Female entrepreneurs of color remain among the most disadvantaged in raising capital, despite growing efforts to support diversity in entrepreneurship, according to The Funding Divide report. Persistent Challenges in Fundraising The report, published by DocSend and Dropbox, found that racially diverse, all-female startup founding teams spent the longest time raising capital. In 2023, they spent an average of 25 weeks fundraising in 2023, a 67% increase from 2022. Despite this extended effort, they secured an average of only $460,000, the lowest amount among all demographic groups. In contrast, racially diverse,

Goldman Sachs is standing firm in its commitment to support Black women through its One Million Black Women initiative as it expands its Black in Business program, according to The Guardian. Launched in 2021, the One Million Black Women initiative pledges $10 billion in investments and $100 million in philanthropic funding over a decade to address racial and gender inequality. Doubling Down On Black In Business Program This fall, Goldman Sachs is expanding its Black in Business education program, doubling the number of entrepreneuers it accepts. The Black in Business

A report from The Alliance for Entrepreneurial Equity has found a troubling decline in venture capital and other forms of funding for Black-owned businesses. While the number of Black-owned businesses are growing, they are severely underrepresented compared to their population making up only 2.5% of all businesses. In recent years, Black-owned businesses have faced challenges in securing funding, a trend that blocks their growth and reflects issues within the American financial landscape. The Alliance for Entrepreneurial Equity’s latest report, a collaboration between the National Urban League and Third Way, illuminates

Two Black founders have teamed together to create Dreamward Ventures, a new Seattle-based fund that plans to invest in diverse founders, including early-stage startups led by Black entrepreneurs. Dreamward Ventures Dreamward Ventures offers early-stage capital, technical due diligence, and network connections to founders who need them most. According to GeekWire, founders Evan Poncelet and Jesse Posey met at a Seattle Angel Conference event and decided to address the gaps in venture capital for Black founders and investors. “It’s hard for the venture capitalists and angel groups to reach out to founders of color, specifically Black

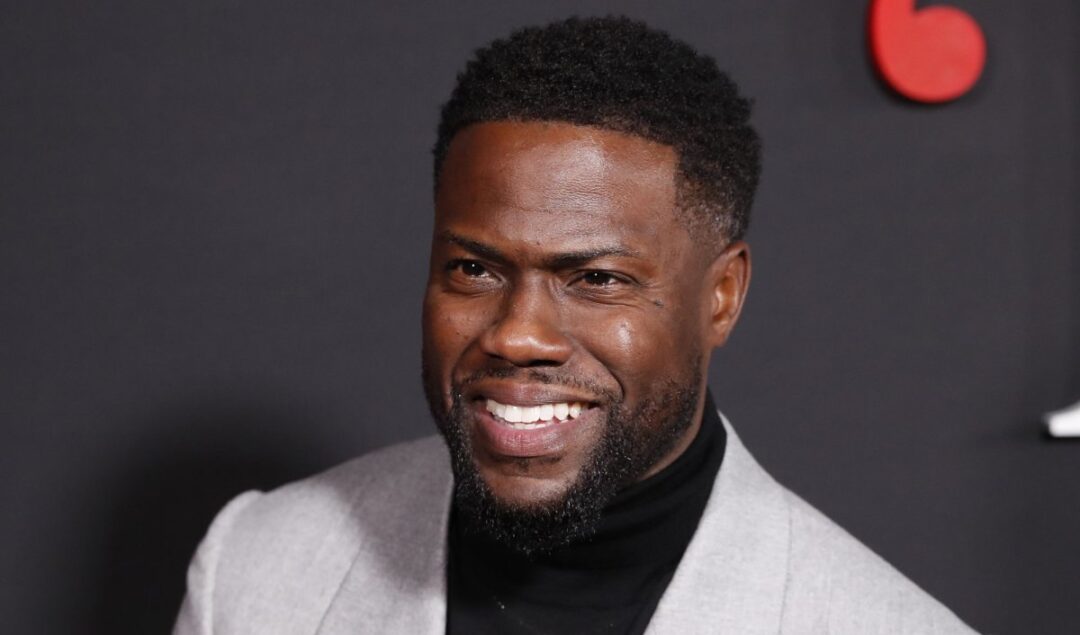

Gran Coramino Tequila, the premium tequila brand co-founded by Kevin Hart and Juan Domingo Beckmann, has disbursed over $1 million in grants to Black and Latine entrepreneurs across the United States to date. The Coramino Fund Since its inception in 2022, Gran Coramino has dedicated a portion of its sales to the betterment of underrepresented business owners, committing $1 from every bottle sold to this cause. The Coramino Fund, established in partnership with the Local Initiatives Support Corporation (LISC), has now dispersed over $1 million in grants. This funding has reached over 100

Leading software company Sage has contributed $100,000 to Morehouse College, supporting a new course for the next generation of Black tech entrepreneurs. Cultivating Future Leaders through Micropreneurship Morehouse College, the nation’s only historically Black liberal arts institution for men, and Sage have joined together to address the underrepresentation of Black professionals in technology. With only 8% of tech workers and 3% of executives being Black, this new course will commence in Fall 2024 to help change the statistics. The 15-week Micropreneurship course, funded by a $100,000 donation from Sage, is designed to immerse students in

Wray & Nephew, the renowned Jamaican rum brand, has partnered with Foundervine to launch the third iteration of their ‘Wray Forward’ program. Research by Wray & Nephew found that 68% of Black entrepreneurs in the UK experience a lack of business tools and resources. Additionally, 76% think that having early access to the right tools could have accelerated their success. A fifth of Black entrepreneuers also needed help with fundraising. These findings underlined the need for support in the Black entrepreneurial community. The ‘Wray Forward’ Initiative The ‘Wray Forward’ initiative connects Black entrepreneurs

The Russell Innovation Center for Entrepreneurs (RICE), a pivotal hub for Black entrepreneurs in Atlanta, announced a $2 million grant from Truist Foundation and two Truist Trusteed Foundations. RICE positions itself as Atlanta’s home for Black entrepreneurs and an economic mobility engine for the community. Its stakeholders have created hundreds of jobs, generated over $100 million in revenue, and spurred $450 million in total economic activity. This financial endorsement by Truist comes at a critical time. It is set to accelerate RICE’s expansion efforts and elevate the stature of Atlanta-based Black entrepreneurs within and

Five Black entrepreneurs are behind “The Xchange,” a $40 million high-rise development project in Chicago’s South Shore neighborhood. The project aims to put the community first, with plans to offer competitive rent and integrate architecture, development, and entrepreneurship programs to benefit local youth. Meet The Team Jemal King, known as the “9-to-5 millionaire,” anchors the group with a tale of resilience and ambition. Despite his NFL dreams, King found his calling in real estate while serving as a police officer, a decision that led to significant success. His determination and

Black-owned tech accelerator Plug In Ventures has secured a new $1 million grant from the California Office of Small Business Advocate (CalOSBA). Plug In is the space for Black and Brown entrepreneurs and VCs to reimagine the innovation economy across the US and beyond. Founded by Derek Smith in 2014, the accelerator investing mentors and expands early-stage entrepreneurs. Since 2019, companies in his firm’s ecosystem have raised over $22 million in VC dollars from climate, sustainability, the creator economy, and athletic apparel. The Funding Plug In Ventures will receive $250,000 annually from CalOSBA over