Here is our latest roundup of tech headlines from across the African continent. Black-owned digital insurance platform, Lami Technologies, has raised $3.7 million in a seed extension funding round. The funding round, which Harlem Capital Partners led, will help the API platform begin its path to building and distributing an end-to-end digital insurance platform. The additional funding brings Lami Technologies’ overall funding amount to $5.6 million. Lami Technologies, founded in 2018 by Jihan Abbas, is an end-to-end digital insurance and API platform enabling companies across sectors to offer insurance products.

The Judee von Seldenec (JVS) Philadelphia Fund for Women has invested $500,000 in Black-owned hair product line, Naturaz. The investment fund, which marks JvS’ commitment to investing $2 million in women entrepreneurs, will financially support nine technology-based ventures based in Philadelphia. The extra funding aims to help close the funding gap, disproportionally impacting Black and Hispanic women founders. Naturaz, founded in 2017 by Mumbi Dunjwa, is a hair product line based in Philadelphia that manufactures and sells vegan hair products for curly hair. Dunjwa uses her experience in chemistry, health,

Black woman-owned sports tech platform PowerHandz has closed a “multimillion-dollar investment” with one of the world’s largest investment companies, Vanguard Holdings Group. In 2021, the company announced its merger with PH Innovation Holdings. The partnership enabled PowerHandz to feature some of its performance products and training content in the multi-sport training app’s live stream, reaching a more comprehensive range of youth, coaches, and parents worldwide. The platform received a multimillion-dollar capital injection from Vanguard Holdings Group a year later. Vanguard has also made a private tender offer to the tech

Ghana-based construction company, LMI Holdings, has partnered with the International Finance Corporation (IFC) to enhance Ghana’s solar technology. The partnership, which will see the IFC loan the company $30 million, will provide dozens of businesses with solar technology and essential infrastructure needed to boost their productivity. The funding will also enhance water development services in the Sub-Saharan African region. LMI Holdings, founded by Kojo Aduhene, is a private power distribution company that works to provide a reliable infrastructure for businesses in Africa. The organization’s commitment to building a 16.8-megawatt rooftop solar plant

Africa-focused VC, Oui Capital, closed its $300 million second fund, Capital Mentors Fund II, targeted at supporting pre-seed and seed stage businesses. The funding round included investors, D Global ventures, Angur Nagpal’s Vibe Capital, One Way Ventures, and Ground Squirrel Ventures. Oui Capital, founded by Olu Oyinsan and Francesco Andreoli, launched its first $10 million fund in 2018. The investment firm aims to bridge the gap between high-growth technology startups in sub-Saharan Africa. It is on a mission to become the first “yeses” entrepreneurs hear as they embark on their startup

Black-owned startup, Qwili, raises $1.2 million in seed funding. The funding round, led by South African venture firm E4E Africa also included Strat-Tech, Next Chymia, Untapped Global, and Codec Ventures. Angel investors Ashwin Ravichandran and Kanyi Maqubela also participated in the funding round. Qwili, co-founded in 2020 by Luyolo Sijake, Thandwefika Radebe, and Tapfuma Masunzambwa, works as a hybrid sales platform to support micro and small merchants in South Africa. The company, which aims to address the lack of access to digital products and services within the African market, has developed a quality and

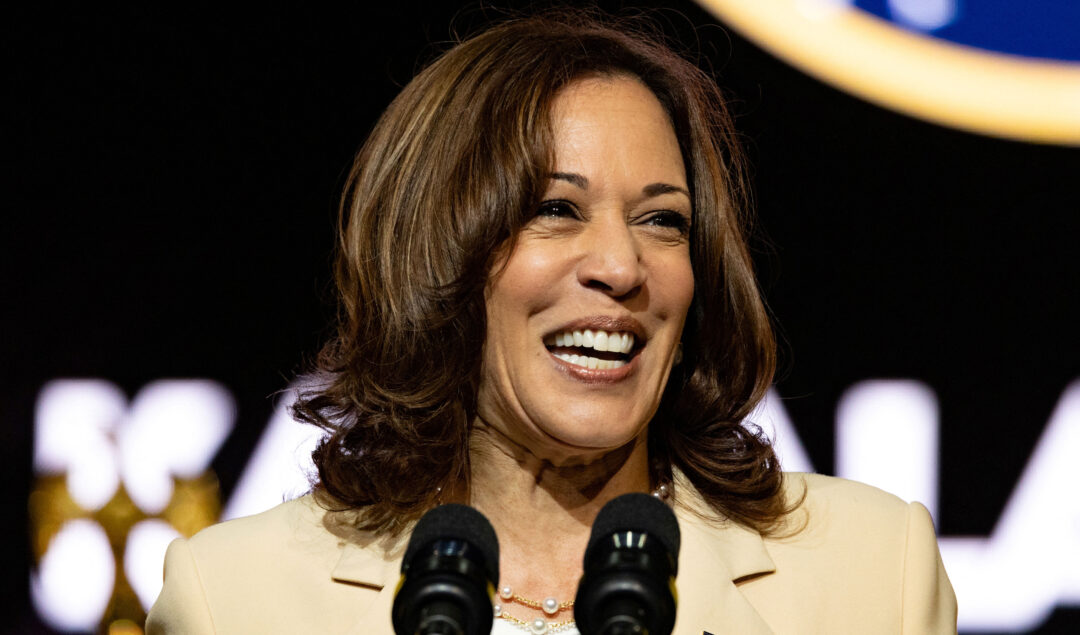

Vice President Harris has announced new public and private sector that aims to align the government with a coalition of companies and foundations to address economic disparities. The initiative, spearheaded by solutions firm Next Street, will see a community of investors make significant contributions to BIPOC businesses by connecting them with investments made by the Biden-Harris administration. A collective commitment The EOC consists of executive leaders from giant companies, including Bank of America, Capital One, Goldman Sachs, Google, Mastercard, Netflix, PayPal, and more. In addition, the community has already invested

Black-owned fintech startup, Guava, has closed a pre-seed funding round of $2.4 million. The funding round, which Heron Rock led, also included investment firm Ruthless for Good Fund, Precursor Ventures, Backstage Capital, and angel investors Lexi Reese and Ed Zimmerman. Guava, founded in 2021 by Kelly Ifill, helps Black-owned businesses bank and build community. The banking and networking platform works to close the racial wealth gap by aiding small Black companies and creators with the tools needed to scale and grow their businesses. The digital platform, which is yet to

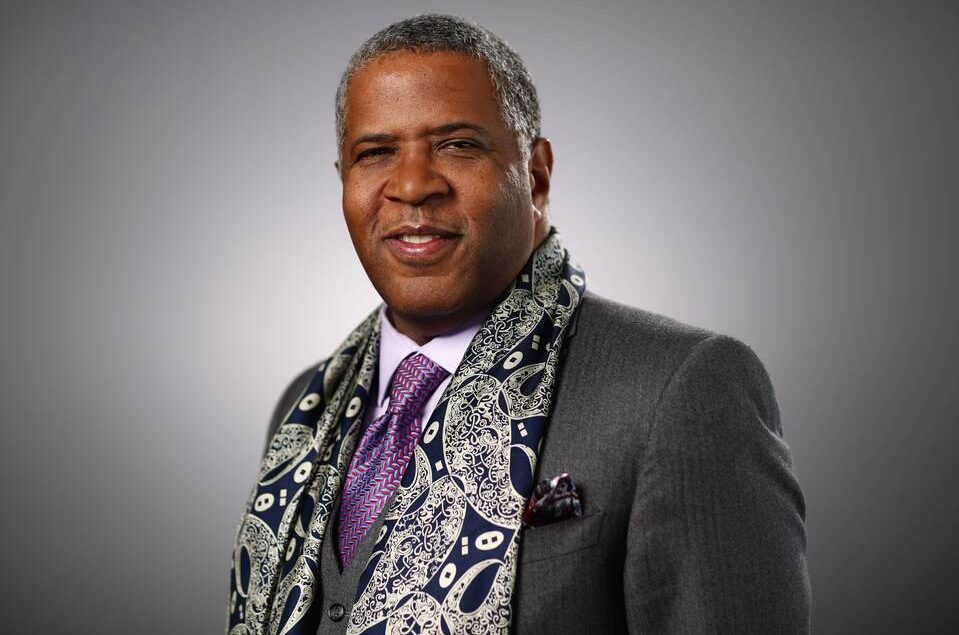

Billionaire philanthropist Robert F. Smith recently announced the launch of the Student Freedom Initiative, a program designed to provide paid internships to HBCU students. Robert F. Smith will launch the Student Freedom Initiative’s HELPS Program in partnership with financial regulation company Prudential Finance. The partnership will address Black students’ disproportionate financial loan burden, which often hinders their career progression. The program aims to provide science, technology, engineering, and mathematics (STEM) HBCU students with $1.8 million in microgrants, which will act as a contingent fund alongside their traditional college loans. Robert F. Smith, famously known

San Francisco-based fintech company, TomoCredit, has raised $122 million in funding and debt financing. The funding round was led by Morgan Stanley’s Next Level Fund and included Morgan Stanley’s Next Level Fund, MasterCard, and debt from Silicon Valley Bank. The funding will help the platform expand its credit product offerings to help support immigrants with no credit history in the US. TomoCredit, co-founded in 2018 by Kristy Kim and Dmitry Kashlev, is a fintech platform dedicated to providing the next generation with a credit card designed to help millennials boost