14 Black and Latinx Emerging Fund Managers To Know (& Fund)

The “Pipeline” is Blocked At The Top —

With the recent uprising against systemic racism in our governmental institutions and society, there has been an increased focus on the on the lack of funding for underrepresented founders. Only 1% of VC funded startup founders are Black, Latinas have received .04% of VC funding, women of color can expect an average of $42k seed funding vs. the average seed funding of $1m, the list of stats goes on.

Yet the problem is far deeper than startup founder-level stats. It exists at the other side of the table —just 3% of VCs are Black and 2% are Latinx. The diversity issue radiates all up the capital stack at the General Partner (GP) level. As the system is currently set up, we’re banking on a trickle-down effect from VCs in ivory towers to invest in underrepresented founders when we should also be intently focused on changing those doing the funding.

As Recast Capital recently reminded us, respected Limited Partners (LPs) like the Kauffman Foundation and consultants like Cambridge Associates have long reported that emerging managers and smaller funds tend to outperform larger scale, established funds, yet many traditional LPs will only allocate capital to brand-name VC firms and stay away from emerging firms given the (often-overestimated) risk.

Meanwhile, diverse emerging fund managers have the networks, insight, social contracts, and oftentimes more applicable experience to source, coach, connect and invest in previously underestimated entrepreneurs. Billions of dollars in market capitalization are being left on the table by the venture capital community.

The composition of the venture capital industry is widely monolithic and collectively lacks the cultural lens, lived experiences and general appetite to unlock value in markets that are not predominantly driven by straight white male consumers.

With the odds stacked against them, diverse emerging fund managers are fighting everyday to raise their first or second funds. The main hurdles for emerging managers include raising capital from LPs that are traditionally looking for warm intros, building a lasting VC platform, and banking for personal liquidity (see below):

Despite these hurdles, when diverse fund managers have access to capital, they tend to outperform white male peers. And even when they have proven themselves, they’re held behind — for example, top performing Black VC firms are penalized for being Black. The list of challenges goes on…and this is why we’re creating this list of trailblazers.

Invest in the Mavericks —

There are several initiatives that are leading the way in supporting diverse emerging fund managers with monetary backing, such as:

- Corigin Ventures Commits $2.5 Million to Diverse GPs

- PayPal Equity Investment for Underrepresented Minority-led Startups and Investment Funds

- Carta’s Diverse Emerging Fund Managers program

In addition, there are several initiatives that are looking to nurture the next generation of fund managers, through up & coming VCs, operators, and startup ecosystem players, including:

- Training Fellowships —HBCUvc, Susa Ventures, Oper8r

- Scout Programs — Lightspeed Scout Representative Initiative, Indie VC

- Venture Partners — Republic has built a track record of supporting diverse founders and its VP Program has focused on identifying diverse VC talent — for example, Kofi Ampadu on this list is a Republic Venture Partner (VP1s & VP2s with the final cohort on the way — apply here)

We need to ensure that as we focus on cultivating talent, we don’t forget to set them up for success in the future with knowledge, access, networks, and money behind them.

We’re shining a long-overdue spotlight on 14 emerging fund managers that have been pounding the pavement to raise funding, and truly represent the future of venture capital.

The criteria for the list was the following:

- Identify as Black and/or Latinx

- Currently raising Fund 1 or Fund 2

- Needed at least 10% commitments on their funds

- Equity-focused funds

- Headquartered in the U.S.

- Seasoned investors and/or operators in the space

Key findings that run parallel with concerning founder stats include a gender imbalance, with far more men raising than women, and lack of emerging fund managers outside of Silicon Valley and NYC.

We can only see these gaps when we take the time to do the research. Let’s continue to move the narrative forward and elevate those that are doing the work. These mavericks are truly an inspiration.

Simeon Iheagwam, Founding Partner, NOEMIS Ventures

The Emerging Manager:

Born in Brooklyn, New York, and raised by parents who immigrated from Nigeria, Simeon Iheagwam’s road to venture capital started at Brooklyn College where he studied finance. After graduating, he began his career in banking at JP Morgan where he spent six years focused on corporate finance and market risk.

With a growing interest in investment banking, Iheagwam went on to get his MBA at Cornell University before making the move to Charlotte, North Carolina to work for Wells Fargo where he focused on leveraged finance. During his time at JP Morgan and Wells Fargo, Iheagwam developed a deep passion for portfolio management and venture capital. His passion for the two led to his next act, pursuing a career in venture.

But there was a problem. Without prior venture capital experience, it would be difficult to convince investors to allow him to invest in startups using their money… [see more at Crunchbase profile)

The Fund:

Simeon Iheagwam is the Founder and Managing Partner of NOEMIS Ventures, a pre-seed / seed-stage venture capital fund that invests in and partners with founders using disruptive technology to change the world in Fintech, Marketplaces and AI/ML. NOEMIS Ventures has been operating for 3.5 years and kicked off with a pilot fund of 10 companies using their proprietary framework. Since inception, the pilot fund has achieved an MOIC (multiple of invested capital) of 3.0x and an IRR (internal rate of return) of 40%. This consisted of 2 companies getting acquired by billion dollar companies (Trigger and Gitlinks) and 5 more companies raising $530mm combined in follow-on rounds. Current companies in the portfolio include Petalcard, Markable, Tailored Industry and Squire. The combined equity value of the pilot fund has grown 551% in the 3.5 years.

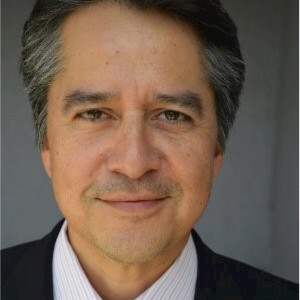

Marcos Gonzalez, Founding & Managing Partner, VamosVentures

The Emerging Manager:

Marcos C. Gonzalezis a private equity, venture and angel investor, having invested in many companies in the USA and abroad. In between investment funds, Marcos co-founded a tech company in Boston during the first internet wave of the 90s. Before tech entrepreneurship and investing, Marcos worked for the Boston Consulting Group. Marcos is the son of Mexican immigrants and a Brown University and Harvard Business School graduate.

The Fund:

VamosVentures is a Los Angeles-based impact VC fund for early-stage tech companies led by Hispanic and diverse founders in the US. The fund is industry agnostic, participating in seed stage or Series A rounds. The fund’s objectives are: (1) market-rate returns, and (2) social impact through wealth creation, social mobility or tech-driven solutions to challenges found in diverse/vulnerable communities. The fund has closed on $18mm with a target of $25mm.

Maria Velissaris, Founding Partner, SteelSky Ventures

The Emerging Manager:

Maria Velissaris is a serial entrepreneur and venture capitalist. She is currently the Founding Partner of SteelSky Ventures, which is an early stage venture fund investing in Women’s Health companies. Maria founded her first business, Wakeboxes in 2000, which eventually became Collegboxes and was later bought by Uhaul. After college, Maria worked as a technology strategy consultant with Booz Allen Hamilton where she excelled and was awarded the National Women of Color Rising Star in Technology Award.

Throughout her career, Maria has been on the forefront of strategy, technology and healthcare working with companies including Samsung, Philips, Kraft and Schweiger Dermatology Group. She is also extremely passionate about developing a pipeline of female entrepreneurs, and is an active member of Pipeline Angels and Golden Seeds, angel groups dedicated to growing the ecosystem of women investors and funding female-led ventures. Maria obtained a BSc in Information Systems from Wake Forest University, an MBA from the Stern School of Business at New York University and serves on the advisory board of The Yale University School Center for Digital Health and Innovation.

The Fund:

SteelSky Ventures is an early stage Women’s Health tech venture capital fund. SV invests across the spectrum of women’s healthcare in telemedicine, digital health applications, SaaS tools, medical devices, and direct to consumer health platforms. These technologies are the future of healthcare, and the SteelSky portfolio has continued to thrive in this new post-covid environment.

Ivan Alo & LaDante McMillon, Co-Founders & Managing Partners, New Age Capital

The Emerging Managers:

Ivan Alo is a strong advocate of inclusive entrepreneurship and global innovation. He is passionate about the use of technology to make the world more accessible and beneficial for all. Ivan started a couple of ventures while in high school & post-college, was a portfolio manager of a multibillion dollar real estate fund, and is an early team member of real estate technology platform CNERGY. Being a founder himself taught him the value of entrepreneurship, the relevant factors involved in building a sustainable business, and most importantly, how to build genuine, productive relationships en route to achieving a common goal. Ivan was selected as a 2020 Forbes 30 under 30 featured honoree.

LaDante McMillon has years of experience developing concepts, designing marketing assets, and creatively capturing the voice of brands and companies through his freelance company LDM Film Perspective. He has worked with several startups across various industries as well as established corporations. As an entrepreneur, LaDante has learned the value of product development, brand development and marketing along with the essential building blocks necessary to build a strong business with the right go-to-market strategy. His desire to create opportunity and understanding between brand and consumer is fueled by his passion for storytelling. LaDante was selected as a 2020 Forbes 30 under 30 featured honoree.

The Fund:

Forging an untraditional path for themselves as fund managers, Alo and McMillon focus on democratizing access to information and opportunity for entrepreneurs that are consistently overlooked, underestimated, and underfunded. As part of their firm New Age Capital, a seed stage venture fund investing in tech and tech-enabled startups founded and led by Black and Latino entrepreneurs, Alo and McMillon have deployed $500,000 (raised from Lightspeed Venture Partners as investment scouts) into 12 companies at the pre-seed, seed, and Series A stages. The pair are currently raising a new fund and have a podcast, ‘Chop’n It Up’, which interviews Black and Latino entrepreneurs about their experiences as founders.

They highlight in their mission statement: “We believe in creating and supporting a world where people of all races, ethnicities, cultures, lifestyles and environments are exposed to new ideas, democratized information, and boundless opportunities through the use of technology.

Jewel Burks Solomon, Justin Dawkins, and Barry Givens, Co-Founders & Managing Partners, Collab Capital

The Emerging Managers:

Jewel Burks Solomon is an advocate for representation and access in the technology industry. As co-founder of Partpic, a startup designed to streamline the purchase of maintenance and repair parts using computer vision, Jewel and her team built groundbreaking technology poised to change the way people everywhere locate products. Partpic raised over $2 million in seed funding from notable investors like AOL co-founder, Steve Case, and Comcast Ventures, and integrated its software into mobile apps/websites of large parts distributors and retailers. Partpic was acquired by Amazon in late 2016 and the technology now powers visual search for replacement parts in the Amazon Mobile Shopping app.

Justin Dawkins is a successful entrepreneur and full stack developer with nearly 20 years of experience. As co-founder of Goodie Nation, he has helped over 30 entrepreneurs launch their tech-enabled social impact businesses.

Barry Givens founded Monsieur where he raised over $4MM in capital from a mixture of traditional VC Funds, professional athletes and corporate executives. He licensed his IP to a leading adult beverage dispenser manufacturer. Barry currently serves as Managing Director for Techstars Social Impact Accelerator.

The Fund:

Most of the wealth creation in the Black community is first generation and has been accrued through non-technical industries such as real estate, construction, finance, entertainment, sports, and others. Lack of entrepreneurial experience in the technology sector and lower risk tolerance in modern investment models, leaves many investors with a slim appetite for higher-risk technology investments. In order to increase participation among this group, we simplify their decision making process with new investment vehicles.

The mission is to establish an institution that provides a viable pathway to sustained wealth for the Black community. Collab Capital establishes this pathway by investing in tech and tech-enabled companies through efficient capital and effective connections between Black innovators, investors, and influencers.

Vincent Diallo, Managing Partner, Interlace Ventures

The Emerging Manager:

Vincent Diallo launched Interlace Ventures last year together with Joseph Sartre. He started his investment career at Bleu Capital — the venture arm of a family office — that he co-founded in 2015 in New York after operating 10 years in China.

Vincent grew up in a small city in the West of France, far from Burkina Faso where his Dad is coming from. After graduating from business school, he started his career at Deloitte Paris. Passionate by Chinese cultures, he then moved to Deloitte Shanghai before becoming the CFO of Sinodis (Acq. Savencia), the largest independent distributor of Western Food in China and took it from $50m to $200m.

He is passionate about meditation and the mind-body alchemy. Vincent is also an active member of BlckVC. He is based in San Francisco.

The Fund:

Interlace Ventures is on a mission to invest and help build the most promising technology companies reinventing commerce and retail through software:

1/ Technology For Brands & Retailers (The How);

2/ Innovative Models & Experiences (The Where);

3/ New Brands & Communities (The What).

There are deep changes at play in the commerce and retail industries fueled by large consumer shifts (deep generational change, Mobile adoption and conscious shopping).

Vincent and Joseph invest at pre-seed and seed stage providing capital and access to a large ecosystem of retailers and brands which make them an ideal co-investor to generalists funds. Their check size ranges from $250k to $500k, targeting ownership of 3 to 6%.

They have a rare and diverse perspective on retail digital transformation: European with African roots, have lived in China for 15 years combined and operate in the USA, 3 different market maturities and structures.

With their experience as operators in the Commerce space and their network of partners (Brands and Retailers) and global advisory group, they have an opportunity to create the thought leader in Early Stage Technology for Commerce; bridging the gap between early stage innovators and the Fashion, Beauty, CPG, Luxury and Grocery industries.

You will find more information about their values and positioning in their manifesto.

Brian Brackeen & Candice Matthews-Brackeen, General Partners, Lightship Capital

The Emerging Managers:

Candice Matthews-Brackeen is the General Partner of Lightship, the Cincinnati based venture capital fund, where she serves as Managing Partner. Lightship works to support underrepresented, early-stage, transformational businesses.

Candice has over 15 years of entrepreneurial experience including co-founding Hello Parent, a national safety technology partner of the Brady Campaign to Reduce Gun Violence, and the American Academy of Pediatrics. She holds a BA Economics from the University of Cincinnati and was a Hewitt-Kautz Fellow. Candice enjoys music and spending time with her two sons.

Brian Brackeen is the General Partner of the Cincinnati based venture capital fund Lightship Capital. Brian is responsible for fund operations, entrepreneurial training, and leadership of the AI team.

Prior to Lightship, Brian founded the globally recognized Miami based face recognition innovator, Kairos. His leadership saw the company raise 13 million dollars, and grew the firm to a 120mm valuation. Kairos was selected by the Wall Street Journal as one of the top 25 startups in the country and drove growth within the company and the face recognition space.

The Fund:

Lightship Capital, founded in 2018, invests in early-stage companies led by Black, Indigenous, and people of color (BIPOC), those in the LBGTQ+ community, women and people with disabilities who operate in the consumer packaged goods, e-commerce, sustainability, artificial intelligence, and healthcare spaces. It announced the $50m fund in late June, with the closing of $20 million from SecondMuse Capital and another close in August. It focuses on five sectors: artificial intelligence, consumer package goods, sustainability, e-commerce, and health care. Lightship Capital is the investment arm of Cincinnati’s Hillman Accelerator.

Kofi Ampadu, Founding Partner, SKU’D Ventures

The Emerging Manager:

Kofi Ampadu is an entrepreneur, startup advisor & investor with over 10 years of professional experience. As a two-time founder, he is well-versed in the pitfalls and rewards of starting new ventures which have made him passionate about knowledge-sharing and mentorship within the startup space. He is on the leadership team of the Startup Leadership Program, serves as a Venture Partner with Republic, and is also a Venture Scout for Prototype Capital and Indie VC.

Kofi currently advises and invests in consumer product startups. Prior to entrepreneurship, he was a strategy consultant at Accenture and an engineer at Kraft Foods. He earned a Bachelor of Science Degree from Rochester Institute of Technology and an MBA from Carnegie Mellon University’s Tepper School of Business.

The Fund:

SKU’D Ventures is a pre-seed venture capital fund focused on consumer product startups. The fund’s mission is to invest in and support founders who are building products to satisfy evolving consumer preferences. Currently, there is a funding gap at the pre-seed stage for consumer brands and SKU’D Ventures aims to fill that void. The fund is also committed to constructing a portfolio of at least 50% Black founder-led companies.

Jason Torres, Founding Partner, Sana Capital

The Emerging Manager:

Jason Torres is the founder of Sana Capital, a healthcare growth-stage private equity firm where he focuses on deal sourcing, firm strategy, and value creation efforts. Issues such as under-insured populations, racial disparities, misaligned incentives plague the US healthcare system leading to reduced access, ineffective outcomes, and soaring costs. Sana actively partners with entrepreneurs and businesses remedying these gaps in healthcare.

Prior to Sana, Jason was a Partner at Mansa Capital, a healthcare growth private equity fund, where he led the evaluation of new investment opportunities, firm operations, and served on the boards of portfolio companies. Jason began his career at Salomon Smith Barney’s asset finance group where he structured debt financings for banks, finance companies, and lenders. Later, Jason worked at Deutsche Bank where he traded positions in the technology, cable, and healthcare sectors.

Jason is philanthropically active as a director of several non-profit organizations serving vulnerable populations in healthcare and education.

Torres graduated Magna Cum Laude from Rensselaer Polytechnic Institute with a B.S. in Finance and Information Systems. He received an M.B.A. from Stanford University Graduate School of Business.

The Fund:

Sana Capital is a healthcare private equity firm that partners with overlooked founders engaged in information technology and services sectors. Sana identifies and invests in growth companies that share our mission to increase access, improve outcomes, and reduce costs within underserved markets.

MacKeever Conwell, Founding Partner, RareBreed Ventures

The Emerging Manager:

Mckeever E. (Mac) Conwell, 2nd, is a Baltimore native and attended Morgan State University, majoring in Computer Science. In 2006 at the age of 19 he joined a co-op program with the Department of Defense where he achieved Top Secret Security Clearance. He went on to become a government contractor doing software development in multiple computer languages and working for several companies, including Northrop Grumman and Booz Allen Hamilton.

In October of 2009 Mac co-founded his first tech startup, Given.to. The Given.to team successfully completed two accelerators, Accelerate Baltimore and NewMe Accelerator, where he was later named entrepreneur-in-residence. Mac and his team sold the technology in 2014. His next venture, RedBerry, was accepted into the Dreamit Ventures Accelerator in Philadelphia.

Brought on board at TEDCO in the newly-created role of Deal Team Coordinator, Mac is using all of the knowledge he has gained working for both public and private sectors. Mac is responsible for the coordination of all stages of new deals brought into TEDCO.

The Fund:

RareBreed VC is a pre-seed fund that is investing in exceptional founders outside of the large tech eco-systems earlier than everyone else. RareBreed will be investing checks of 250K as first or one of the first investors in for target 10% equity, while connecting these founders to 3rd party services to do things like development, design, marketing, PR, etc to increase their capacity at reduced rates, and help them hire a part-time or full-time executive in their vertical. With early meaningful cash upfront, wraparound services to increase capacity, and institutional knowledge from the additions of an executive, RareBreed can accelerate a companies growth at the earliest stages and shrink the time it takes them to go from Pre-seed to Series A.

Samara Hernandez, Founding Partner, Chingona Ventures

The Emerging Manager:

Samara Hernandez was born in Mexico and immigrated to the U.S. at a young age. Growing up in a low income, dual-language household has allowed her to understand and identify markets outside of what is traditionally funded. She launched an institutionally-backed pre-seed stage fund, Chingona Ventures, after being in venture and seeing the types of founders, business models and industries that were being funded. Samara also co-founded the Latinx Founders Collective, an organization supporting the growth of Latinx founders in technology. She is on the advisory boards of Angeles, an angel group focused on investing in Latinx founders, and Camino Financial, a Fintech platform pioneering access to affordable credit to underbanked Latinx businesses. Prior to this, she was an investor at MATH Venture Partners, an early-stage venture fund investing in technology start-ups with differentiated approaches to customer acquisition. In this capacity, she led new investment review, diligence and execution.

Prior to venture capital, Samara worked at Goldman Sachs, where she was continually ranked top 5 in selling financial products, providing market insights, advising on portfolio construction, and consulting on business practices. She started her career in the Fixed Income, Currency and Commodity (FICC) group where she lead multiple technology enhancing projects across global exchanges. Samara earned an Industrial and Operations Engineering degree from the University of Michigan and a Master’s degree in Business Administration from Northwestern University. She lives with her husband and one-year old son in Chicago.

The Fund:

Chingona Ventures is a pre-seed fund based in Chicago and invests all over the U.S. in “badass founders” who have backgrounds that uniquely position them to create businesses in markets that are growing and often overlooked. These areas include food and wellness that are democratizing access to health, female technology, financial technology in overlooked customer segments, and education technology with changing demographics. Since its launch in 2019, the fund has made 11 investments in companies like Curu, Tiny Organics and Encantos. Chingona invests at the earliest stages, even at the idea stage, with first checks ranging from $100–250k.

Andre Charoo, Founding Partner, Maple VC

The Emerging Manager:

Andre Charoo is the founding partner of Maple VC. Prior to Maple, Andre was one of the first 25 employees at Uber and Hired. At Uber, Andre led new market entry for the company into Canada and hired talent that scaled through the IPO. At Hired, Andre was most recently VP of Strategic Development and previously led the company’s expansion into 16 markets across 6 countries. Andre is also a Venture Partner at Inovia, a multi-stage firm founded in Canada with more than $1B in AUM. He is also the Co-Chair of the C100, an expat community of influential Canadian founders, execs and VC partners. Andre was born and raised in Toronto and holds a Bachelor of Economics from University of Toronto.

The Fund:

Maple is a $10M single-GP, seed stage fund based in San Francisco, that invests in exceptional Canadian founders (both in Canada and expats abroad) and partners with them on talent and growth. Founding Partner, Andre Charoo, leverages his operating experience and success with hiring scalable talent and creating expansion playbooks from being one of the first 25 employees at Uber and Hired (both companies co-founded by Canadians).

In the last decade, the track record of Canadian founders (mostly expats) who have created multi-billion dollar tech companies is outstanding: Shopify, Uber, Red Hat, Slack, Instacart, Wish, Cloudflare, Databricks, LightspeedPOS, PagerDuty, Notion, Getaround, Faire and Kik. Maple is uniquely positioned to leverage this network of founders, operators and early alumni employees to partner with the next wave of great Canadian founders (location agnostic).

As proof of concept, Maple 1 (2016 vintage) made 9 highly concentrated investments in a majority of Canadian founders and achieved a 60% follow-on rate so far from seed to Series A with top firms including a16z, Greylock and Sequoia.

Alex Guerrero, Principal, Act One Ventures

The Emerging Manager:

Alejandro Guerrero is a Principal at Act One Ventures, a Los Angeles based pre-seed/seed fund investing in business software. Alejandro has been part of the 2-person core founding team since before the first close on Act One’s Fund I in March 2016. His responsibilities include the entire spectrum of venture capital management: fund formation and governance, fundraising, Limited Partner (LP) management, deal sourcing, deal diligence, deal execution, portfolio management.

Previously, Alejandro was the co-founder & CEO of Uniq Apps, a SaaS platform for encrypted work messaging. Prior to Uniq, he was the co-founder of Live Entertainment Network, an interactive video player platform that helped artists monetize live shows on a “premium-content-only” destination. While CEO at Uniq he was also a Volunteer Associate at UCLA Ventures.

Alejandro is a startup guy through and through with a dozen years of experience in the tech industry from both sides of the table.

The Fund:

Los Angeles based Act One Ventures is a community-focused, early-stage venture capital fund investing in business software at the pre-seed/seed stage. Since 2015 the team of Alejandro Guerrero and Michael Silton — a 3X founder with 1 fail, 1 exit, 1 IPO — have raised $46mm in AUM. They have achieved multiple liquidity events, with a fund net IRR running in the top quartile. They have invested in 28 companies, over 70% of which are founded by women or minorities.

As founders by background, Alejandro and Michael have a combined set of skills and experiences that are fundamental to supporting early-stage founders on their journey. They take an empathetic approach to the challenges founders face raising money and building startups. Alejandro and Michael met at UCLA Ventures in 2013, where Michael was the Managing Director and Alejandro was a Volunteer Associate.

Chinedu Enekwe & Mark Fleming, Co-Founders & Managing Partners, $100m Stealth Fund

The Emerging Managers:

Chinedu Enekwe was principal at the NYC based pre-seed & seed fund, Exponential Creativity Ventures, and managed AffinitiVC, an investment syndicate & consulting firm deploying over $15M since 2017 with 2 exits. Before launching AffinitiVC, Chinedu co-founded tip hub and managed its pre-accelerator program, Diaspora Demo, which supported over 35 startups raise over $20 Million in after program funding and achieved 3 exits since 2014. Chinedu also led Xcellon Capital, serving as an investment director managing their $25M fund.

Mark Fleming currently serves as an advisor at the venture capital firm TXV Partners. He specializes in high growth startups in the SaaS, fintech, e-commerce, and consumer products industries. Previously, he worked at Alibaba Group & Ant Financial, on their investment team living in China, where he invested in fintech and e-commerce startups in emerging markets. He built partnerships with consumer-focused companies looking to enter the China market and invested in startups around the world looking to use the Alibaba ecosystem in their home countries. Mark received his MBA in finance and entrepreneurship at the Kellogg School of Management.

The Fund:

Currently, in stealth, Chinedu & Mark are creating a new VC fund investing in the future of retail and finance for the next generation of internet users with checks at $500k to $2M in Seed, Seed+ & Series A rounds. The fund backs founders that tap into the pulse of global human connections to build once-in-a-lifetime opportunities.

We had a holistic approach in crafting the list — if you’d like to get on our radar, please get in touch. Written by Cheryl Campos, Director at Republic @cycampos15, and Chase Emanuel, creating more owners at Carta.