays by Audre Lorde and to honour the many silences I have nursed over the years and the vast silences I know countless Black people are forced into in their professional lives. It took a bout of illness in the last days of 2020 to

Since its launch in 2021, Stackwell Capital has worked hard to eliminate the racial wealth gap, and the launch of its new Robo-investing app is a testament to this. The app which has launched yesterday and is currently available for download in the App Store. The program, intentionally designed for the Black community, has given users endless opportunities to enhance their knowledge of the financial market. New data has revealed that white households hold eight times more wealth than Black households. Additionally, only 34% of Black households invest in the stock compared to white