Incredible Health, an award-winning job-matching platform for nurses, has closed an $80 million Series B funding round. The latest funding round was led by Base10 Partners, including investors Andreessen Horowitz and Obvious Ventures. To date, the digital marketplace has hit a staggering $1.65 billion valuation, making its founder, Dr Iman Abuzeid, one of the very few Black female founders spearheading a unicorn company. Abuzeid founded the nurse-hiring startup in 2017 to act as the bridge between healthcare workers and industry hires, matching “the right nurse with the right role at

Tech startup ImIn has further closed $1 million in seed funding to expand its employee scheduling app. Black-led venture capital firm Collab Capital led the funding round. ImIn, founded by Chime Solutions exec Lauren Wilson, is a staffing software platform aimed at helping the call center industry. After seven years of working at her father’s high-volume call center business, Wilson came up with the idea to launch her app after identifying the missed opportunities both companies faced because of a familiar yet widely accepted industry challenge: absenteeism. According to a 2017 US Department

Black-owned digital app, ShearShare, has raised $2.3M in a seed funding round led by Fearless Fund. The round also included Level Up Ventures, New York Ventures, Gaingels, Chloe Capital, Portfolia, Pipline Angels, Bacon Family Trust, and ACV Auctions co-founder Jack Greco. The additional funding brings ShearShare’s total funding amount to $6.2M. Known to many as the “HairBnB,” ShearShare has created an easily accessible mobile app that provides licensed beauty and barbering professionals with flexible and affordable spaces to rent. In addition, entrepreneurs can use these spaces with no-term leases or commission fees.

The pre-seed fund, Visible Hands, has officially launched the second cohort of its “Visionaries Accelerator” program. The initiative, which aims to support overlooked and underrepresented founders, welcomed 51 new founders to its flagship program. The program, which will take place from September to December, will see each company work full-time towards building their business, with financial support from the Visible Hands team. Each founder will receive a starting investment of $25,000. Throughout the program, they will have the chance to earn additional assets of up to $150,000 as they progress.

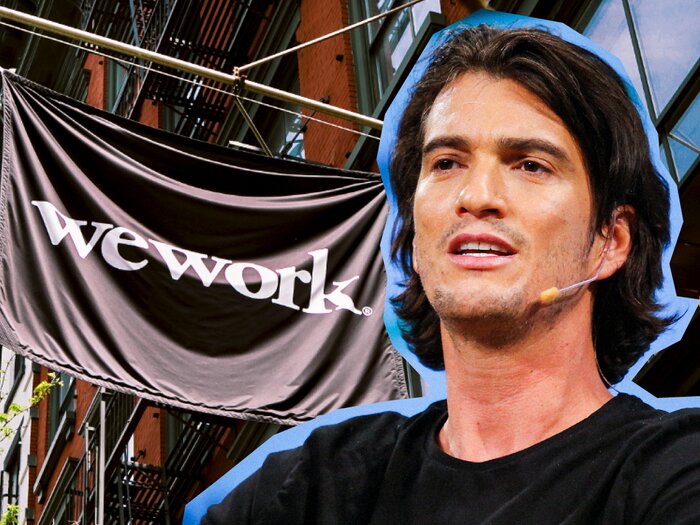

Billionaire Silicon Valley mogul, Adam Neumann, has bounced back from the spectacular failure of WeWork to become the face behind a $1 billion residential real estate company, Flow. According to Bloomberg, venture capital powerhouse Andreessen Horowitz has pledged approximately $350 million to kickstart Neumann’s newest venture. This investment will be the largest check written for single funding round, in the fund’s history, according to the New York Times – and it’s got everyone on the internet talking. Failing upwards Neumann’s new business venture comes three years after the world witnessed the meteoric

Black-owned digital bookkeeping platform, Pastel, has raised $5.5 million in a seed funding round. The round led by pan-African venture capital firm TLcom Capital also included other VC firms such as Global Founders Capital, Golden Palm Investments, DFS Labs, Ulu Ventures and Plug and Play, and Soma Cup. Pastel, co-founded in 2020 by Abuzar Royesh, Olamide Oladeji, and Izunna Okonkwo, is a platform designed to help build digital tools to provide a solution to issues small businesses across Africa face. The platform’s primary goal is to unlock the potential of

LA-based tech non-profit, Minor-IT has expanded its I.T. training services to help African American and minority youths hoping to succeed in the I.T. industry. Minor-IT, founded in 2019 by Stephen Jones, works to enable minority youth to help them pursue I.T. careers through educational experience, peer-to-peer learning, and networking. They offer guidance and mentoring to help students with the tools needed to achieve unlimited career success. They also sponsor counsel and network with children and teens to help facilitate change in an underrepresented industry. “For me, breaking into I.T., getting

Black-owned scheduling platform Calendly has been named one of the world’s top private cloud companies on Forbes’ Cloud 100 list. Calendly is a cloud scheduling company on a mission to revolutionize how the world schedules. Tope Awotona launched the platform in 2013 and it is now worth a staggering $3 billion. The app uses an automated tool to make the process of scheduling easier. Users can sync their calendars with the platform and share a link that will bring people to their Calendly page. People will not be able to see your

B2B startup Vori has raised $10 million in Series A funding. The funding round was led by Silicon Valley-based venture fund, The Factory, and included participation from Greylock, E2JDJ, MKT1, and Mollie Stone’s Markets. Vori, founded in 2019 by Brandon Hill, Robert Pinkerton, and Tremaine Kirkman, is revolutionizing the grocery industry with its B2B operating system. Vori’s platform is committed to enhancing retailers’ inventory workflows by digitizing traditionally labor-intensive processes. Their work unlocks the data required for grocery retailers, brands, and distributors to effectively address food access and food waste

Black-owned SaaS startup, Stimulus recently closed a $2.5 million seed round. The funding round was led by Black Ops VC and included Genius Guild, Morgan Stanley, Northwestern Mutual Future Ventures, REFASHIOND Ventures, Bronze Valley, The BFM Fund, Plain Sight Capital, Penn Medicine, and a few angel investors. Stimulus, founded in 2017 by Tiffanie Stanard, is a relationship intelligence (SaaS) platform that uses data insights and relationship-building tools to help companies make the best purchasing decisions while assisting them in optimizing, nurturing, and growing their supplier ecosystems. The company’s mission is to help businesses