Copenhagen-based Unconventional Ventures has announced the second close of its €30 million fund ($32 million), dedicated to investing in diverse founding teams and founders. Unconventional Ventures According to Tech Funding News, Unconventional Ventures (UV) is the only European fund with a diversity impact at its heart. It is an impact-focused investment firm investing in early-stage startups led by underrepresented founders in Europe. Launched by Thea Messel and Nora Barvey in 2018, UV has a VC structure and invests across the Nordics in healthcare, women’s health, diversity tech, sustainable fashion, food

Founder of digital services and software development firm Fearless aims to make it a $1 billion company by 2030. Fearless Founded in 2009 by Delali Dzirasa, Fearless is an impact-focused digital services integrator building software while creating conditions for organizations and their staff to thrive. Human-centred digital solutions and organizational transformation help unlock the potential of people, organizations and tech. Dzirasa wanted to make government services accessible and usable for civil servants and the general public. He has grown the company for 14 years by bootstrapping, a funding option allowing

Founders Factory Africa (FFA) has raised $114 million in funding to scale its model to better serve founders across the African tech ecosystem. Founders Factory Africa Founders Factory Africa, founded in 2018 by Roo Rogers, Alina Truhina and Sam Sturm, is an African early-stage investor supporting founders across the continent. With a portfolio of over 55 ventures across 11 countries in East, West, North and Southern Africa, they combine capital investment with support for entrepreneurs. They invest up to $250,000 in ventures at idea, pre-Seed and Seed stage for ventures

Endeavor Miami is partnering with venture capital firm DeepWork Capital to funnel more capital into underrepresented early-stage founders. Endeavor Miami and DeepWork Capital Endeavor Miami was founded in 2013, with the support of the John S. and James L. Knight Foundation, as the first U.S. affiliate of Endeavor, an organization supporting entrepreneurs worldwide. According to Biz Journals, Miami’s Endeavor entrepreneurs generated over $700 million in revenues and employed over 5,000 individuals in 2021. Now the organization has partnered with DeepWork Capital, an Orlando-based early-stage venture capital firm that primarily invests in tech and

Black-owned SquadTrip has announced it has successfully secured $1.5 million in funding to revolutionize group travel. Making group travel easy SquadTrip is an automated payment solution for large and small groups, making booking and payments easy for group trips. Their online platform allows users to save time managing group travel by creating trip sites, automating guest billing and keeping track of all traveller logistics from one place. It is the first travel platform targeting millennials with flexible payment instalments, Apple Pay checkout and promo codes. The company was founded by

Kickstarter, the crowdfunding platform which brings creative projects to life by directly connecting them with their communities, has hired Sindy Wilson as their new chief financial officer (CFO). Who is Sindy Wilson? Wilson has two decades of experience as a finance executive. She previously held leadership roles at Oldcastle Infrastructure, Ernst & Young, Cox Automotive, and, most recently, Lyft as their VP of finance transformation and analytics. Throughout her two decades in finance, Wilson told Forbes she never once worked for a Black female CFO, and most of the time, it wasn’t even

Founding President at Public Ventures, Zoey Dash McKenzie, has launched a $100 million impact fund to nurture the next generation of life science and climate tech startups emerging from academic research. TechCrunch reports that McKenzie is particularly keen to support Canada-based life science and clean tech startups that focus on improving health equity and supporting climate preparedness for underserved communities. Investing in climate equity According to UN Women, women and girls experience the most significant impacts of climate change, amplifying existing gender inequalities and posing unique threats to their livelihoods,

Black-owned VC firm Cornerstone V.C, which boasts a diversity-led investment thesis, has hired its first female partner Ella Wales Bonner. Bonner will spearhead the development of Cornerstone’s in-house coaching practice to support the leadership potential of its portfolio companies. Who Are Cornerstone V.C.? Born out of a Black-led angel group, Cornerstone Partners, Cornerstone V.C. firm was founded by Rodney Appiah, Edwin Appiah, and Wilfred Fianko. The early-stage venture capital firm invests in innovative B2B technology solutions in the U.K., launching its first £20 million ($23.9 million) fund last year. Cornerstone V.C. invests in many more

The Fifteen Percent Pledge was launched three years ago by creative director, activist and fashion designer Aurora James to urge major retailers and corporations to commit 15% of their shelf space to Black-owned businesses. Since then, more than 625 Black-owned businesses have developed business relationships with 29 companies across three countries that have taken the pledge such as Ulta, Sephora, Vogue, Macy’s and Old Navy. According to Forbes, the Pledge’s work with its partners has created the potential to shift $14 billion to Black entrepreneurs and businesses. Now, to mark

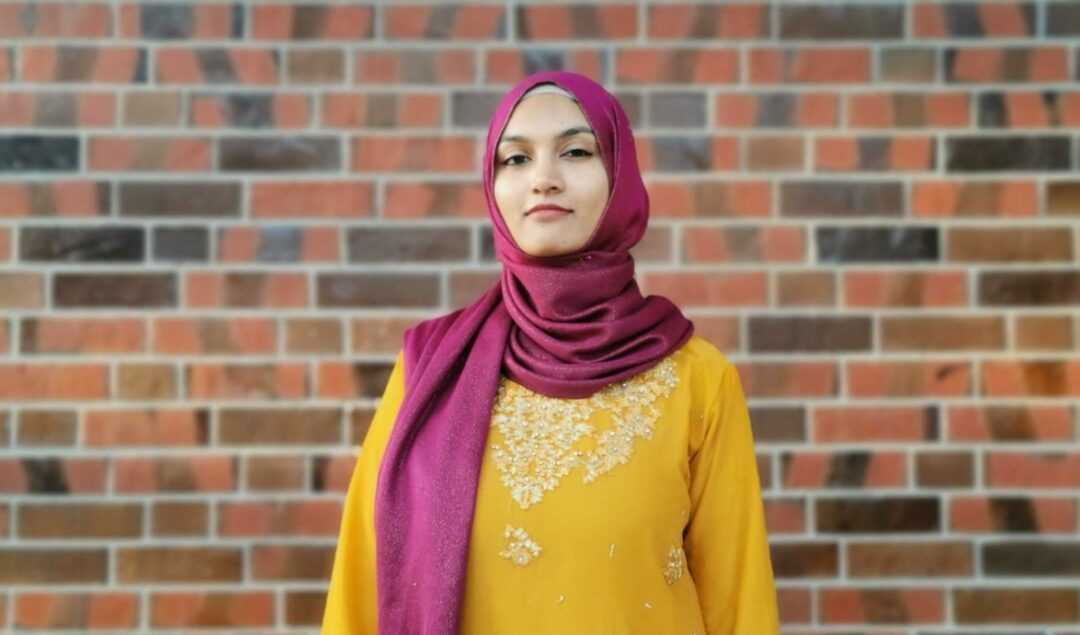

The Migrant Accelerator (TMA), a Germany-based, early-stage startup accelerator for founders with a migration background, including Black, Indigenous, and people of color (BIPOC), has just announced its first cohort of 10 startups. TMA aims to create a softer landing and sense of belonging for BIPOC founders who encounter discrimination on a structural and individual basis. “Migrant founders in Germany are overlooked and underfunded,” said Laila Zohaib, Stuttgart-based startup coach and investor relations manager. “Since the 1960s, migrant led-businesses have served as the backbone of the local German economy and are