Andreessen Horowitz partner Kofi Ampadu has left the venture firm months after it paused Talent x Opportunity (TxO), the fund and operating program he led, TechCrunch reports. TxO was launched in 2020 amid a wave of corporate commitments to diversity, equity, and inclusion after the murder of George Floyd. The initiative was designed to expand access to capital, networks, and mentorship for founders who fall outside traditional venture pipelines. The Talent X Opportunity Fund In a farewell note announcing his departure, Ampadu framed TxO as a response to the venture

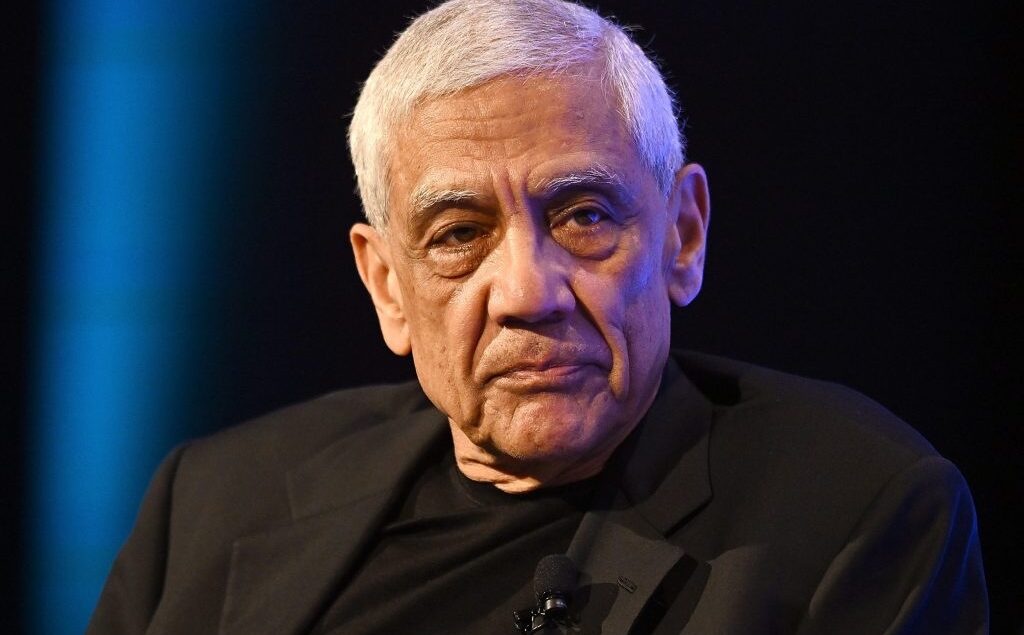

Billionaire investor Vinod Khosla publicly distanced himself and his firm from comments about ICE made by Keith Rabois, a managing director at Khosla Ventures. Rabois had defended federal agents following the fatal shooting of Alex Pretti, a 37-year-old ICU nurse, in Minneapolis. Tech leaders from companies including Google, OpenAI, and Anthropic have also condemned the shooting and criticizing what they described as unnecessary escalation by ICE agents. Rabois’ Remarks Draw Internal Criticism Rabois wrote on X that “no law enforcement has shot an innocent person” and claimed that “illegals are

Former Harvard students AnhPhu Nguyen and Caine Ardayfio have raised a $6.6 million seed round led by General Catalyst to develop Mira: audio-first smart glasses that “remember everything.” Described as a “second brain,” Mira designed to learn throughout your daily life and provide personalized, private insights. The Viral Moment That Started It All Nguyen and Ardayfio first drew widespread attention in September 2024 after an X video demonstrating their hacked Meta Ray-Ban smart glasses went viral. In the demo, the pair used facial recognition tools and public data sources to

Andreessen Horowitz (a16z), one of Silicon Valley’s most influential venture capital firms, has paused its Talent x Opportunity (TxO) fund which was created to support founders from underserved backgrounds. The move, first reported by TechCrunch, includes layoffs of several staff members from the TxO team. On October 16, participants received an email from Kofi Ampadu, the a16z partner who led TxO, announcing the pause: “While [TxO’s] purpose has not changed, we are pausing our existing program to refine how we deliver on it.” The Talent x Opportunity Fund a16z launched

Join our Patreon for extra-long episodes and ad-free content: https://www.patreon.com/techish Techish host Michael Berhane and TechCrunch reporter Dominic-Madori Davis unpack what’s really going on with funding for Black founders — and why so many are heading back to the 9-to-5. They also get into Elon Musk’s clash with X’s head of product, Nikita Bier, Meta’s smart glasses and the end of privacy, and why academics need to step out of the ivory tower. Follow Dom on Instagram (@dominicmadori) and subscribe to her Substack, The Black Cat. Chapters 00:28 Black Founders Are

Dria Ventures has launched its first fund with $8 million to invest in pre-seed and seed-stage startups addressing America’s rising cost crisis. Led by Founder and Managing Partner Megan Maloney, the fund is targeting two sectors where “the math is broken”: healthcare and Main Street productivity. In healthcare, costs now make up nearly 20% of the country’s GDP, while small businesses are spending upwards of $120,000 annually on outdated software. Dria is backing founders who are building practical, cost-saving infrastructure to fix these broken systems. A thesis rooted in lived

The temporary surge in funding for Black startup founders after George Floyd’s murder was driven largely by investors who had never previously backed a Black entrepreneur, and most showed only surface-level support, new research from Cornell University shows. Funding returned to prior levels within two years. Cornell researchers analyzed PitchBook data on venture funding from 2020 to 2023, using algorithms and manual review to classify the race of 150,000 founders and 30,000 investors. Surge in funding in the wake of Black Lives Matter The researchers found that at the height

Workplace surveillance in the Global South is on the rise, according to a new report by Coworker.org, a labor rights nonprofit based in New York. Technologies for tracking and managing staff workers are expanding in scale and sophistication in more than 150 startups and regional companies based in Kenya, Nigeria, Colombia, Brazil, Mexico, and India, researchers said. The term “Little Tech” was made popular by the VC firm Andreessen Horowitz (a16z), which argues that excessive regulation was stifling innovation. The Coworker.org report found that the Little Tech ecosystem, which primarily consists of unregulated, venture

Fewer Black professionals are entering venture capital, and even fewer are rising through the ranks, a new report has found. The Black Venture Report 2025 On Juneteenth, BLCK VC released the third edition of its Black Venture report. Its first edition was promoted by a question between the co-founders: Where are we, really? That question expanded into a critical report that highlights the link between Black representation and power in venture capital. “Our research continues to expose a stark truth: Black investors remain severely underrepresented, especially in senior roles,” it

Venture capital firm Collab Capital has closed a $75 million Fund II, with backing from Apple, Goldman Sachs Asset Management, and The Leon Levine Foundation. The fund will focus on Seed and Series A investments, supporting founders who, as Collab puts it, are “best equipped to solve real-world, consequential problems through unique market expertise and lived experience.” Using Fund II to sharpen its investment model Collab Capital was founded by Barry Givens, Justin Dawkins, and Jewel Burks Solomon, who gained Silicon Valley prominence as the first head of Google for