Adesuwa Okunbo Rhodes is the Managing Partner and Founder of Aruwa Capital Management and one of a handful of women leading VC firms in Africa. Aruwa invests between $500,000 and $2.5 million in post-seed stage startups. Beyond being able to invest in an underrepresented market, existing data suggests that gender diversity improves companies’ profitability, and Rhodes was keen to exploit this. “I’ve been in the industry for 14 years. I was running a fund prior to launching Aruwa, and when I was fundraising for that fund, I looked around and saw that there

The business and tech industry has created two flaws, according to Henri Pierre-Jacques, a managing partner at Harlem Capital. Sharing his thoughts on the investor ecosystem on Linkedin, he said: “young companies are now all called ‘startups,’ implying they are tech-focused when most aren’t […] We push all young companies towards VC when most shouldn’t raise venture capital. “There aren’t enough ways for young companies that aren’t startups to get growth capital, so they have been essentially forced to become ‘startups’ to target VC.” For context – back in March

POC-led embedded integration platform, Paragon, has raised $13 million in a Series A funding round led by Inspired Capital Partners. The funding round also included investors FundersClub and Garuda Ventures. Paragon, founded in 2019 by Ishmael Samuel and Brandon Foo, provides customers with a seamless, self-service experience that fits within the users’ existing workflow. The program, which is still relatively new in the market, has helped several companies integrate with different SaaS apps in a matter of minutes. The platform’s vision is to build a connecting layer for all software

Black woman-owned sports tech platform PowerHandz has closed a “multimillion-dollar investment” with one of the world’s largest investment companies, Vanguard Holdings Group. In 2021, the company announced its merger with PH Innovation Holdings. The partnership enabled PowerHandz to feature some of its performance products and training content in the multi-sport training app’s live stream, reaching a more comprehensive range of youth, coaches, and parents worldwide. The platform received a multimillion-dollar capital injection from Vanguard Holdings Group a year later. Vanguard has also made a private tender offer to the tech

Africa-focused VC, Oui Capital, closed its $300 million second fund, Capital Mentors Fund II, targeted at supporting pre-seed and seed stage businesses. The funding round included investors, D Global ventures, Angur Nagpal’s Vibe Capital, One Way Ventures, and Ground Squirrel Ventures. Oui Capital, founded by Olu Oyinsan and Francesco Andreoli, launched its first $10 million fund in 2018. The investment firm aims to bridge the gap between high-growth technology startups in sub-Saharan Africa. It is on a mission to become the first “yeses” entrepreneurs hear as they embark on their startup

Black-owned startup, Qwili, raises $1.2 million in seed funding. The funding round, led by South African venture firm E4E Africa also included Strat-Tech, Next Chymia, Untapped Global, and Codec Ventures. Angel investors Ashwin Ravichandran and Kanyi Maqubela also participated in the funding round. Qwili, co-founded in 2020 by Luyolo Sijake, Thandwefika Radebe, and Tapfuma Masunzambwa, works as a hybrid sales platform to support micro and small merchants in South Africa. The company, which aims to address the lack of access to digital products and services within the African market, has developed a quality and

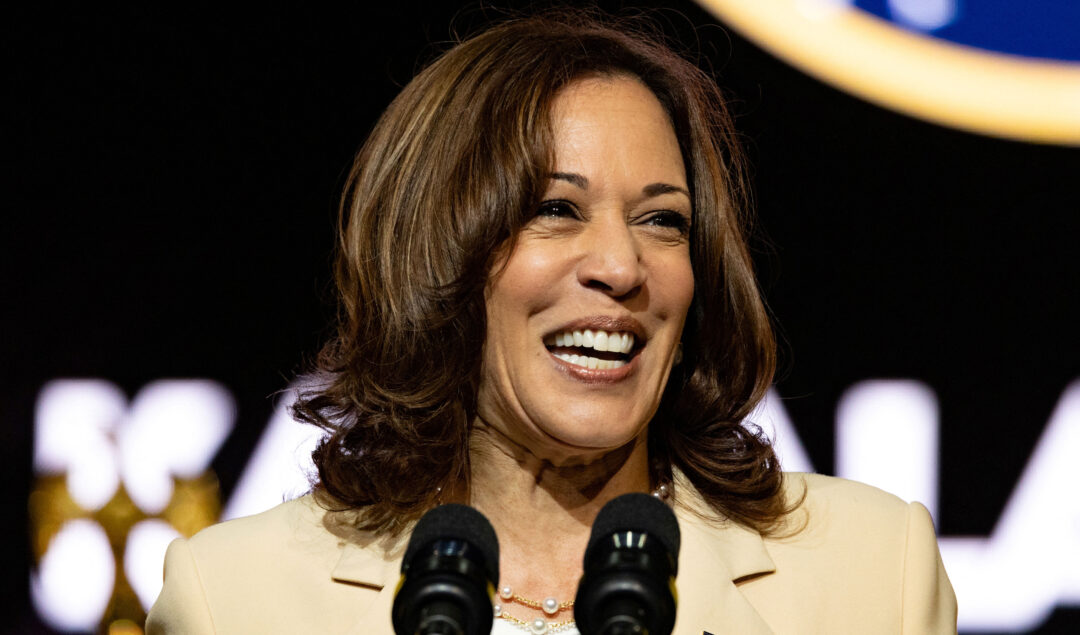

Vice President Harris has announced new public and private sector that aims to align the government with a coalition of companies and foundations to address economic disparities. The initiative, spearheaded by solutions firm Next Street, will see a community of investors make significant contributions to BIPOC businesses by connecting them with investments made by the Biden-Harris administration. A collective commitment The EOC consists of executive leaders from giant companies, including Bank of America, Capital One, Goldman Sachs, Google, Mastercard, Netflix, PayPal, and more. In addition, the community has already invested

Working in venture capital after business school, Kelly Ifill has seen how difficult it can be for Black entrepreneurs to raise money through the earliest rounds of fundraising, known as the friends and family round, designed to help fledgling startups get off the ground. As the cozy term suggests, founders are expected to secure investments ranging from $10,000 to $150,000 from trusted, well-heeled contacts to serve as seed money before moving on to more significant investments from angel and institutional investors. But it’s not always easy for some groups to

Investment firm Twenty Five Ventures recently announced the launch of their diversity fund: 25V Diversity Fund. The venture capital firm aims to invest up to $10 million in early-stage real estate, property, and fintech startups led by Black and Latinx entrepreneurs. Twenty-Five Ventures, founded in 2020 by Maximillian Diez, works to create an entrepreneurial ecosystem that allows everyone to access financial and knowledge-based resources where founders and investors can thrive. According to a Crunchbase report, Black and Latinx founders receive less funding than non-minority counters. So, despite recent figures showing

Black-owned fintech startup, Guava, has closed a pre-seed funding round of $2.4 million. The funding round, which Heron Rock led, also included investment firm Ruthless for Good Fund, Precursor Ventures, Backstage Capital, and angel investors Lexi Reese and Ed Zimmerman. Guava, founded in 2021 by Kelly Ifill, helps Black-owned businesses bank and build community. The banking and networking platform works to close the racial wealth gap by aiding small Black companies and creators with the tools needed to scale and grow their businesses. The digital platform, which is yet to