Target’s new CEO, Michael Fiddelke, told employees in Minneapolis on Feb. 4, 2026, that he plans to rebuild customer and employee trust after the retailer’s pullback from DEI triggered backlash. Reporting from Bloomberg News shows Fiddelke used his first town hall to concede that Target “lost” trust and that leadership failed to communicate clearly in the moment. CNN reports that the credibility gap was tied to the dismantling of DEI commitments, including a program that helped Black-owned businesses secure shelf placement, plus the removal of minority hiring goals and the

Complyance said Wednesday it raised a $20 million Series A led by GV to sell AI agents that run continuous governance, risk, and compliance checks inside enterprise tech stacks. Reporting from TechCrunch describes a product aimed at replacing periodic, audit-based reviews that can take weeks or months with automated checks that run in seconds. The shift matters because large companies increasingly treat compliance as a real-time control surface tied to vendor access and data movement, not a quarterly paperwork cycle. Capital is shifting compliance from audits to always-on controls Complyance

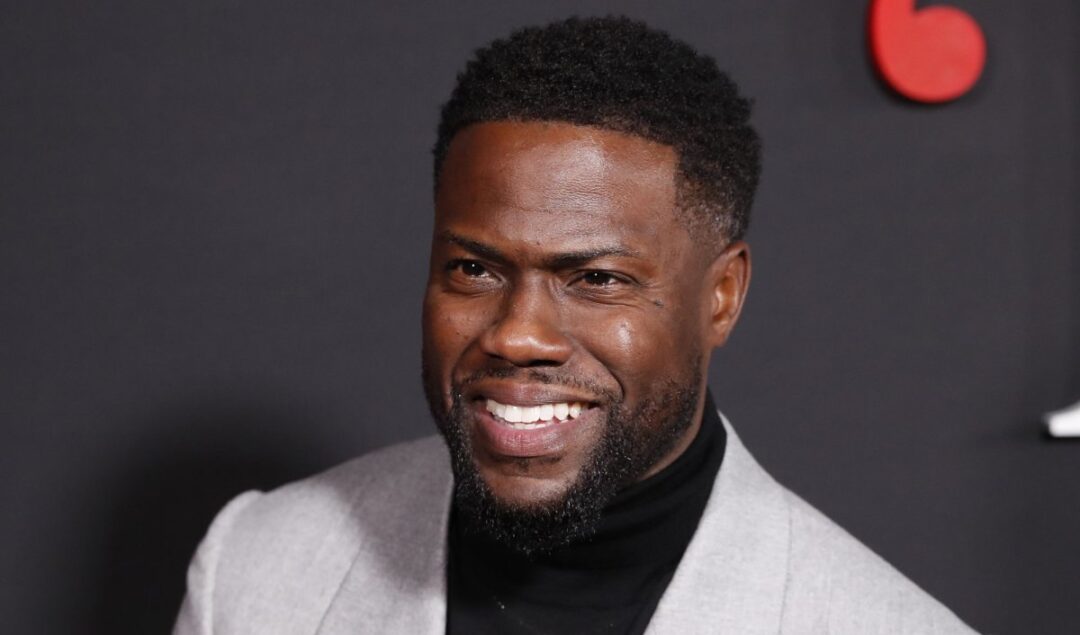

Kevin Hart’s Gran Coramino tequila has generated about $200 million in cumulative retail sales since 2022, executives said on Yahoo Finance’s “Opening Bid.” Reporting from Yahoo Finance cites co-founder and liquor executive James Morrissey saying the brand produced $85 million in 2025 retail sales, sold 3.6 million bottles, and delivered nearly $2 million in weekly consumer-level sales in stores. Yahoo Finance also reported that Gran Coramino sold nearly 300,000 nine-liter cases in roughly three years, with about half of those cases attributed to 2025. The numbers matter because U.S. spirits

iHeartMedia extended a multi-year deal with Charlamagne Tha God, keeping “The Breakfast Club” and The Black Effect Podcast Network tied to iHeart’s audio distribution and ad stack. Black PR Wire reported the agreement as an extension of an existing relationship that spans broadcast radio, a nationally syndicated morning show with more than 7 million monthly listeners, and a podcast joint venture. The structural importance lies in the control of monetization rails. iHeart keeps a high-volume Black audience and premium talent inside its integrated ad-tech and syndication system, while Charlamagne retains

Nike faces a federal EEOC investigation in Missouri after the Trump administration moved in court on Feb. 4, 2026, to compel information tied to allegations of anti-white discrimination. Documents cited by The New York Times show the U.S. Equal Employment Opportunity Commission, which currently has a 2-1 Republican majority, seeks records on layoffs, hiring, internships, and career programs that it says may have treated white workers and applicants differently. The investigation matters because it tests how far large employers can use demographic targets and race-tracked development programs before regulators reframe

Dozens of AI “nudify” apps remain available on Google Play and Apple’s App Store, even as concerns mount over tools that can generate nonconsensual sexualized images, according to a new report by the Tech Transparency Project (TTP). A breakdown in platform moderation TTP identified 55 nudify apps on Google Play and 47 on Apple’s App Store, many of which can remove clothing from images of women or depict them as partially or fully nude. The report estimates these apps have been downloaded more than 705 million times and generated around

Google is rolling out Black History Month programming across Search, Play, TV, YouTube, Chrome, Meet, Maps, and Arts & Culture in the US throughout February. The campaign is anchored by a hip-hop–themed Google Doodle featuring a custom beat by Detroit rapper, singer, and producer Illa J. A Google Doodle sets the tone for Black History Month Google launched the campaign with a Doodle music video focused on the mechanics of hip-hop beat-making, using one of its most visible entry points to set the tone and route users into related experiences.

Google software engineer Chisom Okwor is building Braidiant, a US-based startup developing an automated handheld device to speed up hair braiding for professional stylists. Launched in 2024, the company targets a labor-intensive market where price, time, and physical strain limit supply. Okwor previously worked on Google Maps for cars and paid for her undergraduate computer science degree by braiding hair. That experience shaped Braidiant’s focus on building tools that support stylists’ work rather than replace it. Automating Standardized Braiding Styles Hair braiding in the US is often expensive and time-consuming,

Two recent Stanford graduates have raised $2 million to launch Breakthrough Ventures, a hybrid accelerator for college student and recent graduate founders across the US, according to TechCrunch. The program mirrors how top universities often turn class projects into venture-scale companies by packaging funding, infrastructure, and investor exposure into a single pathway. While Breakthrough recruits founders nationally, much of its deal flow and decision-making remains anchored in Stanford-connected spaces, a dynamic that shapes who sets early company terms and captures ownership at the earliest stages. Funding, Infrastructure, and Formation Rolled

Paystack, the Nigerian fintech owned by Stripe, reorganized its businesses under a new holding company, The Stack Group, in Nigeria this week after reaching group profitability. The new structure places four businesses under TSG: Paystack’s core merchant payments business, the consumer payments app Zap, Paystack Microfinance Bank, and a venture studio known as TSG Labs. The shift reflects a strategic move to manage risk, regulation, and ownership across distinct financial products. A Holding Company Model to Contain Risk and Regulation By adopting a holding company structure, Paystack has separated payments,