Pitfall of Transitioning From Startup To Business

When it really comes down to it, there are only three initial paths you can take as a startup founder.

These three, according to Porter (in ‘Generic Competitive Strategies’) are:

- Cost leadership: low-cost provider in your space

- Differentiation: providing a unique product

- Focus/niche: pick a segment (geography, market or product)

To bring a product to market with one of these three is not innovative regardless of how you finesse it on a pitch deck. Where it gets more interesting is in combining two of the three approaches to create something that can be (truly) considered innovative. This combinatory effect gets amplified when technology is involved

A. Cheaper + Different (from current) = Uber, WhatsApp, Spotify

B. Different + Niche = Looker, Datadog, StitchFix

C. Niche + Cheaper = not one that works well because you can charge a premium with a niche product..

The issue comes when, as you build your startup, you combine things too soon. Combinatory effects amplify the fundamental culture and execution issues you have in your startup.

Transitioning from startup to business

You’ve hacked together an MVP using the lean startup principles, you spent little money and think you might have product market fit. You’ve been scrappy and managed to do all these things without the resources or the clarity that you think your more established competitors have.

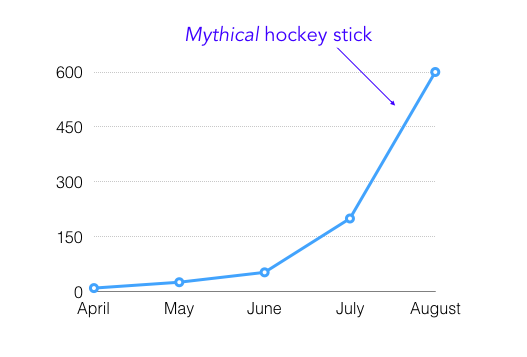

You convince a few investors to pump some money into your startup, since you can now predict how many $$s you can make from putting $1 in. Things are looking up to the right. Your day to day as a startup becomes less existential because there is some money in the bank and you are ready to do the work necessary to take your company to the next level.

And then things start to stall, no matter how well you are executing. It happens to coincide with the period you’ve spent raising money. So you blame it on how much time you spent talking to VCs.

But that’s truly not the case.

The real issue is that you now have to pick a strategic direction which you will plow the money into. What I’ve seen happen is that most startups think they don’t need a strategy but unintentionally (in the name of pivoting or lean startuping) end up picking a losing strategy.

For most startups the best path to follow is obviously #3 but this is anathema to what the founder thinks the investors want, the assumption being that if you go niche/focus you are reducing your market size.

This is not the case.

With focus and a clearer definition of what or who your market is, you actually increase the size of your opportunity.

It’s how Amazon started — by focusing on books.

It’s how Apple recovered — but building Macs for the design conscious.

It’s how Auction Bay better known as Ebay really kicked off — with Pez dispenser enthusiasts as the initial group. Yes, really.

And it’s why Tesla is winning in the electric vehicles space — because of their initial premium bet on Roadster buyers.

Apparently that’s a pez dispenser

But the reaction to the lull that happens as the company beds in is to try to be the low cost provider through discounts, freemium memberships, and more — with products that are differentiated to as many market segments as possible.

When you go niche you immediately define the approach to the other two possibilities, you can charge a premium because you truly understand that niche and the customers know that, and your product is immediately differentiated, which is unattractive to other niches. For now.

To pick cost leadership or differentiation without picking a niche or segment as you transition into a real business is a recipe for failure. Avoid at all costs.

Sidenote: the phrase ‘execution eats strategy’ only applies when you are executing on the right strategy.