Venita Cooper and Vincent Sanders have created an AI-powered sneaker resale price-prediction startup – Arbit. According to their website, Arbit is the only price prediction model designed to empower sneaker buyers to get fair prices in the resell market. They collect real-time prices from trusted sites, providing pricing insights and trend analysis that allows users to shop prices on one app. Arbit’s Journey Cooper’s passion for sneaker culture began in 2019 when she opened Silhouette Sneakers and Art in Tulsa, which attracted attention from Brian Brackeen in 2021. After more than four years in the business, Cooper announced

Toro Taxes and Trez, two Latine-owned companies, have formed a strategic partnership to better deliver their services to Latine entrepreneurs across the U.S. The Partnership The Latine market represents nearly 19% of the country’s population and continues to be the fastest-growing demographic in the US. Toro Taxes, the largest Hispanic tax preparation and business services franchise in the U.S., operates over 200 locations nationwide. Trez, a specialized payroll and benefits platform designed for the Latine community, will serve as the primary platform for onboarding the Toro Taxes’ clients onto the

Black-owned AI analytics platform AI Squared has announced a $13.8 million Series A funding round led by Ansa Capital with participation from Latimer Ventures, NEA and Ridgeline. AI Squared As investments in AI increase, data science teams in businesses and governments are looking to implement AI models that can utilize more value from their data to improve decision-making. AI Squared, founded in 2019 by Benjamin Harvey, PhD, helps organizations deliver data and AI insights into their business applications. The company estimates that up to 90% of AI models enterprises develop do not make it

A national program, The Hidden Genius Project, teaches technology and entrepreneurship to young Black men in Chicago and around the US. The Hidden Genius Project The project was founded in 2012 by five Black male entrepreneurs and technologists who had noticed the high unemployment of Black male youth and the large number of careers in tech. To address the challenge, they created a program to connect young Black males with the skills, mentors and experiences needed to become high-performing entrepreneurs and technologists. “The hidden genius project trains and mentors Black male youth in

Cincinnati woman Azizah Nubia created Cincy Black Travel Guide to connect visitors with cultural events and Black businesses in the area. After attending Black Tech Week during its run in the Tri-State area, Nubia noticed other people of color weren’t familiar with Cincinnati’s Black community’s annual events and activities. This sparked her idea to create a platform in July 2023, to make it easier for travellers to find and enjoy what Black people had to offer in the city. Cincy’s Black Travel Guide Cincy’s Black Travel Guide is a digital tool accessed via the website or

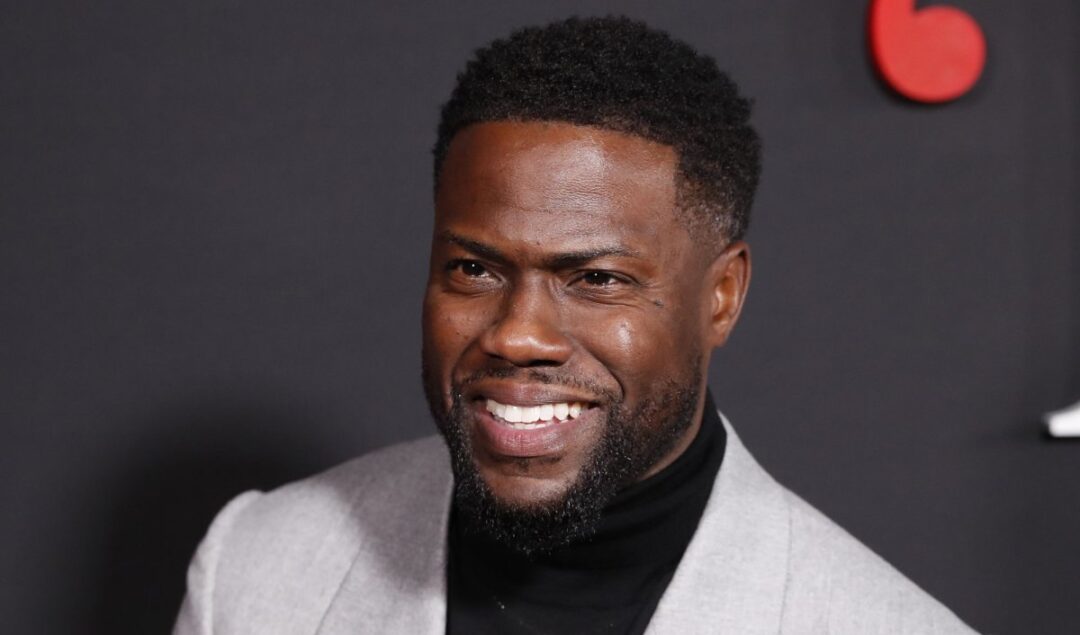

Gran Coramino Tequila, the premium tequila brand co-founded by Kevin Hart and Juan Domingo Beckmann, has disbursed over $1 million in grants to Black and Latine entrepreneurs across the United States to date. The Coramino Fund Since its inception in 2022, Gran Coramino has dedicated a portion of its sales to the betterment of underrepresented business owners, committing $1 from every bottle sold to this cause. The Coramino Fund, established in partnership with the Local Initiatives Support Corporation (LISC), has now dispersed over $1 million in grants. This funding has reached over 100

MyFiLi is a new AI-powered edtech platform designed to transform how families, schools, and nonprofits engage with financial literacy. The Urgent Need for Financial Literacy Currently, consumer credit card debt in the U.S. has hit an all-time high of $1.79 trillion, and savings account balances average just $4,521. MyFiLi.com addresses this gap by providing tools and knowledge that help users navigate the complex nature of financial management. According to BlackNews, Founder and CEO Joseph Green‘s mission is to empower everyone to develop a healthy relationship with money. “By making financial literacy education accessible,

Primary Venture Partners has partnered with over 25 leading New York-based venture firms and startups to introduce the Factor Fellowship. This program will tackle the diversity, equity and inclusion (DEI) challenges head-on by connecting the city’s VC-backed startups with top talent from underrepresented groups. Addressing Diversity in Venture Capital and Startups The data on diversity within the venture capital and startup landscape shows that only about 13% of venture capital decision-makers are women. Funding for Black founders also declined in 2023, failing to reach the $1 billion mark for the first time since 2016.

Robert F. Smith’s Vista Equity Partners has raised over $20 billion for its latest fund, making it the largest in its history. This new fund, known as the eighth flagship fund, passes the previous record of $17 billion raised in 2019. Embracing AI for Strategic Growth Vista Equity Partners, known for its investments in technology companies, will leverage AI to improve efficiency and performance across the firm and its portfolio companies. “You will also hear more about how we have adopted generative artificial intelligence not just as a tool but as

Parham Aarabi, a University of Toronto researcher, has developed an AI tool, named PRE, that could change how e-commerce sites cater to users with color vision deficiencies. AI-Powered Solutions for Improved Web Navigation “Around 8% to 10% of the population has a type of color-blindness,” said Aarabi according to Texh Xplore. “I wanted to see how this might impact web navigation.” Aarabi’s AI model simulates the browsing behaviors of virtual users, tracking interactions like page pauses, cart additions, and responses to discounts. The tool’s insights reveal that while colorful images typically attract users, those with color blindness respond differently, favoring monochrome imagery. By