The fund, dubbed the Norrsken22 African Tech Growth Fund, reached its first close of $110 million last week and it’s the latest fund launched by Norrsken after closing €125 million impact fund for European startups last March. This is good news for the continent which saw a boom in investment last year. Africa VC funding reached an all-time high in 2021 at over $4 billion, more than what startups in the continent raised in the two previous years combined. But still – deals such as $100 million-plus rounds were relatively

The company was founded in 2015 by Femi Kuti, Opeyemi Olumekun, and Matthew Mayaki and now – six years later – it has just raised $40 million. Headquartered in Lagos, Nigeria, and Austin, Texas, Reliance Health began operations in Nigeria as a telemedicine-focused startup, Kangpe, it later expanded into a single-fee healthcare provider to better address the complex, evolving needs of patients. Reliance Health operates business-to-business and business-to-customers models. RelianceHMO is the company’s health insurance plan for both sets of customers where individuals can select monthly, quarterly, or yearly health plans. But businesses can

The initiative, launched by Meta five years ago to drive connectivity in underserved regions, will reportedly be discontinued. Meta, formerly Facebook, quietly issued this notice on its website stating its plans to wind down the program later this year. The program was envisioned to bridge the internet gap across emerging markets like Africa, where connectivity is lowest across the globe. According to the 2021 GSMA mobile economy report, about 28% of the population in sub-Saharan Africa is connected to the mobile internet. This is in comparison to the connectivity in other regions

Amitruck, a Kenyan tech-enabled logistics platform, has just raised $4 million in seed funding – bringing the total funds raised to date to $5 million. The most important purpose of this round is hiring, according to Amitruck founder and chief executive officer Mark Mwangi. The seed round was led by Better Tomorrow Ventures (BTV), with the participation of Dynamo Ventures, Rackhouse Venture Capital, Flexport Inc, Knuru Capital, Launch Africa Ventures, Uncovered Fund and a number of angel investors. Launched in 2019 as a digital logistics marketplace, Amitruck connects shippers with transporters

Kenyan insurtech startup Lami Technologies has acquired Bluewave Insurance Agency for an undisclosed amount as it seeks to make insurance covers accessible to more people across Africa. The deal has also opened up new markets for Lami, which states that its technology enables underwriters and businesses to streamline insurance via a single platform, in Malawi and the Democratic Republic of Congo where Bluewave already has operations. Bluewave insurance, also a Kenyan startup, was founded by Adelaide Odhiambo, who now joins Lami as the head of commercial partnerships. Since its inception, Bluewave has

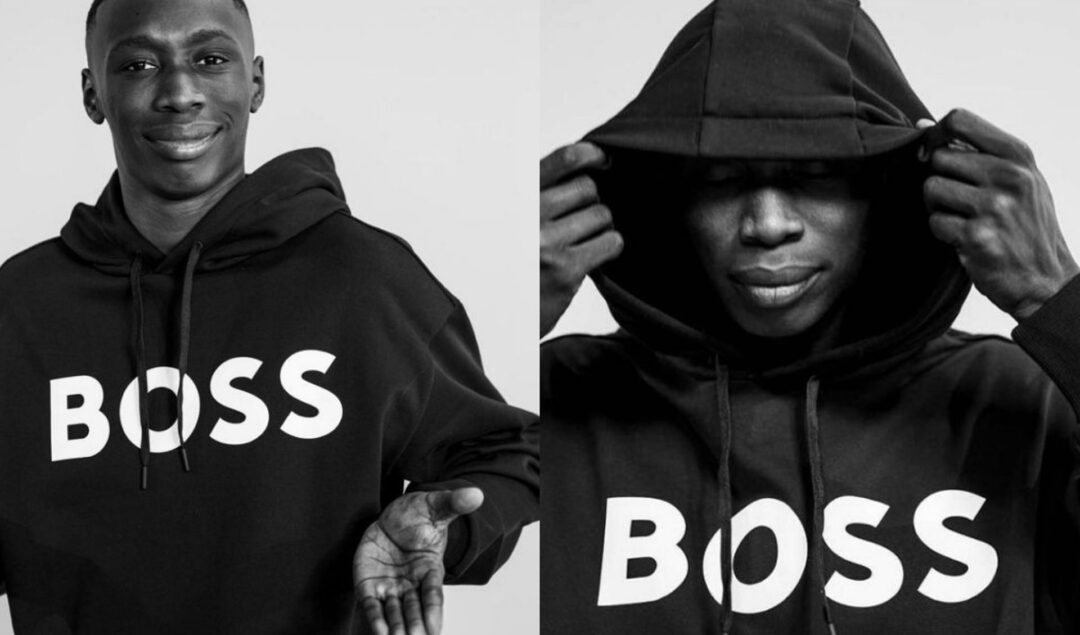

Lame, TikTok’s second most-followed creator with 130 million followers, has partnered with Hugo Boss to star in a campaign surrounding its re-brand. Lame will also co-design a capsule collection with the fashion label as part of a multi-year pact. BOSS’ Rebrand The iconic brand has drafted supermodels, social media sensations, and world-class athletes for a celebrity campaign designed to usher in a new era for core brand BOSS after nearly 50 years. Lame will appear in the campaign alongside Hailey Bieber, Kendall Jenner, model Joan Smalls, South Korean actor Lee Min-ho, rapper Future, boxer Anthony Joshua, tennis pro Matteo

Nestcoin, a Black-owned company founded last November with a mission to build, operate, invest in web3 applications and make crypto accessible to everyone, has raised $6.45 million pre-seed. The company’s products cut across Decentralized Finance (DeFi), media, digital art, and gaming. Described by its founder as a venture collective, it launched its media arm called Breach last year to create bite-sized and informative crypto content for the average African. It also set up Metaverse Magna (MVM), a gaming guild that introduces users to the world of play-to-earn crypto-powered games like Axie

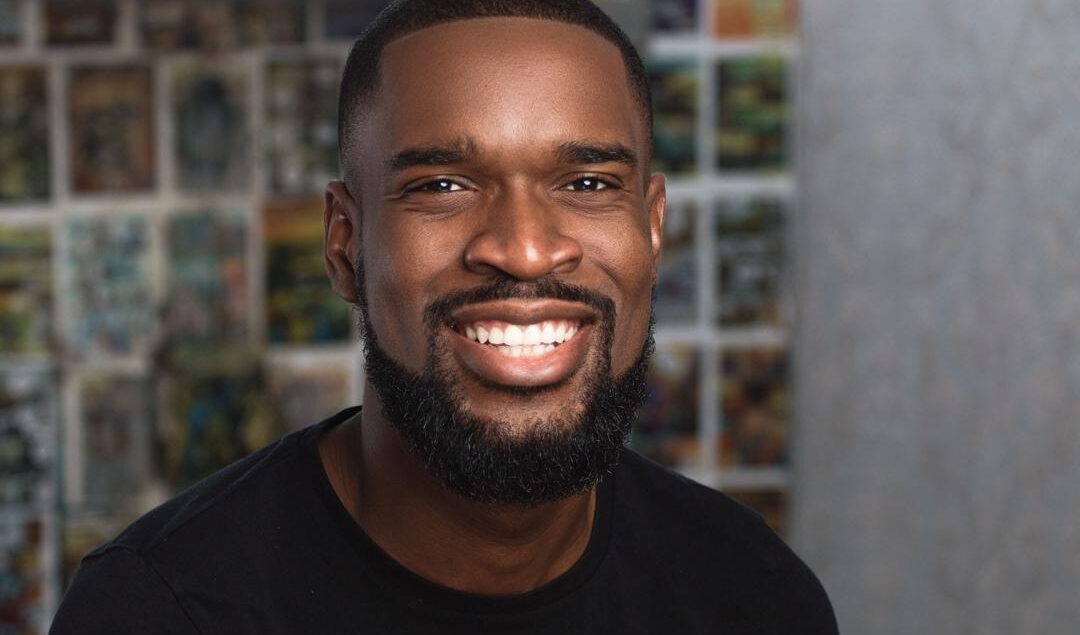

James Manyika is reportedly Google’s first VP of technology and society. But this shiny new role comes with huge responsibilities, as he is tasked with shaping and sharing Google’s views on how technology affects societies. The new appointment comes as Google battles different antitrust lawsuits, increasingly tougher regulations, and protests over its treatment of employees, and this appointment can be seen as the tech giant’s attempt to address these issues directly. Mayinka is a Zimbabwean national and according to his LinkedIn profile, he obtained his first degree in Electrical Engineering from the University

Since its launch, AfroSaúde has helped 2,000 patients to find and book consultations with nearly 1,000 black professionals in Brazil, including medical practitioners, dentists, and therapists. Payment for the consultations is made through the AfroSaúde platform, which takes a commission. Igor Leo Rocha, a journalist, who suffers from folliculitis, a bacterial condition whereby hair grows back into the skin when it is cut, causing painful inflammation, launched the platform in 2019 with his partner Arthur Lima. Their reasons? Rocha told the FT that many doctors he saw prescribed “strong medication

Bamboo, an investment platform that allows Nigerians to buy and trade US stocks in real-time from their mobile phones or computers, has raised $15 million in a Series A funding round. Launched in January 2020 by CEO Richmond Bassey and COO Yanmo Omorogbe, the start-up has rapidly grown in popularity with retail investors, claiming over 300,000 accounts in Nigeria. Its users can access all equities available on the US stock exchanges, that is, the stocks of roughly 6,000 companies. Last year, the company launched Powered by Bamboo, it’s API solution that allows asset managers, fintech