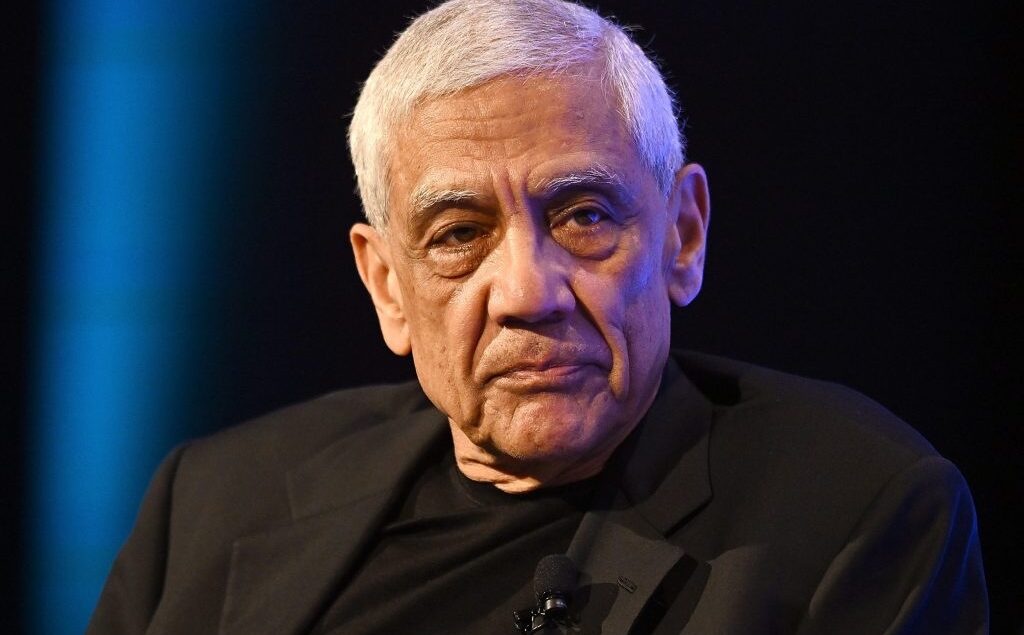

Billionaire investor Vinod Khosla publicly distanced himself and his firm from comments about ICE made by Keith Rabois, a managing director at Khosla Ventures. Rabois had defended federal agents following the fatal shooting of Alex Pretti, a 37-year-old ICU nurse, in Minneapolis. Tech leaders from companies including Google, OpenAI, and Anthropic have also condemned the shooting and criticizing what they described as unnecessary escalation by ICE agents. Rabois’ Remarks Draw Internal Criticism Rabois wrote on X that “no law enforcement has shot an innocent person” and claimed that “illegals are

Kenya’s government has launched the sale of a majority stake in its state-owned oil pipeline company, marking the country’s first stock market listing in a decade, Reuters reports. On January 19, the government began selling 65% of Kenya Pipeline Company (KPC) to the public, hoping to raise about $835 million. If successful, it would be the region’s biggest initial public offering (IPO) since Safaricom listed in 2008. Why Kenya Is Doing This Now Kenya has been under pressure from rising public debt, and President William Ruto’s administration has said it

Dria Ventures has launched its first fund with $8 million to invest in pre-seed and seed-stage startups addressing America’s rising cost crisis. Led by Founder and Managing Partner Megan Maloney, the fund is targeting two sectors where “the math is broken”: healthcare and Main Street productivity. In healthcare, costs now make up nearly 20% of the country’s GDP, while small businesses are spending upwards of $120,000 annually on outdated software. Dria is backing founders who are building practical, cost-saving infrastructure to fix these broken systems. A thesis rooted in lived

Recognize Partners, a New York-based investor in new digital companies, has closed its second fund, Recognize II, with over $1.7 billion in total commitments. The second fund was oversubscribed and closed less than five months after its launch. It included support from existing and new investors. The LP base includes leading global institutions such as endowments, foundations, pensions, insurers, family offices, outsourced CIOs, and fund-of-funds across the US., Europe, Asia, and Latin America. Who are Recognize Partners? The New York-based investor supports innovative founders and management teams utilizing AI, software, and

Nigerian open banking startup Okra will return three years of runway to investors, as reported by Techpoint. The company was founded in 2019 to build APIs helping people securely access their bank accounts from third-party apps. However, the company shut down following the departure of its CEO, Fara Ashiru. Okra still had three years of runway before it would return to its investors. Ashiru did not disclose the amount that would be returned, and Okra has not provided the exact amount that would be returned to investors; however, Techpoint estimated

Investment firm Vessel has launched the Michigan Angel Collective (MAC), an early-stage angel syndicate, Crain’s Detroit Business reports. MAC will join the Ohio Angel Collective and Kentucky Angel Collective under the umbrella of the United States Angel Collective. Leading the new initiative is James Feagin, a Detroit-based social innovation leader and former head of economic mobility at the Gilbert Family Foundation. He is also the managing partner for Detroit-based Black Bottom Ventures. According to Vessel partner Wolf Starr, the Ohio Angel Collective was created to fill a funding gap for

ColorCreative, a management and production company co-founded by Issa Rae, is set to undergo a major expansion thanks to a new strategic partnership with HarbourView Equity Partners, a Black-woman-founded investment firm. The terms of the deal have not been disclosed, but with HarbourView’s backing, the company plans to evolve into a fully integrated, independent studio platform with global ambitions. “Partnering with HarbourView allows us to dream even bigger,” said Rae, per Private Equity Insights. “We remain committed to supporting the kinds of projects that made us fall in love with

Technology investor Invictus Growth Partners has secured $574 million for its second flagship fund and related co-investment vehicles, as first reported by the Wall Street Journal. Founded in 2019 by John DeLoche and William Nettles, Invictus specializes in growth buyouts of lower middle-market businesses in sectors such as cloud, cybersecurity, and fintech. Invictus targets founder-led, bootstrapped companies generating at least $10 million in annual recurring revenue. Betting Big On AI With its new fund, the California-based firm will strengthen its focus on AI and machine learning technologies driving key industries.

Zeal Capital Partners has closed its second fund at $82 million, tripling its assets under management (AUM) to $186 million in just five years. The Washington, DC-based firm plans to invest the new capital in early-stage startups across fintech, healthcare, and the future of learning and work. A Broader, Stronger Investor Base Zeal’s investor base has grown significantly with this latest fund. Zeal’s limited partners now include Citi Impact Fund, M&T Bank, MassMutual, Wells Fargo, Zaffre Investments and Spelman College, according to a press release shared with POCIT. In addition

This week, hosts Abadesi and Michael discuss the state of the economy—how politics, layoffs, and shifting trends are hitting both new grads and seasoned pros. They chat about smart investing, changing consumer habits, and why building your brand matters more than ever. Plus, they explore hidden opportunities, sustainable growth, and the future of DEI. Chapters 00:00 The Economy A Mess and Everybody’s Struggling?07:09 Investment Strategies For Uncertain Times11:07 No-Buy Year: Getting Thrifty in 2025 14:23 Industry Trends and Opportunities Listen to the episode You can find the Techish podcast on Spotify, Apple,