Equinix has announced its plans to acquire MainOne, a West African data center and connectivity solutions provider in Nigeria, Ghana, and the Ivory Coast, for $320 million. Armed with over $200 million in equity and debt investment, MainOne was built as West Africa’s first privately owned, open access undersea high capacity cable submarine. It’s a 7,000-kilometer cable stretching from Portugal to West Africa with landings along Accra in Ghana, Dakar in Senegal, Abidjan in the Ivory Coast, and Lagos in Nigeria. Funke Opeke launched MainOne in 2010 after noticing the poor internet

MarketForce, a Kenyan B2B retail and financial services distribution startup has expanded into five additional markets across Africa to grow RejaReja — its retailer ‘super app’ that allows informal merchants to order and pay for inventory digitally. The startup has partnered with Cellulant, a pan-African payments company that makes it possible for local and international merchants to accept “locally appropriate and alternative” payment methods from their customers to expand into these new markets. Cellulant has partnerships with 46 mobile-money operators in Africa, 120 banks and serves 35 African countries with a physical

The Kenyan startup has secured $2 million in pre-seed funding and is headed for its next phase of growth, which will involve extending loans to traders offering more relief to those that are often left out and regarded as high risk by the traditional banking sector. Fredrik Jung Abbou; a two-time unicorn founder and Norrsken Impact Accelerator were among the investors that funded the firm while the debt round had the participation of French Public Investment Bank (Bpifrance) and GreenTec Capital Partners. The funds include $1 million equity and $1

DrugStoc has raised $4.4 million in a Series A funding round led by Africa Healthcare Master Fund, Vested World, the German Development Bank and others. The investors will play a vital role in the sector’s continued growth. The firm plans to open more fulfillment centers and increase transit points and routes. It also hopes to provide more improved logistic alternatives for deliveries projected to be tardy. The founders plan to tap into more investment prospects in cold chain infrastructure with the hope of creating safer distribution for perishable items. To

A minority-owned platform that allows you to compare colleges, course options, and tuition fees all in one go has just managed to raise $1M in a pre-seed round that will go towards improving its search and recommendation technology. Craydel was launched earlier this year by co-founders Manish Sardana, John Nguru, and Shayne Aman Premji. It was inspired by the lack of a reliable portal in Africa to guide the big decisions on which college and course selection students will take. The trio then decided to bring to life a platform that would eliminate this

MFS Africa, an inter-operability hub connecting mobile network operators across the continent through a single API, has raised $100 million in a Series C round. That’s a pretty significant number for a Series C funding round, and it’s split between $70 million equity and $30 million debt. Private equity fund AfricInvest FIVE co-led the round with existing investors Goodwell Investments and LUN Partners Group. New investors CommerzVentures, Allan Gray Ventures, Endeavor Catalyst, and Endeavor Harvest joined in while ShoreCap III returned as an existing investor with other funds. For someone who spent more than

Google is taking applications for its seventh ‘Google for Startups’ accelerator program. Applications for the three-month virtual accelerator program are now open to technology startups located in Algeria, Botswana, Cameroon, Côte d’Ivoire, Egypt, Ethiopia, Ghana, Kenya, Morocco, Nigeria, Rwanda, Senegal, South Africa, Tanzania, Tunisia, Uganda, and Zimbabwe. The accelerator program launched in 2017 is designed to help Startups scale their solutions across the continent. Successful applicants from Seeds to Series A will gain access to free support alongside Google’s networks, advanced technology, experts, and mentors through virtual boot camps every

Twiga Foods has raised $50M in its Series C round to take its mission to expand food and retail distribution across the African continent. The firm, which launched in 2014, uses technology to build supply chains in food and retail distribution. It claims to simplify the supply chain between fresh food producers, FMCG manufacturers, and retailers through a B2B e-commerce platform and it currently has over 100,000 registered customers and delivers to 10,000 every day. Twiga now plans to use the funding to test out a model they’re developing “to reduce the

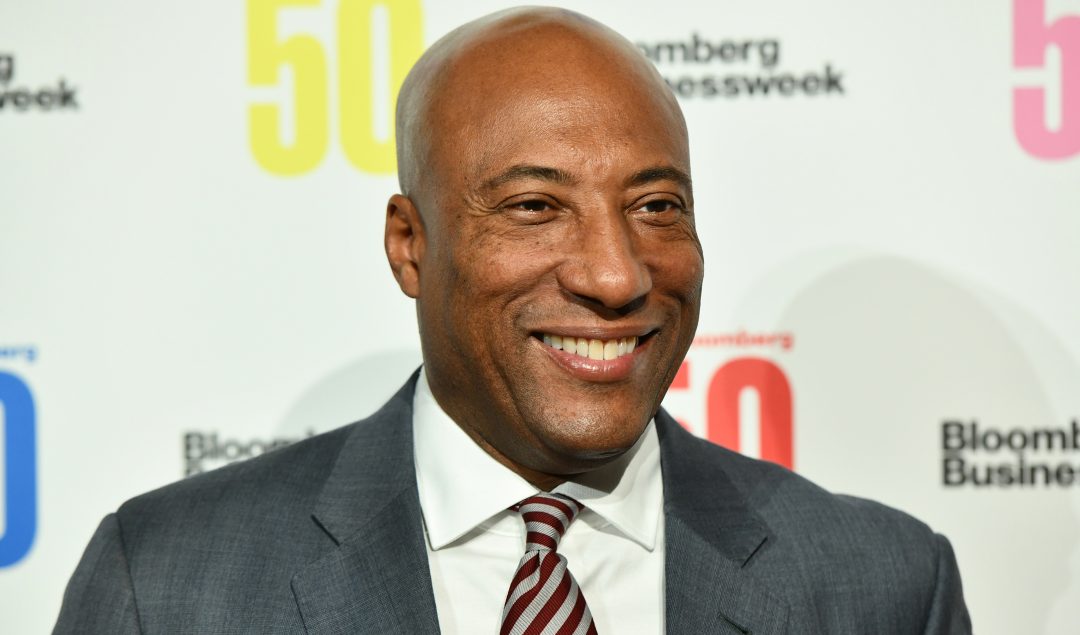

Byron Allen, the 1980s comedian-turned-media-mogul, aims to acquire Tegna Inc in an $8 billion deal. The news comes months after it was reported that Allen’s Weather Channel’s business had taken a hit due to the pandemic as the TV advertising dried up, leading to piling debt load. Tegna, formerly owned by Gannett Co Inc, is a chain of 64 TV and radio stations that span 50 markets across the U.S. The deal could significantly boost Allen Media Group, which has amassed 33 local TV network affiliate stations. Allen — who came to

An African startup described as the “booking.com for healthcare” by its founder has raised $1.5 million from its most recent round. RecoMed acts as a marketplace where patients can find and book services with healthcare professionals across South Africa. Sheraan Amod first founded the company after a brief stay in the U.S, where he experienced for the first time what it was like to book medical appointments online, which wasn’t the case back in his home country, South Africa. Mr. Amod then returned and created the company he refers to as